Welcome to Finance Redefined, your weekly dose of important decentralized finance (DeFi) insights — a publication crafted to carry you vital developments during the last week.

DeFi has turn into a outstanding selection for buyers after a number of centralized finance (CeFi) collapses all through 2022. Some key curiosity areas for buyers embody “NFTfi,” on-chain by-product platforms, decentralized stablecoins and Ethereum layer 2’s.

February noticed seven DeFi exploits leading to a web lack of about $21 million. March isn’t any completely different, with a number of exploits already recorded, resembling on Hedera’s mainnet. DeFi lender Tender.fi was exploited, however the white hat hacker that drained $1.59 million returned the funds.

Twister Money builders mentioned {that a} new model of the blending instrument would intention to be extra regulator pleasant, the place regulation enforcement can differentiate between the authorized and unlawful switch of funds.

The DeFi market had a bearish previous week, with a lot of the tokens within the prime 100 buying and selling within the pink due to the brand new federal funds and Fed charge hike.

Crypto funding shifting from CeFi to DeFi after main collapses: CoinGecko

Digital asset funding companies poured $2.7 billion into decentralized finance initiatives in 2022 — up 190% from 2021 — whereas investments into centralized finance initiatives went the opposite approach — falling 73% to $4.3 billion in the identical timeframe. The staggering rise in DeFi funding got here regardless of total crypto funding figures falling from $31.92 billion in 2021 to $18.25 billion in 2022.

Based on a March 1 report from CoinGecko, citing knowledge from DefiLlama, the figures “doubtlessly level to DeFi as the brand new excessive development space for the crypto trade.” The report says the lower in funding towards CeFi might level to the sector “reaching a level of saturation.”

Proceed studying

7 DeFi protocol hacks in Feb, with $21 million in funds stolen: DefiLlama

Reentrancy, value oracle assaults and exploits throughout seven protocols brought on the DeFi house to bleed not less than $21 million in crypto in February.

Based on DeFi knowledge analytics platform DefiLlama, one of many largest within the month was the flash mortgage reentrancy assault on Platypus Finance, leading to $8.5 million of misplaced funds.

Proceed studying

DeFi lender Tender.fi suffers exploit — White hat hacker returns funds

An moral hacker drained $1.59 million from the DeFi lending platform Tender.fi, main the service to halt borrowing whereas it makes an attempt to recoup its property.

Web3-focused good contract auditor CertiK, and blockchain analyst Lookonchain, flagged an exploit that noticed funds drained from the DeFi lending protocol on March 7. Tender.fi confirmed the incident on Twitter, citing “an uncommon quantity of borrows” by the protocol.

Proceed studying

Hedera confirms exploit on the mainnet led to the theft of service tokens

Hedera, the corporate behind distributed ledger know-how, Hedera Hashgraph, has confirmed a sensible contract exploit on the Hedera mainnet, which led to the theft of a number of liquidity pool tokens.

Hedera mentioned the attacker focused liquidity pool tokens on decentralized exchanges (DEXs) that derived their code from Uniswap v2 on Ethereum, ported over to be used on the Hedera token service.

Proceed studying

Twister Money dev says ‘sequel’ to crypto mixer goals to be regulator-friendly

A former Twister Money developer claims to be constructing a brand new crypto mixing service to resolve a “vital flaw” of the sanctioned crypto mixer, hoping to persuade United States regulators to rethink its place on privateness mixers.

The code of a brand new Ethereum-based mixer, “Privateness Swimming pools,” was launched on GitHub on March 5 by its creator, Ameen Soleimani.

In a 22-part Twitter thread, Soleimani defined that the “vital flaw” with Twister Money is that customers can not show they’re not related to North Korea’s Lazarus Group or any felony enterprise.

Proceed studying

DeFi market overview

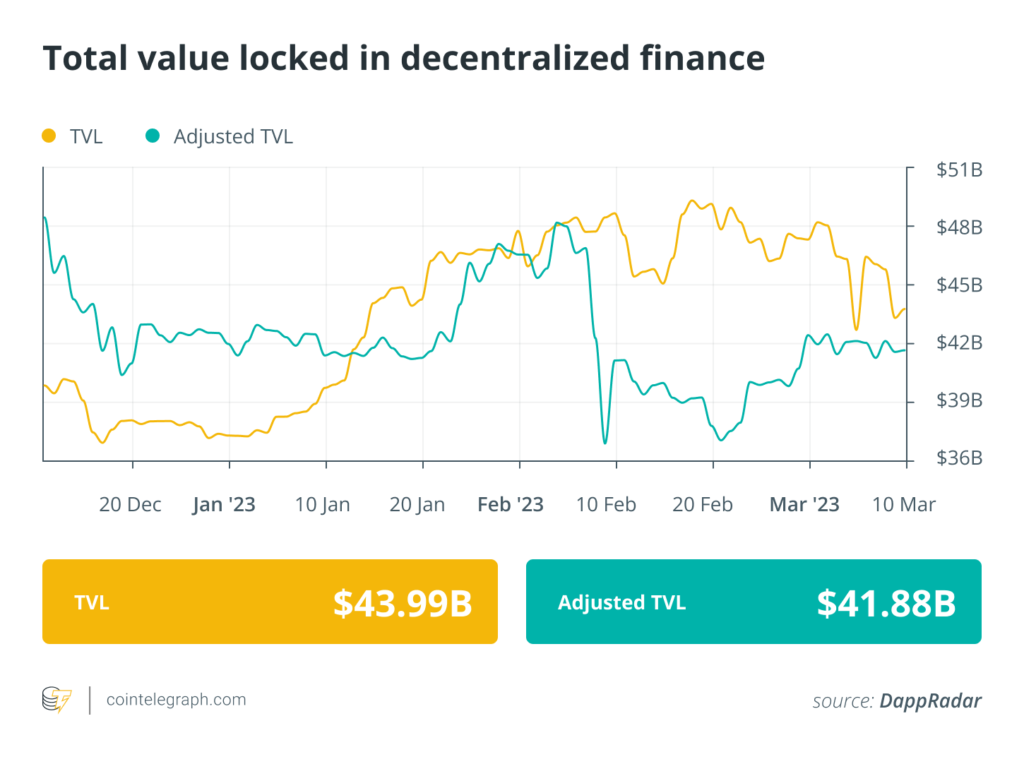

Analytical knowledge reveals that DeFi’s complete market worth dipped beneath $45 billion this previous week. Knowledge from Cointelegraph Markets Professional and TradingView exhibits that DeFi’s prime 100 tokens by market capitalization had a bearish week, with a lot of the tokens buying and selling in pink, barring a couple of.

Thanks for studying our abstract of this week’s most impactful DeFi developments. Be a part of us subsequent Friday for extra tales, insights and schooling on this dynamically advancing house.