- Commonplace Chartered added one other 20% enhance to its earlier Bitcoin prediction.

- On-chain information confirmed that BTC was nearer to its backside than the market high.

Like Clockwork, Bitcoin [BTC] has been topic to quite a few value projections, with the newest coming from Commonplace Chartered, the outstanding worldwide monetary establishment. In a report shared by Reuters on 10 July, the financial institution declared a bullish forecast for Bitcoin, suggesting it might hit $50,000 by the top of 2023.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Nonetheless, the bone of competition, which had sparked debate across the crypto neighborhood, was the establishment’s $120,000 prediction for 2024. Geoff Kendrick, Commonplace Chartered FX’s analyst, stated that the choice to extend the projection by 20% was because of Bitcoin miners’ choices.

BTC skyrockets and miners change

In protection of his opinion, Kendrick famous that BTC’s current soar might power miners to hoard extra of the Bitcoin provide. Often, when this occurs, the demand for Bitcoin will increase, thereby resulting in an increase in value.

Additionally, miners’ revenue will probably enhance from transaction charges alone, fairly than the mix of block rewards and transaction charges. Kendrick, who predicted a $100,000 hit in the identical yr earlier, stated,

“Elevated miner profitability per BTC (bitcoin) mined means they’ll promote much less whereas sustaining money inflows, decreasing web BTC provide, and pushing BTC costs larger.”

In Could, Bitcoin miners recorded an enormous rise in charges generated. Nonetheless, the situation at press time was not near the hike talked about. And in line with Glassnode, miners’ charges have dropped to 1.66%.

This prompt that mining charges have been going extinct as a result of the king coin might attain its complete provide of 21 million. And when this occurs, as Kendrick identified, demand would soar, and the BTC value would skyrocket.

Near the underside

Kendrick additionally talked about that miners’ strategy to the market would possibly change when the worth hits $50,000. In response to him, if the worth hits the milestone, then miners, who’ve lately been promoting 100% of their new cash, would cut back the speed of promoting.

He stated,

“If the worth hits $50,000 although, they might most likely solely promote 20-30%.It’s the equal of miners decreasing the quantity of bitcoins they promote per day to only 180-270 from 900 at the moment.Over a yr, that would cut back miner promoting from 328,500 to a spread of 65,700-98,550 – a discount in web BTC provide of roughly 250,000 bitcoins a yr.”

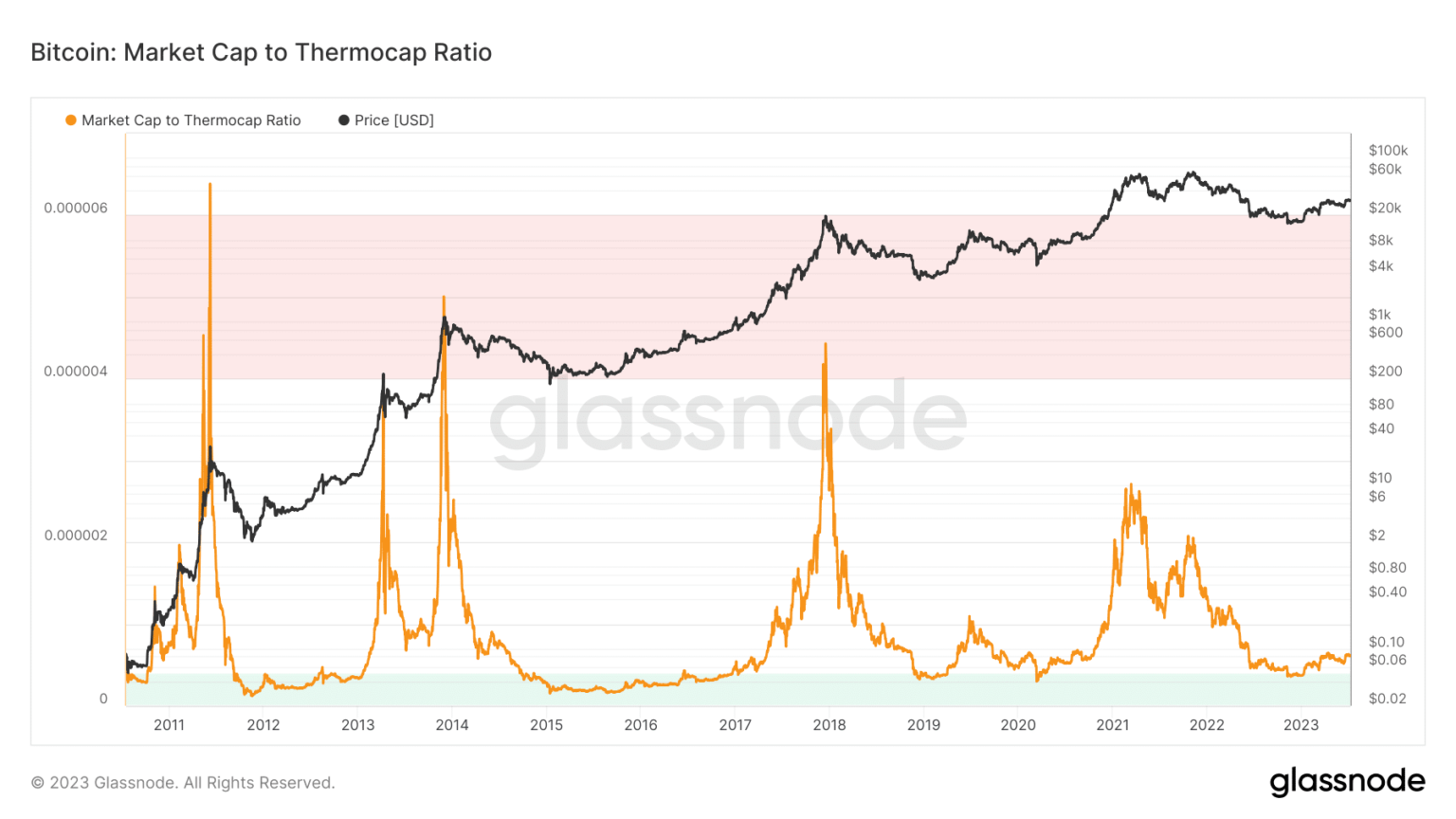

Maybe it’s essential to judge the state of some different metrics. In doing this, one of many go-to metrics is the Bitcoin Market Cap to Thermocap Ratio. Calculated because the ratio of adjusted provide to growing provide, the Market Cap to Thermocap Ratio reveals if BTC’s value is buying and selling at a premium relative to the miners’ safety spend.

At press time, the metric had mildly risen to 0.00000063. But it surely was nonetheless at a really low level. Traditionally, a excessive worth of this metric hints at a BTC market high. So, the state at press time alerts a neighborhood market backside.

With whales frequently accumulating, the Bitcoin Market Cap to Thermocap Ratio reveals that the coin nonetheless has huge potential to rally. Nonetheless, this was no assure that the $50,000 or $120,000 prediction could be met.

Supply: Glassnode

BTC value motion

This yr, BTC has proven indicators of suppressing the expectation of bears. And on a 12 months-To-Date (YTD) foundation, the coin has gained over 70%. On the technical aspect, BTC has skilled a major quantity of promoting strain recently.

Take, as an illustration, when the worth hit $30,900 on 6 July, a number of collaborating used the chance to seize beneficial properties. This led to a plunge under $30,000. Nonetheless, elevated demand at $29,992 might neutralize sellers’ dominance and push the worth again up.

Moreso, the Superior Oscillator (AO) had elevated was 218.85. This constructive studying signifies that the fast paced common was far more than the slow-moving common. Therefore, this means that the slight downtrend may not dominate for lengthy.

![Bitcoin [BTC] Price Action](https://statics.ambcrypto.com/wp-content/uploads/2023/07/BTCUSD_2023-07-11_10-43-59.png)

Supply: TradingView

Retail can be gearing up

In analyzing different on-chain information, Santiment confirmed that the availability distribution has been spectacular. This was as a result of whales weren’t the one ones concerned in accumulation. Primarily based on the stability of tackle of the 0 to 10 retail cohort, accumulation was additionally on the rise.

Often, this means that market individuals contemplate the BTC at $30,000 a superb shopping for alternative. So, the broader sentiment was that the coin value would not going carry out higher than it was.

Supply: Santiment

Moreover, the Market Worth to Realized Worth (MVRV) Z-Rating was 0.70. Usually, the MVRV Z-Rating evaluates if BTC is undervalued or overvalued. It does this by evaluating the market worth to realized worth.

When it’s considerably larger, and within the purple zone, the Z-Rating signifies {that a} market high. However on the time of writing, the MVRV Z-Rating was solely somewhat above the inexperienced area.

Oftentimes, this means a considerably decrease market worth than the realized worth. As such, Bitcoin’s worth could possibly be thought-about undervalued, and a major rally could possibly be attainable in the long run.

Supply: Glassnode

Reasonable or not, right here’s BTC’s market cap in ETH phrases

In conclusion, the likelihood of Bitcoin hitting $120,000 in 2024 or $50,000 in 2023 is one thing that may be debated. However from the on-chain information analyzed, a rally stays visibly attainable. However when precisely it’s going to occur can’t be decided.

Nonetheless, Commonplace Chartered’s prediction might have some historic backing. Other than the miners’ motion talked about, BTC’s value often skyrockets after every halving. So, this could possibly be some extent to have a look at.