DeFi

The Maker Decentralized Autonomous Group (MakerDao) has proposed elevating rates of interest on its DAI stablecoin. Beneath the proposal, the DAI Financial savings Price (DSR) will rise from 1% to three.3%.

If the proposal passes, its penalties may very well be felt throughout the DeFi ecosystem.

What’s the DAI Financial savings Price?

The Dai Financial savings Price (DSR) is a elementary part of the Maker Protocol. It units the speed of curiosity customers to earn on their deposited DAI. Curiosity is accrued in real-time, accumulating from the system’s revenues.

The proposed fee hike was submitted by BlockAnalytica. It’s a part of a collection of bundled-together adjustments to DAI’s stability-enforcing mechanisms. DAO members will now vote on the proposal.

DAI Returns May Beat Different Stablecoins

With improved returns for DAI holders, the dollar-pegged stablecoin might quickly provide a greater return on funding in comparison with its Decentralized Finance (DeFi) friends. And the outcomes might have a big influence on the broader DeFi house.

Moreover, if the proposal to lift the DSR to three.3% is permitted, it’s going to surpass the returns supplied by Compound and Aave, which presently earn 2.5% and a pair of% respectively.

And in such a reconfigured DeFi market, buyers could select to reallocate their funds into the Maker protocol.

Implications for DeFi Borrowing

Commenting on the brand new proposal in a tweet, Block Analitica founder Primoz Kordez stated the transfer would set charges increased throughout the DeFi panorama. Furthermore, he remarked that “DAI in DSR is the benchmark for [the] most secure DeFi stablecoin yield.”

In flip, he identified that this could drive up the price of DeFi borrowing.

That will have an effect on the price of borrowing from MakerDAO’s personal lending product Spark, which launched earlier this month. Beneath the 1% DSR, Spark permits customers to borrow DAI with a 1.1% rate of interest. And as Kordez noticed, a 3.3% DSR might see the price of borrowing DAI rise to round 4.5%.

Following The Fed

MakerDAO’s proposal to lift the DSR follows a collection of fee hikes imposed by the U.S. Federal Reserve. The Fed’s personal base rate of interest presently stands at 5.25%.

Whereas increased federal rates of interest result in larger yields on {dollars} deposited in banks, the improved returns on fiat money don’t seem to have deterred folks from holding stablecoins.

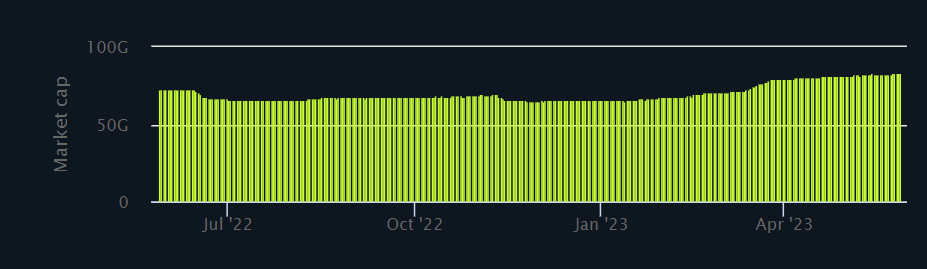

For instance, Tether’s USDT issuance has elevated in current months. And there’s now over $83 billion price of USDT in circulation. This reveals a wholesome urge for food for digital {dollars} that don’t reside with U.S. banks.

TUSD Market Cap (Supply: BeInCrypto)

And since Tether doesn’t pay out curiosity on to holders, the corporate has been in a position to leverage returns it constructed from U.S. Treasury Payments to purchase an extra 1.5 billion USD price of Bitcoin.

Furthermore, the worth of Bitcoin has usually responded positively to Fed fee hikes.