- Ethereum’s variety of wallets in loss reached a seven-month excessive

- Metrics and market indicators advised that ETH’s worth would possibly decline additional

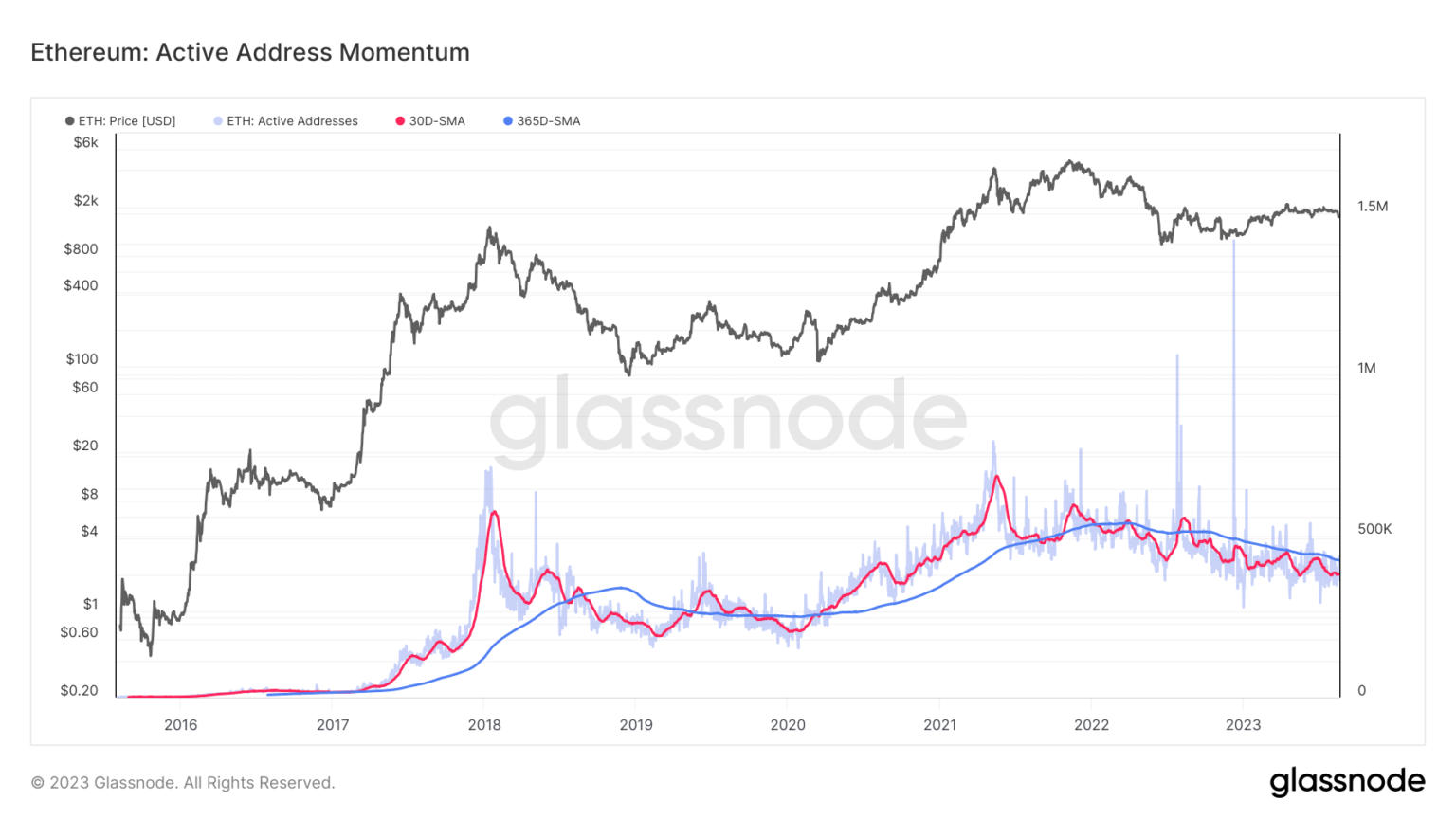

Over the previous couple of months, Ethereum [ETH] witnessed a decline in its community exercise. This was the case because the blockchain’s month-to-month common lively addresses dropped.

The month-to-month common of lively ETH addresses stood decrease than the yearly common. This clearly indicated low exercise, which may very well be taken as a bearish sign. Whereas the blockchain’s community exercise declined, its worth additionally did not shoot up.

Is Ethereum’s reluctance to push its worth up a consequence of much less community exercise?

Supply: Glassnode

Learn Ethereum’s [ETH] Value Prediction 2023-24

The rationale for ETH’s worth drop

Based on CoinMarketCap, ETH was down by greater than 9% within the final seven days, reflecting its sluggish habits. On the time of writing, it was buying and selling at $1,670.05 with a market capitalization of over $200 billion.

The value drop had a serious impression on buyers’ portfolios. As per Glassnode Alerts’ tweet, the variety of ETH addresses in loss reached a seven-month excessive of 42,602,870.333.

📈 #Ethereum $ETH Variety of Addresses in Loss (7d MA) simply reached a 7-month excessive of 42,602,870.333

View metric:https://t.co/eTr2V1rqmQ pic.twitter.com/lEkFdTk0XV

— glassnode alerts (@glassnodealerts) August 21, 2023

Nonetheless, upon taking a more in-depth look, the explanation behind the downtrend may not have been much less community exercise. This was as a result of whereas ETH’s lively addresses dropped, Layer-2s like Base, Optimism [OP], and rollups gained reputation.

The first motive behind market contributors shifting to L2s was that they supplied extra scalability. For reference, Coinbase’s L2 Base bridged $251 million, with ETH accounting for $155 million out of the overall inside days of launch.

A more in-depth take a look at Ethereum’s state

A take a look at Ethereum’s on-chain efficiency gave a greater understanding of what was happening within the ecosystem. Upon checking, it was revealed that buyers in funds and trusts, together with Grayscale, have comparatively weak shopping for sentiment.

Moreover, as per CryptoQuant, ETH’s web deposit on exchanges was excessive in comparison with the seven-day common, suggesting excessive promoting strain. Nonetheless, it was attention-grabbing to see that when ETH fell sufferer to the newest worth correction, buyers took it as a possibility to extend accumulation.

This was evident from Glassnode Alerts’ tweet, which identified that Ethereum’s trade outflow quantity reached a one-month excessive throughout that interval.

📈 #Ethereum $ETH Change Outflow Quantity (7d MA) simply reached a 1-month excessive of 9,627.006 ETH

Earlier 1-month excessive of 9,608.990 ETH was noticed on 20 August 2023

View metric:https://t.co/LzFffVHu6i pic.twitter.com/dhJIEP4CZO

— glassnode alerts (@glassnodealerts) August 21, 2023

How a lot are 1,10,100 ETHs value in the present day

Not solely metrics, however a couple of market indicators have been additionally bearish. For instance, the Shifting Common Convergence Divergence (MACD) displayed a bullish edge available in the market.

Moreover, ETH’s Chaikin Cash Movement (CMF) additionally registered a downtick, rising the probabilities of a worth decline. Nonetheless, the Cash Movement Index (MFI) rebounded from the oversold zone, which might help the token enhance its worth.