As reserves proceed to say no throughout all main centralized exchanges (CEXs), Binance, the highest change by buying and selling quantity, is starting to lose market share to different rivals.

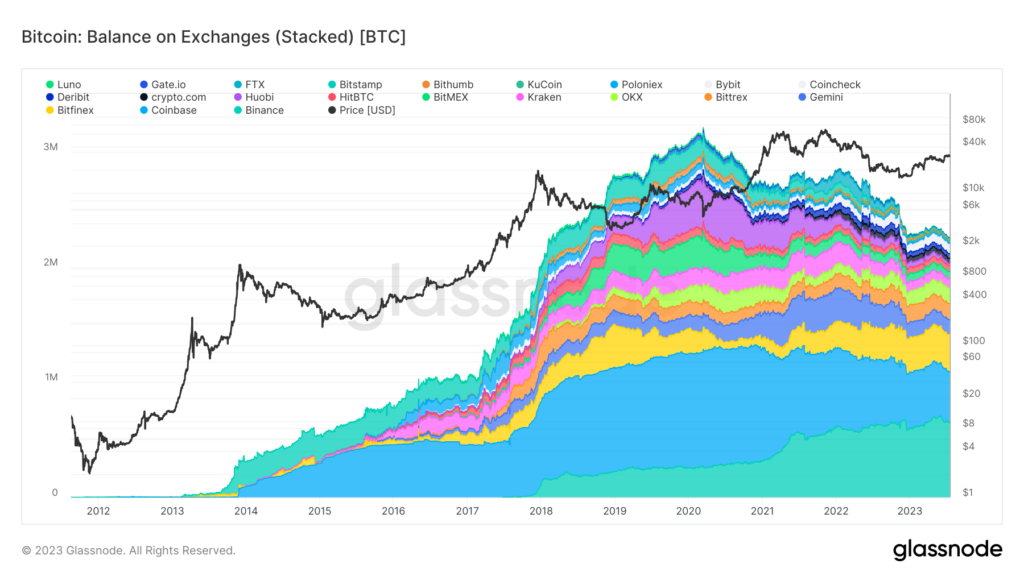

Knowledge offered by Glassnode reveals the height for CEX Bitcoin reserves was hit in 2020, reaching 3 million BTC. Since then, ranges have fallen to simply over 2 million BTC.

An analogous development could be seen for different digital property, reminiscent of stablecoins which peaked later, towards the tip of 2022. Stablecoin balances on exchanges have begun a small revival since June 2023 however are nonetheless solely at ranges final seen in 2021.

Challenger exchanges acquire market share.

Throughout the evolving panorama, Bitget, a crypto derivatives change, has emerged as a notable contender, cementing its place as a prime 4 CEX by market share. In response to Bitget’s Q2 2023 Transparency Report, seen by CryptoSlate, the change noticed important development in market share and a dramatic surge within the quantity of its native token, BGB.

Including to Bitget’s constructive trajectory, the platform’s native token, BGB, surged by 80% in buying and selling quantity, making it the best-performing CEX token in 2023.

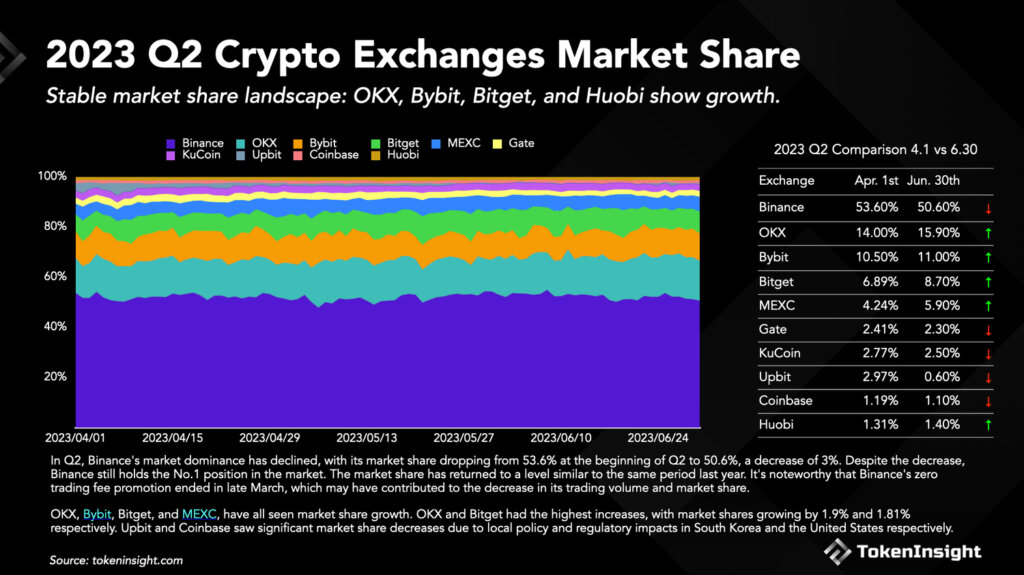

Bitget achieved a buying and selling quantity of over $60 billion for spot buying and selling and $606 billion for futures buying and selling, outperforming most centralized exchanges, as reported by the TokenInsight Crypto Trade Report Q2 2023.

Bitget’s market share rose to eight.7% from 6.89%, whereas Binance’s market share by quarterly collected buying and selling quantity fell 3% to 50.6% from 53.6%.

Nevertheless, OKX led challenger exchanges over the interval with market share development of 1.9% to succeed in 15.9%, narrowing the hole to Binance. Following updates to rules in Hong Kong, OKX onboarded over 10,000 new prospects in its first month of buying and selling within the area.

These modifications come amidst a difficult interval for the crypto trade, with Bitcoin costs fluctuating and authorized points plaguing main gamers like Binance and Coinbase.

Adjustments to the CEX panorama.

As per information from Glassnode, the aftermath of the FTX collapse led to a big divergence between Bitcoin deposits and withdrawals, indicating a decreased belief in crypto exchanges. Moreover, a evaluation of exchanges holding fewer than 20,000 Bitcoin reveals a normal downward development in Bitcoin storage, with Huobi seeing a dramatic decline.

Regardless of this development, Binance stays dominant, holding over 652,000 Bitcoin- over 3.2% of the overall Bitcoin provide. Nevertheless, Binance CEO Changpeng Zhao (CZ) anticipates that decentralized finance (DeFi) will outgrow centralized finance (CeFi) within the subsequent six years,

“Extra individuals will use DeFi merchandise and work together instantly with blockchains. This additionally provides monetary entry to individuals the place TradFi (or banks) haven’t any penetration. It’s my robust perception that DeFi will turn into larger than CeFi within the subsequent 6 years or so.”

Supporting CZ’s thesis, the platform has just lately confronted heightened regulatory scrutiny, resulting in investigations and exits from particular markets. Whereas CZ is optimistic about the way forward for Binance, the potential of DeFi, combined with regulatory uncertainty, and the rise of challenger exchanges, poses an fascinating problem for the pillar of the crypto world that’s Binance.