The decentralized finance (DeFi) ecosystem is witnessing a sturdy resurgence, with the whole worth locked (TVL) catapulting to a staggering $60 billion for the primary time in 18 months.

This milestone underscores the rising curiosity within the DeFi sector, with protocols like Lido Finance and restaking narrative main this shift.

DeFi TVL Surges 68% in 4 Months

The DeFi ecosystem’s complete worth locked jumped 68%, from $36 billion in October 2023 to $60.55 billion. This rise is especially because of the crypto market rally and sector improvements, particularly in liquid staking and restaking.

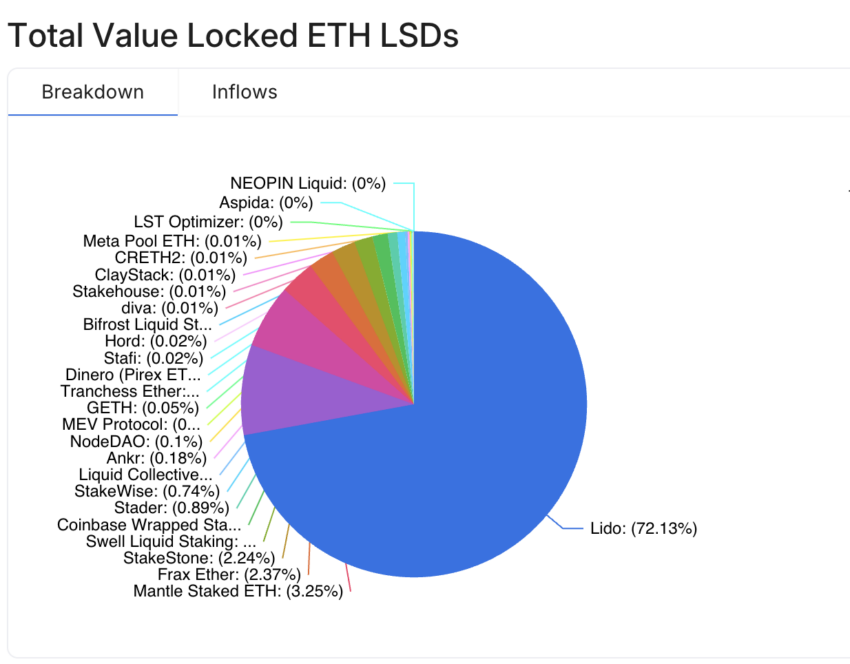

Lido Finance, main in liquid staking, now has a 37% market share. Its TVL stands at $22.65 billion, with a 4.50% development within the final seven days. The protocol is near a serious milestone of 10 million staked ETH, representing 72.13% of all liquid-staked Ethereum.

It’s value noting that the DeFi sector’s complete liquid-staked Ethereum additionally rose, reaching 13.20 million ETH, value $31.17 billion.

Learn extra: 11 Finest DeFi Platforms To Earn With Lido’s Staked ETH (stETH)

Whole ETH Locked Throughout DeFi Protocols. Supply: DefiLlama

Ethereum restaking, a novel DeFi narrative, can also be changing into a key development in 2024. It permits customers to leverage the identical ETH throughout a number of protocols, bolstering safety throughout these platforms. This mannequin has been instrumental in enhancing the robustness of smaller and rising blockchains by leveraging Ethereum’s established safety infrastructure.

On the coronary heart of the restaking narrative is EigenLayer, a middleware platform that launched to mainnet in June 2023. Even with out its native token, EigenLayer has carved a distinct segment within the DeFi sector with a TVL of $4.07 billion, witnessing a notable 161% development in only one month.

“Restaking is the fastest-growing crypto sector proper now. A giant wave of protocol launches utilizing EigenLayer is coming our means,” Ignas, a pseudonymous DeFi researcher, mentioned.

Nevertheless, the restaking narrative additionally has its critics. Analysts like Miles Deutscher have raised issues, drawing parallels between the restaking mannequin and the DeFi Ponzi schemes that marred the sector in 2021 and 2022. Deutscher’s skepticism stems from the inherent dangers and the pursuit of yield that characterised the earlier DeFi manias, urging stakeholders to tread cautiously.

“I see restaking as the following model of the DeFi Ponzis…The re-staking narrative for my part may be very paying homage to the 2021 DeFi Ponzi protocols. When folks tackle extra threat, they looking for yield, they’re hungry for alternative on chain, and that’s what actually noticed the DeFi Ponzi Mania of 2021[and] 2022,” Deutscher mentioned.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.