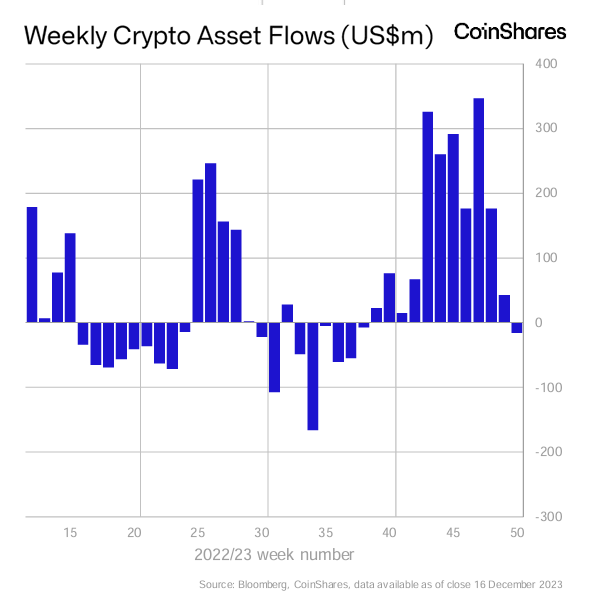

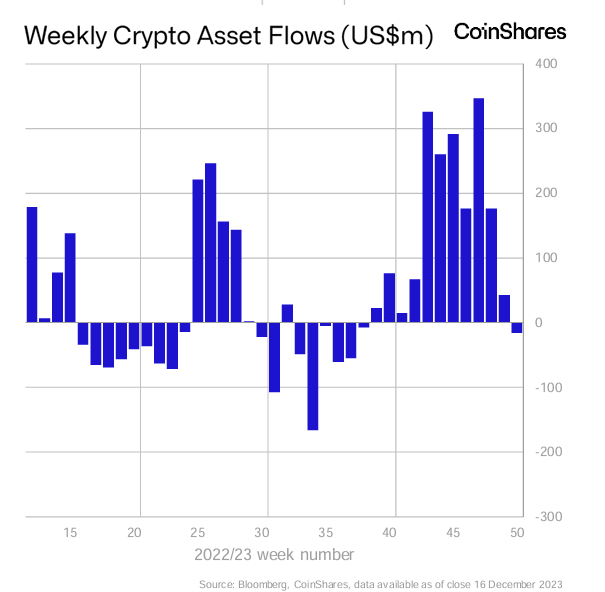

Following 11 weeks of constant inflows into digital asset funding merchandise, outflows totaling $16 million showcased a slight reversal available in the market.

The most recent CoinShares report highlights this refined shift within the funding panorama of digital property. The general buying and selling exercise for the week stood at $3.6 billion, considerably greater than the year-to-date common of $1.6 billion. Regardless of the current outflow, this strong buying and selling quantity spotlights a continued curiosity available in the market.

Even within the face of a seemingly imminent spot Bitcoin ETF approval, proxy Bitcoin investments within the type of blockchain equities continued to garner constructive investor sentiment. These equities noticed substantial inflows totaling $122 million final week. CoinShares stories that this inflow brings the overall for the earlier 9 weeks to $294 million, marking essentially the most important such run on document. This strong curiosity in blockchain equities highlights the rising recognition of the long-term potential of blockchain expertise past the quick fluctuations within the crypto market.

Bitcoin was essentially the most affected, witnessing outflows of $33 million. Even short-bitcoin positions, sometimes a hedge towards Bitcoin’s worth, noticed minor outflows totaling US$0.3 million.

Contrasting with the final outflow development, altcoins emerged as a vibrant spot, registering inflows of $21 million. Solana stood out with $10.6 million of inflows, far outpacing every other challenge. Cardano, XRP, and Chainlink adopted this constructive transfer, which collectively attracted inflows of $3 million, $2.7 million, and $2 million, respectively.

A more in-depth have a look at the geographical distribution of those flows reveals a extra complicated image. In the US, outflows have been most pronounced, reaching $18 million. Sweden and Germany equally skilled outflows, albeit on a smaller scale, totaling $4 million and $10 million, respectively.

Nevertheless, this development was not common throughout areas. Canada ($6.9 million) and Switzerland ($9.1 million) noticed continued inflows, with Brazil at $3.5 million. CoinShares attributes this blended sample throughout completely different areas to profit-taking actions moderately than a basic shift in investor sentiment towards digital property.

Total, the current actions in digital asset funding mirror a various and dynamic market. Whereas there are indicators of cautious profit-taking, the continued excessive buying and selling volumes and selective inflows into sure property and areas point out underlying confidence within the long-term prospects of the digital asset sector.

The total report from CoinShares is accessible on its web site, which is launched weekly on a Monday.