- Main cash BTC and ETH logged inflows final week.

- Brief BTC and Brief ETH, alternatively, posted outflows.

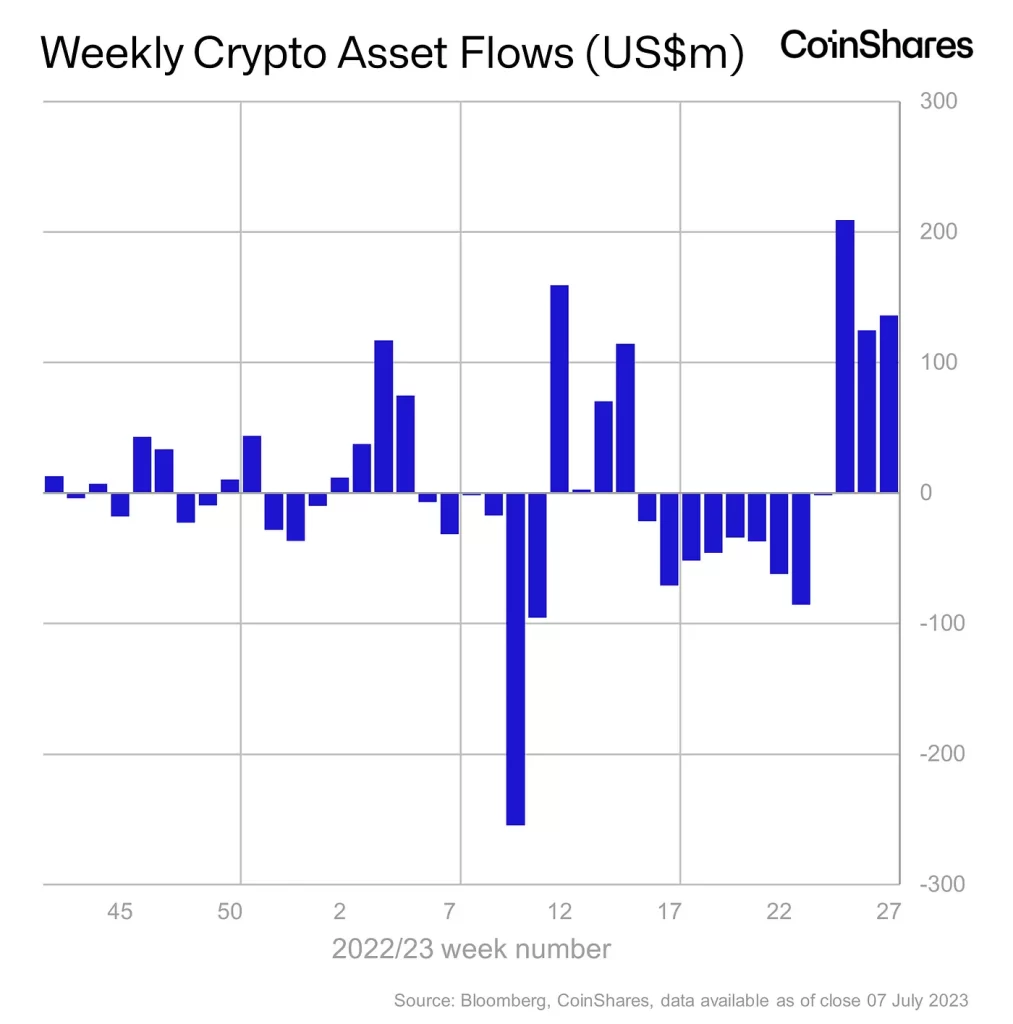

Inflows from digital asset funding merchandise totaled $136 million final week, bringing the third consecutive week of inflows to $470 million, CoinShares present in a brand new report.

In response to the digital property funding agency, the previous three weeks of consecutive inflows efficiently corrected the previous 9 weeks of outflows, which totaled $423 million. This introduced the year-to-date flows to a web constructive $231 million.

Supply: Coinshares

Apparently, regardless of the inflows logged final week, the interval was marked by a lower in buying and selling turnover. CoinShares discovered:

“Buying and selling turnover has slowed although, with funding merchandise totaling US$1bn for the week in comparison with US$2.5bn common within the prior 2 weeks. These decrease volumes could also be because of the seasonal results, the place decrease volumes are sometimes seen throughout July and August.”

Bitcoin takes the entrance seat

For the third consecutive week, Bitcoin [BTC] remained “the main focus amongst traders,” because the king coin logged inflows, totaling $133 million, final week. This accounted for 98% of the overall inflows recorded throughout that interval.

Though BTC lingered inside a slender worth vary throughout that interval, an 8% uptick was seen in inflows into digital property final week.

The extra $133 million in inflows introduced the main coin’s YTD web inflows to $290 million, with its property below administration (AuM) valued at $25 billion.

This represented the second week of BTC logging a web influx YTD, having been in a web outflow place of $171 million three weeks in the past.

Then again, short-Bitcoin funding merchandise noticed an outflow of $1.18 million final week, representing 11 weeks of consecutive outflows. Nonetheless, regardless of this latest bearishness for short-Bitcoin, it remained the second best-performing asset when it comes to inflows YTD at $58 million, information from the report confirmed.

Supply: Coinshares

Ethereum recorded inflows, however at what price?

Whereas main altcoin Ethereum [ETH] posted inflows that totaled $2.9 million, CoinShares famous that the coin “has solely marginally benefitted from improved investor sentiment.” The report said:

“The final 3 weeks of inflows signify simply 0.2% of whole property below administration (AuM) in comparison with Bitcoin’s 1.9%, and stays in a detrimental web flows place year-to-date of US$63m.”

Supply: Coinshares

As for different altcoins, Solana [SOL], Ripple [XRP], Polygon [MATIC], and Litecoin [LTC] recorded inflows of $1.2 million, $900,000, $800,000, $500,000, respectively, whereas Cosmos [ATOM] and Cardano [ADA] noticed minor outflows.