Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.

- The amount profile device confirmed EOS has misplaced a essential assist stage.

- The stuffed imbalance confirmed demand might reverse the current retracement.

EOS has carried out properly within the markets and maintained its upward trajectory regardless of uncertainty throughout the market. Despite the fact that Bitcoin has retraced a great portion of its good points over the previous two weeks, EOS was fast to rebound.

Learn EOS Worth Prediction 2023-24

This was a present of power. Cash resilient throughout a BTC dump, or those which are fast to get well, are typically robust cash for patrons and will outperform a great chunk of the opposite mid-cap cash. Other than relative power, technical causes have been additionally noticed for EOS’s current efficiency.

EOS confirmed indicators of a rebound after filling the FVG

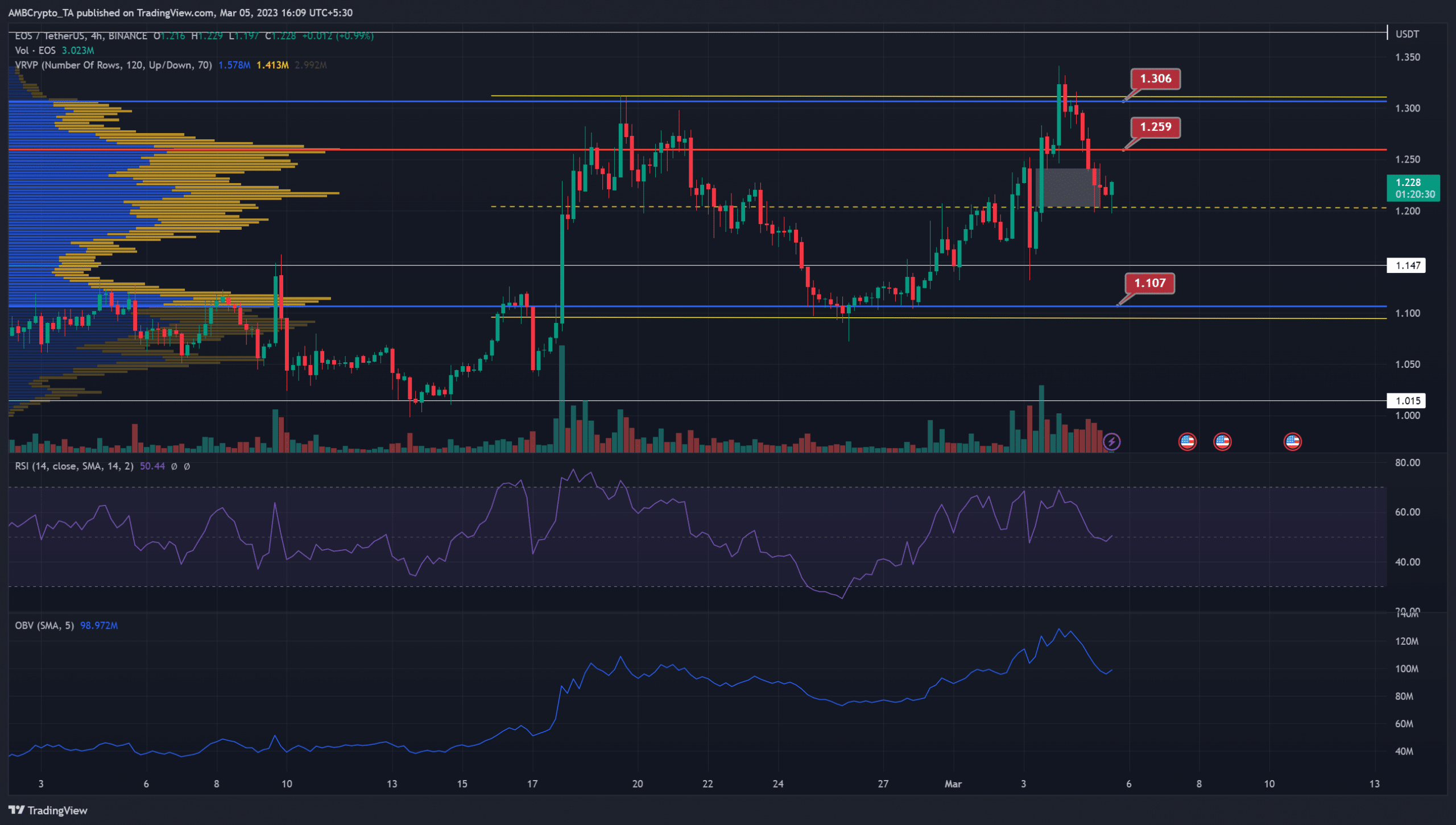

Supply: EOS/USDT on TradingView

The Seen Vary Quantity Profile confirmed the Level of Management at $1.26. The Worth Space Excessive and Low sit at $1.3 and $1.1, and these three ranges are key horizontal ranges for EOS within the coming weeks.

In yellow, a spread was plotted for the asset that prolonged from $1.1 to $1.31, with the mid-range mark at $1.2. The vary values are fairly near the values highlighted by the VPVR device, which strengthened their significance.

On the 4-hour chart, the RSI stood at 50 and has been above the impartial 50 mark since 28 February. This highlighted some bullish momentum on this interval, and the buying and selling quantity was excessive relative to the previous weeks.

The OBV has additionally trended upward all through March, regardless of the drop in costs.

Is your portfolio inexperienced? Verify the EOS Revenue Calculator

Furthermore, the market construction remained bullish on the every day timeframe, regardless of the volatility on H4. Moreover, the value stuffed an imbalance (white) on the charts from the current pump. This imbalance sat proper atop a assist stage. Altogether, the inference was that extra good points can comply with for EOS.

Lengthy positions are discouraged primarily based on Open Curiosity knowledge

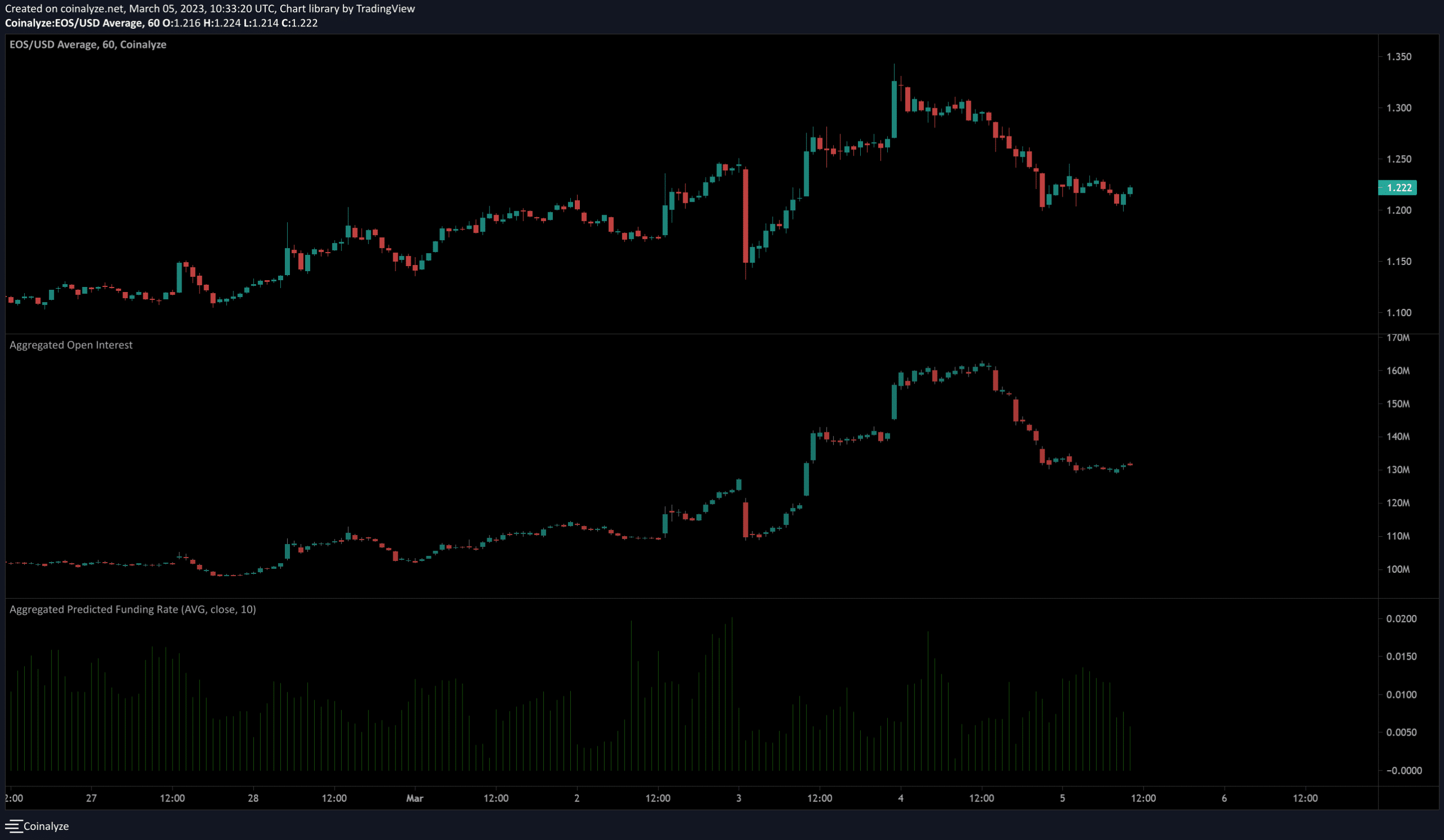

Supply: Coinalyze

The futures knowledge was optimistic for the bulls. The funding fee was constructive which confirmed bullish sentiment available in the market. The Open Curiosity noticed a pullback when EOS confronted rejection on the vary highs.

This meant lengthy positions have been seemingly closed in the course of the dump however the quick sellers didn’t enter the market en masse, as that might have seen an increase in OI. Due to this fact, the patrons have some room to shift issues of their favor.