- The L2 protocol turns into the second sidechain to be built-in with Convex Finance

- The event would enable blockchain interaction as CVX traders shun HODLing

Within the final quarter of 2022, Convex Finance [CVX] dedicated to integrating a number of sidechains on its community. So, on 9 March, the liquidity supplier introduced that it had launched on Polygon [MATIC] to additional foster the mission.

How a lot are 1,10,100 CVXs price right this moment?

Sidechains are secondary blockchains with their very own consensus protocol, permitting the dad or mum blockchain to enhance its safety and privateness.

Pool within the pool— that’s the way in which

In keeping with the Medium-channeled assertion, the combination would enhance liquidity provision on Curve Finance [CRV], and likewise enhance token staking on the protocol.

The disclosure implies that Polygon turns into the second sidechain and layer-two (L2) Ethereum [ETH] scaling resolution to be concerned.

In November 2022, Convex added Arbitrum to the fray. This led the previous to create a cross-chain interface so customers can work together with its Liquidity Swimming pools (LPs).

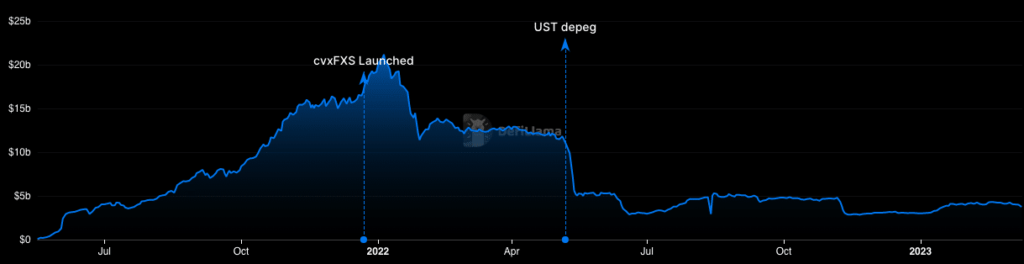

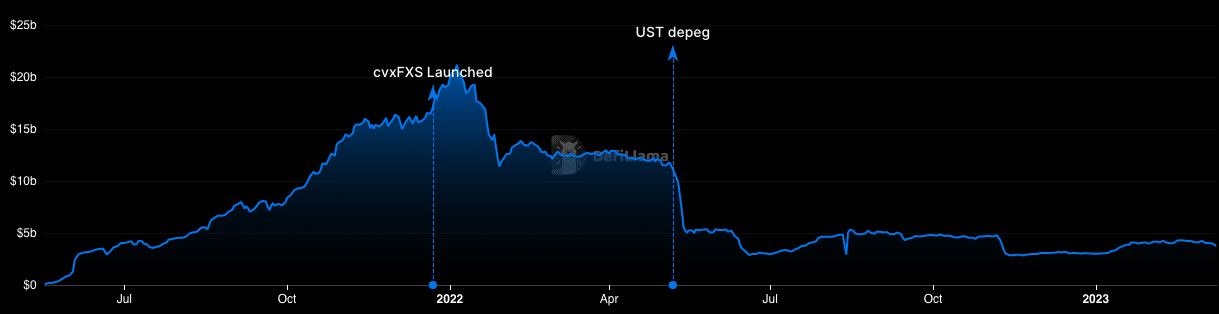

Convex confirmed that the case Polygon could be much like the interplay with Arbitrum. Nonetheless, data from DeFi Llama revealed that the Convex Finance Complete Worth Locked (TVL) remained nonetheless within the fifth place.

Supply: DeFi Llama

The TVL represents the variety of belongings deposited by liquidity suppliers in sensible contracts right into a protocol. On the time of writing, the TVL had decreased by 5.60% within the final 24 hours. An interpretation of this factors to hesitation in positively impacting the DeFi sector capital and functions.

Convex added that the event would allow the single-sided staking in keeping with its recently-passed cvxFXS proposal. Moreover, the blockchain yield optimizer identified that the present Arbitrum swimming pools would align with the Polygon integration to assist consumer entry. The communique talked about,

“Convex will likely be migrating the present Arbitrum swimming pools to new swimming pools, with the intention of aligning the code base with Polygon to stop confusion for integrators.”

Hitting the tops and bottoms

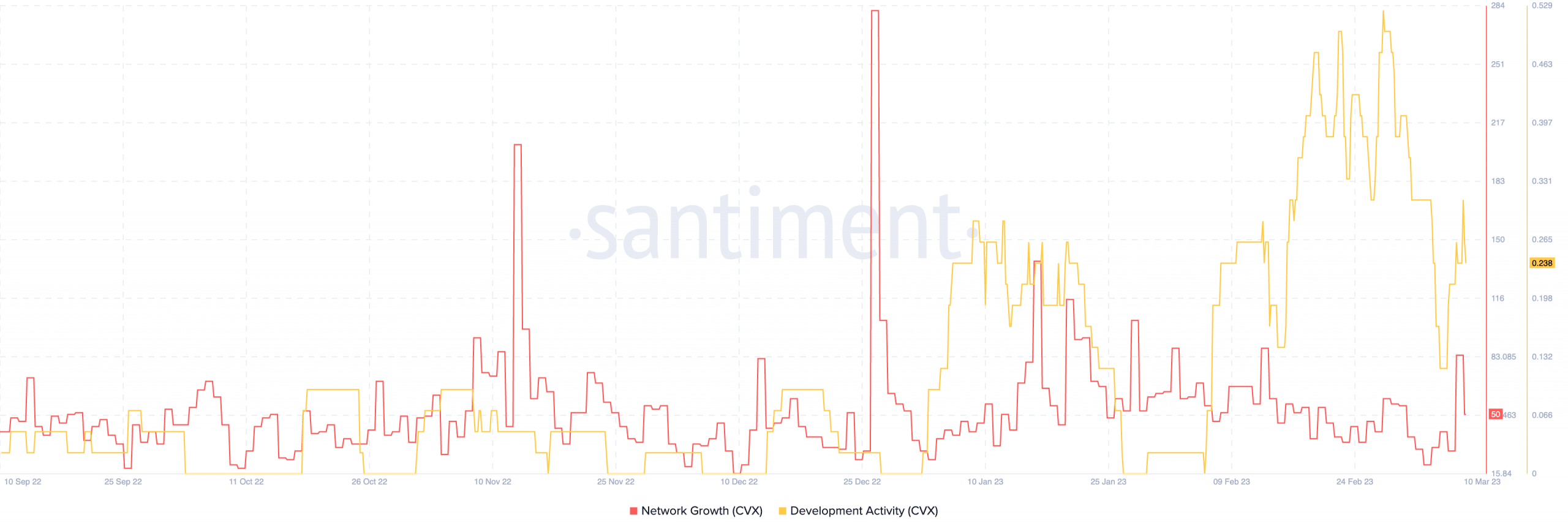

In the meantime, the Convex improvement exercise picked up a major enhance on account of the replace. The metric explains builders’ contribution to upgrades inside an ecosystem.

Learn Convex’s Finance [CVX] Value Prediction 2023-2024

As revealed by Santiment, the Convex improvement exercise rose to 0.309 regardless that it dropped to 0.238 at press time. This transient soar implied a powerful dedication from the Convex Finance improvement crew.

Supply: Santiment

The community development additionally posed an identical pattern to the event exercise. The metric illustrates the adoption of a undertaking. So, the downturn implied that Convex solely gained traction for a short time with minimal notable development.

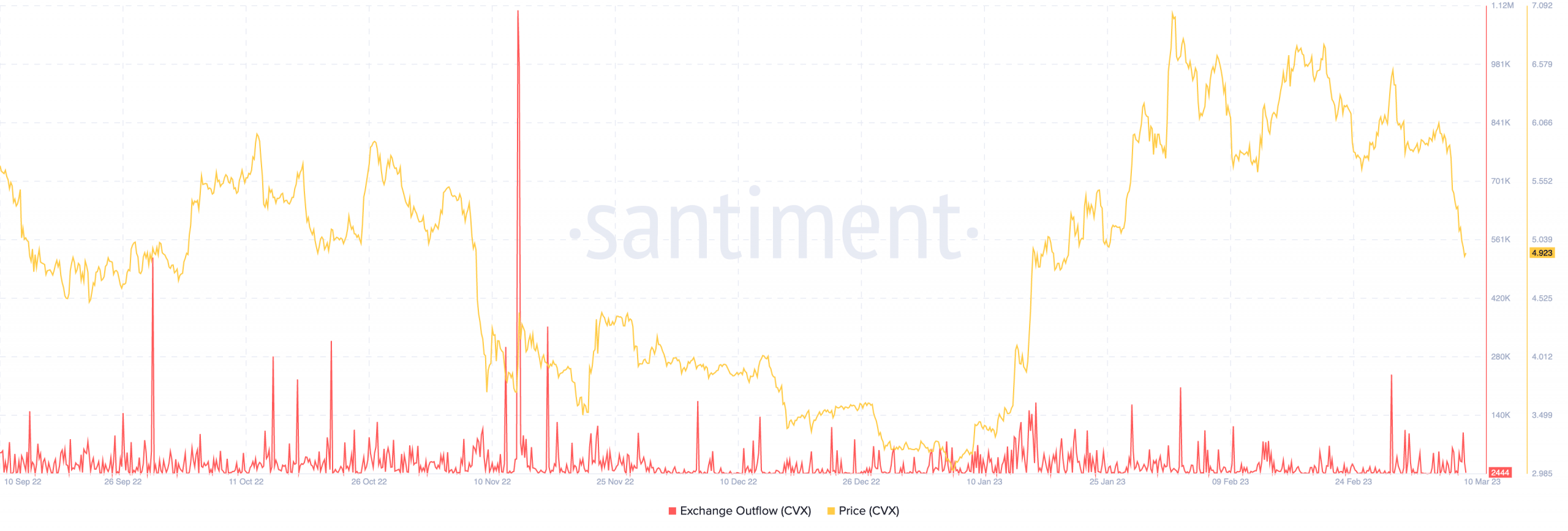

Whatever the improvement, CVX traders have remained resolute in neglecting to carry the token for the brief time period. This was as a result of the trade outflow was 2444— a lower from the 1 March excessive. At press time, the CVX traded at $4.92, following the broader market value collapse.

Supply: Santiment