Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- Chainlink [LINK] hit an important promote stress zone above $7.5.

- LINK’s open curiosity (OI) surged however might face headwinds.

Chainlink [LINK] has been in a consolidation section for the previous few weeks. It oscillated between a crucial provide (crimson) and demand (inexperienced) zone. To this point, the provision zone above $7.5 has proved a problem to bulls.

Learn Chainlink’s [LINK] Value Prediction 2023-24

Can bulls bypass the promote stress zone?

Supply: LINK/USDT on TradingView

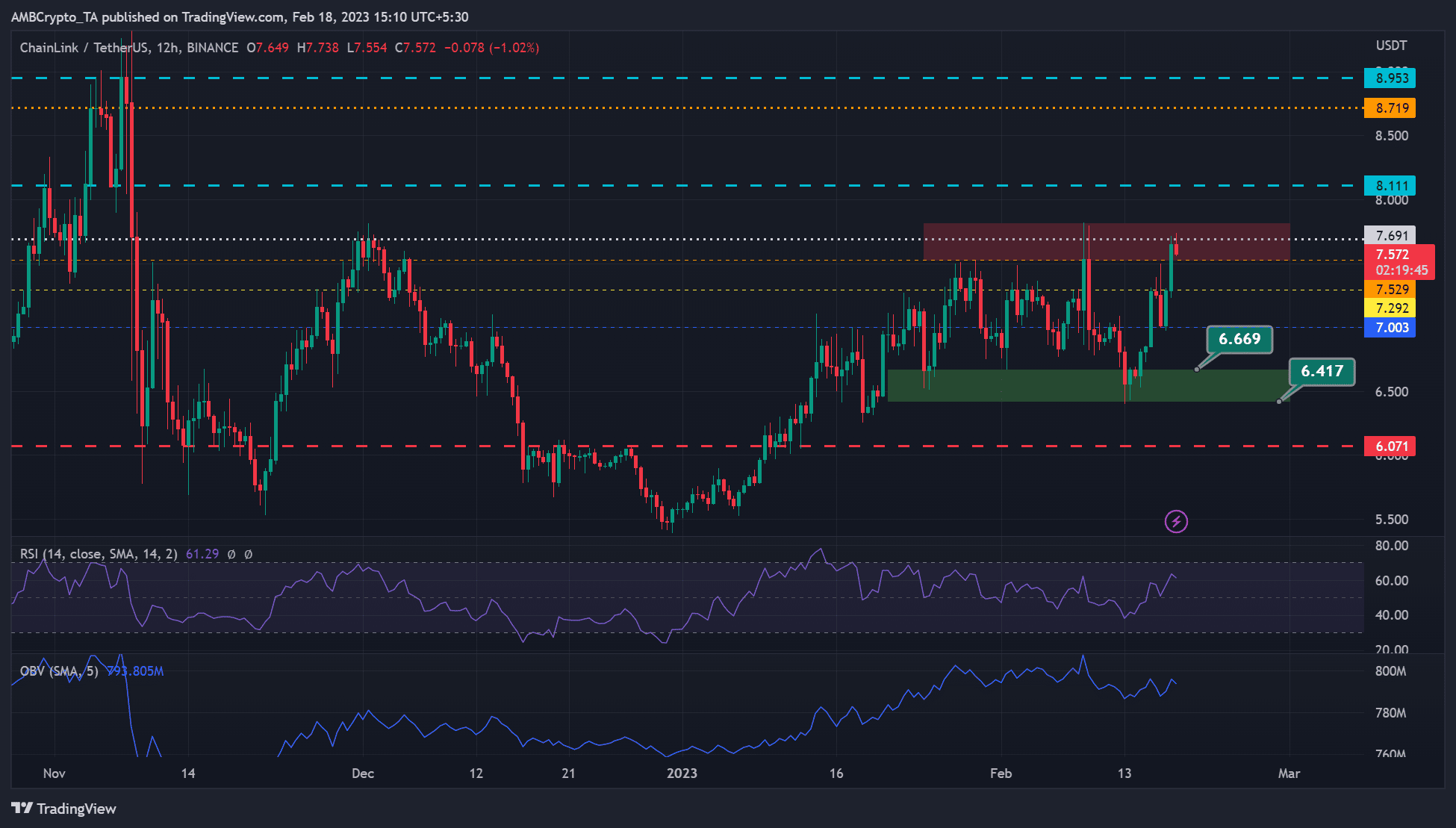

LINK was bullish on the 12-hour chart, as proven by the RSI’s worth. Equally, the OBV (On Steadiness Quantity) has risen, boosting the latest uptrend however confronted a downtick at press time. However LINK has reached the promote stress space (crimson) of $7.520 and $7.813.

The zone has additionally been a crucial resistance stage on the three-hour charts. Because of this, bulls should still discover issue overcoming it, particularly if BTC fails to reclaim the $25K stage.

Ergo, bears may revenue from short-selling alternatives at $7.529, or $7.292, if the worth correction extends towards the demand zone (inexperienced). The $7.003 or $6.669 ranges can be preferrred shopping for alternatives, so sellers can lock earnings at these ranges.

Is your portfolio inexperienced? Take a look at the LINK Revenue Calculator

A session shut and affirmation above the provision zone will give bulls a transparent view to focus on the $8 worth and the pre-FTX stage of $9. However the upswing will invalidate the above bearish bias.

LINK’s open rate of interest elevated, however …

Supply: Coinglass

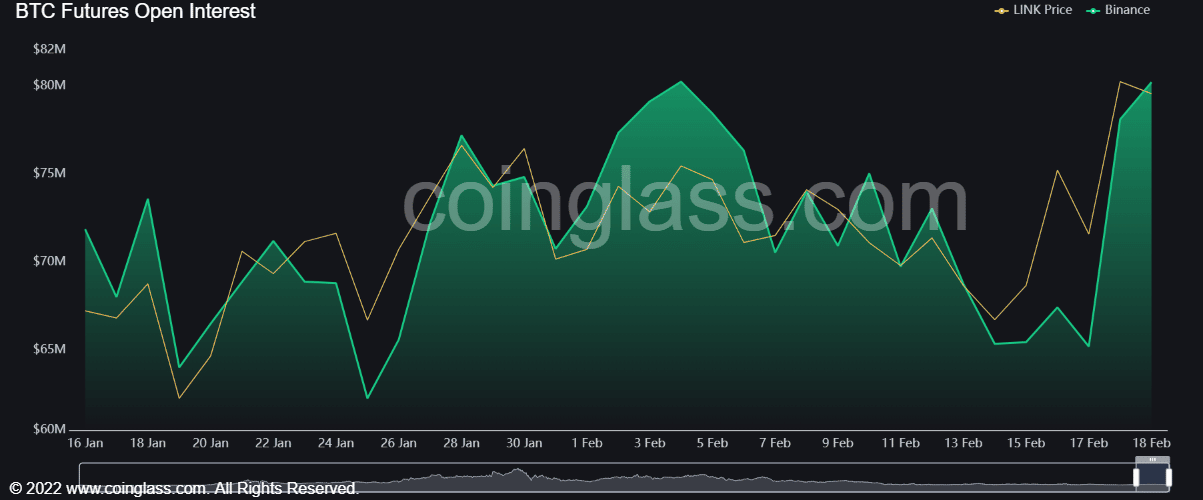

As per Coinglass, LINK’s open curiosity (OI) price elevated tremendously from 17 February. It exhibits a large demand for the altcoin within the futures market, thus reinforcing the bullish sentiment, on the time of writing.

As well as, over $550K value of short-positons had been liquidated prior to now 24 hours alone, in accordance to Coinalyze. This additional lends credence to a potential further rally. Nevertheless, near $100K value of long-positions has been rekt, too. This requires warning.

An upswing above $7.5 and steadily rising OI will give bulls impetus to focus on the $8. Nevertheless, any drop in OI will present bears with extra market affect.