Within the fourth quarter of 2023, the cryptocurrency market skilled a notable resurgence, accompanied by the anticipation of a possible Bitcoin ETF approval. Among the many standout performers throughout this era was Fantom (FTM), a Layer-1 protocol launched in 2018.

In keeping with a current report by Messari, Fantom witnessed vital development, with its circulating market cap hovering by 140% quarter-over-quarter, from $0.5 billion to $1.3 billion.

This efficiency surpassed all cryptocurrencies’ total market cap development at 54% in This autumn. Moreover, Fantom climbed up the market cap rankings, ascending 5 spots from 63 to 58 by the tip of the quarter.

FTM’s Potential For Future Progress

The circulating provide of FTM remained comparatively steady quarter-over-quarter, with modifications in provide dynamics between This autumn 2022 and Q1 2023.

Notably, Fantom launched the Ecosystem Vault and Fuel Monetization program throughout This autumn 2023, decreasing the burn charge of transaction charges and reallocating a portion of charges to the Fuel Monetization program and Ecosystem Vault.

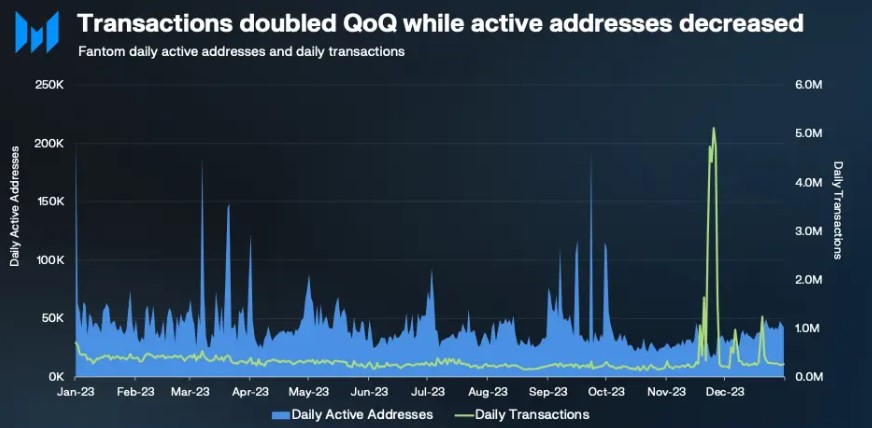

The variety of day by day lively addresses on the Fantom community skilled a 27% decline quarter-over-quarter, averaging 32,700 in This autumn’23. Nevertheless, a gradual improve in day by day lively addresses all through December signifies potential future development because the crypto market emerges from the bearish section.

Associated Studying: Helium (HNT) Heats Up: 21% Soar After Telefónica Deal Ignites Progress

Common day by day transactions on Fantom reversed their declining pattern, surging by 126% to 531,000. This improve was primarily attributed to the emergence of Fantom Inscription FRC20s, with November 25 marking an all-time excessive of 5.11 million transactions, together with 4.99 million inscriptions.

When it comes to new addresses, This autumn’23 noticed a ten% improve to a median of 21,100 day by day new addresses. Messari means that the surge in day by day new addresses might be attributed to the launch of Estfor Kingdom, a preferred blockchain-based sport on Fantom that gained traction in late Q3’23. December additionally witnessed an uptick in day by day new addresses, doubtless influenced by improved market circumstances.

Fantom DeFi Ecosystem

Per the report, Fantom’s Whole Worth Locked (TVL) denominated in USD elevated by 58% quarter-over-quarter, from $51 million in Q3 to $81 million in This autumn. Nevertheless, TVL denominated in FTM decreased by 29% in the identical interval, primarily because of asset value fluctuations.

This autumn’23 additionally witnessed shifts within the high DeFi purposes on Fantom, with new entrants resembling Equalizer Trade, WigoSwap, and SpiritSwap gaining market share. Notable protocols by TVL included Spookyswap, Beethoven X, Equalizer Trade, WigoSwap, Tomb Finance, and SpiritSwap.

These protocols collectively gained $29 million in TVL, accounting for practically 100% of Fantom’s TVL development in This autumn. Equalizer and WigoSwap skilled essentially the most vital market share will increase.

The common day by day decentralized change (DEX) quantity on Fantom declined by 10% to $10.2 million in This autumn 2023. Nonetheless, rising new DEXs like Equalizer Trade and WigoSwap contributed to the ecosystem’s total development.

Associated Studying: Bitcoin Whales Go On Shopping for Spree As Worth Dips, Right here’s How A lot They Purchased

In abstract, Fantom’s efficiency was notable within the fourth quarter of 2023. The protocol skilled a surge in market cap, strong income development, and an increasing DeFi ecosystem. Nevertheless, its native token has declined considerably.

Regardless of the current sharp correction throughout the cryptocurrency market, Fantom’s native token FTM has not been an exception. Presently, the token is buying and selling at $0.3306, reflecting a decline of over 3% throughout the final 24 hours, 37% over the previous 30 days, and a year-to-date lower of 18%.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site totally at your personal threat.