The rise of decentralized finance is especially robust in areas with weak banking methods, similar to Sub-Saharan Africa, Latin America, and Japanese Europe. Consultants consider it’s because defi provides monetary instruments and providers historically unavailable to folks in these areas. Consultants level to the user-friendliness and safety of defi in comparison with conventional monetary establishments in these areas. Nevertheless, challenges like advanced onboarding processes, laws, and hacking threats hinder widespread adoption.

Pre-Crypto Winter Enthusiasm Returns

In keeping with consultants, curiosity in decentralized finance (defi) and defi-related providers in Sub-Saharan Africa, Latin America, and Japanese Europe is essentially because of financial instability and the respective areas’ weakened banking methods. Citing the current Chainalysis crypto adoption index, the consultants insist that defi is making inroads in these elements of the world as a result of it offers customers entry to providers and monetary instruments which have historically been the protect of the few, largely customers in Western nations.

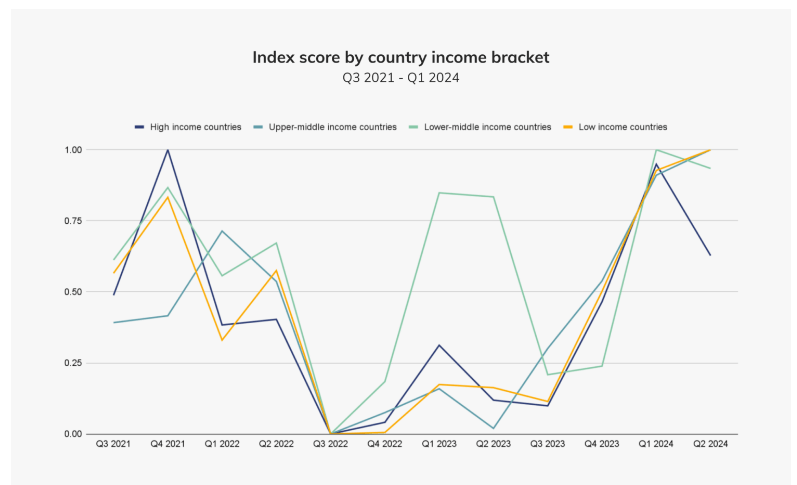

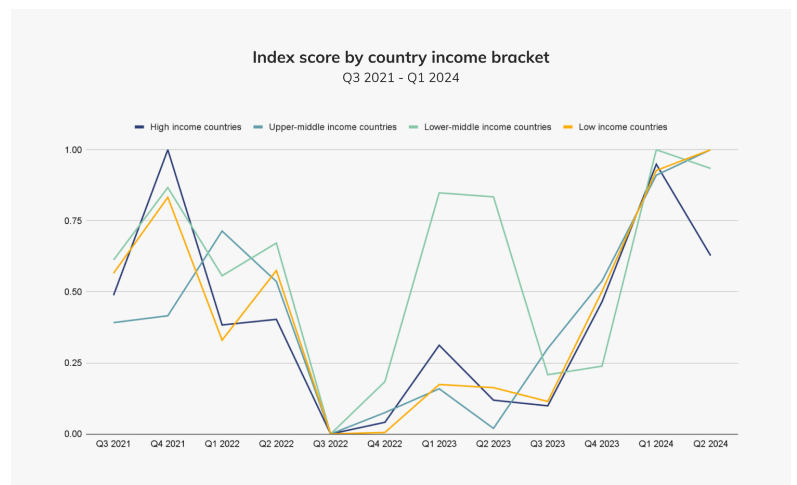

Whereas the Chainalysis index signifies rising crypto exercise throughout all areas, a more in-depth take a look at the information exhibits a decline in high-income nations starting within the first quarter of 2024. Apparently, this drop in exercise seems to have coincided with a interval when bitcoin (BTC) hit a brand new all-time excessive and the approval of bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Trade Fee (SEC).

In the meantime, the index exhibits that the trajectory of crypto exercise in decrease and lower-middle-income nations remained largely unchanged. This can be a sign that individuals in these areas are embracing crypto with the identical enthusiasm as they did earlier than the beginning of the so-called crypto winter.

Fragmentation Stalls Defi

Commenting on the Chainalysis knowledge, which hints at elevated defi exercise in among the much less developed areas of the world, Ivo Georgiev, CEO and co-founder at Ambire Pockets, defined to Bitcoin.com Information that this can be taking place as a result of defi seen as “extraordinarily helpful”, notably in markets the place monetary establishments are perceived to be unfriendly to customers.

Georgiev’s sentiments are echoed by Justin Wang, founding father of Zeus Community, who argues that individuals in these areas are at all times searching for different monetary options that provide safety and transparency. In keeping with Wang, defi stands out as a result of it gives a trustless and decentralized monetary system managed by good contracts. This provides the sort of “monetary autonomy” and safety that they can’t get from conventional monetary establishments.

Nonetheless, regardless of seeing notable progress in lower-income or less-developed nations and promising to disrupt the worldwide monetary system, the decentralized finance business faces challenges that hinder the envisaged worldwide adoption. A few of these challenges embody advanced onboarding processes, regulatory uncertainty, and the specter of hacking which continues to develop.

However, a spokesperson for the crypto alternate Bybit identifies the fragmentation of liquidity as one key downside hindering progress within the defi house. Whereas admitting that options to this downside are coming on-line, the spokesperson nevertheless mentioned extra must be finished to enhance the “on-chain expertise in order that customers can entry the property they’re searching for with adequate order guide depth to reduce slippage.”

‘Rising Pains’

Explaining why fragmentation shouldn’t be serving to the business’s trigger, Kiril Nikolov, a defi Technique Specialist with Nexo, mentioned:

Liquidity is extremely fragmented throughout quite a few networks and lengthy lists of derivatives for the underlying property. Better fragmentation ends in much less environment friendly markets, which in flip encourages worth extraction practices like MEV (Miner Extractable Worth) and excessive slippage.

Though the challenges holding again defi are a part of the “rising pains” that include trying to redefine the monetary system, consultants consider that when business contributors ultimately discover the best options, adoption will explode.

Do you agree with the consultants’ views? Share your ideas within the feedback part under.