The publish Ethereum is Poised to Maintain $1800- Will ETH Value Break Above Resistance Line? appeared first on Coinpedia Fintech Information

The crypto market has not too long ago met a pointy collapse, creating panic promoting amongst traders. The Securities and Change Fee (SEC) has not too long ago filed lawsuits in opposition to two main cryptocurrency exchanges, Binance and Coinbase, resulting in a major downturn available in the market. This bearish momentum has created a massacre within the crypto area, with Ethereum (ETH) gaining consideration. Nonetheless, regardless of the unfavorable information, the ETH value continues to point out optimistic momentum, leaving traders on the sting of the following value degree.

Ethereum’s On-Chain Information Supplies Bullish Confidence

Ethereum whales, or giant non-exchange holders, have been steadily buying extra of the cryptocurrency this yr, now proudly owning an unprecedented 31.8 million ETH, valued at over $59.6 billion. This development, famous by analytics agency santiment

santiment

On-Chain

, happens amidst current market instability attributable to U.S. regulatory actions.

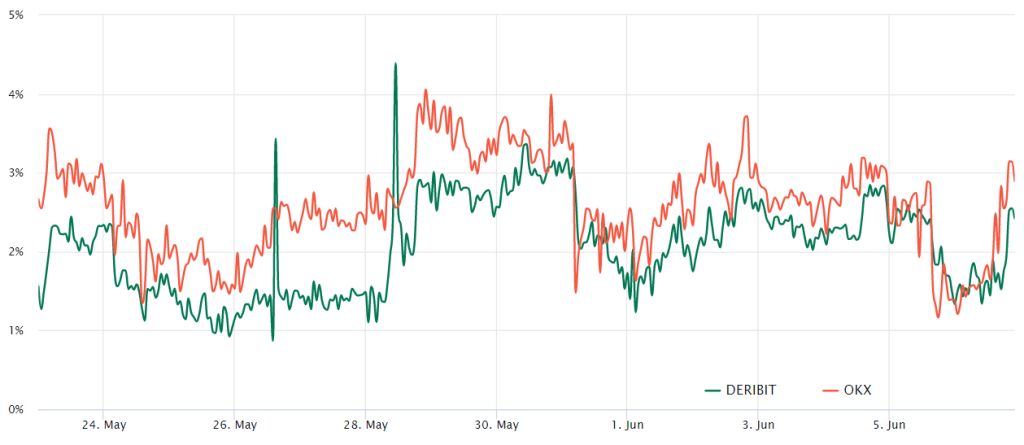

Quarterly futures of Ether are favored by giant traders, referred to as whales, and arbitrage desks. These fixed-month contracts normally carry a small premium over the spot markets, suggesting that sellers demand a better value for suspending settlement.

Consequently, in a sturdy market, ETH futures contracts ought to exhibit a 4 to eight% annualized premium. This situation, known as contango, is a standard prevalence not unique to cryptocurrency markets.

Primarily based on the futures premium, additionally known as the essential indicator, it seems that skilled merchants have been steering away from leveraged lengthy positions or bullish bets. Nonetheless, even when the worth retested the $1,780 mark on June 6, it wasn’t enough to shift the sentiment of those giant traders and market makers in the direction of a bearish outlook.

Additionally Learn: Will Bitcoin and Ethereum Encounter a ‘Merciless Summer season’? Listed below are Necessary Ranges to Watch

What To Count on From ETH Value Subsequent?

Within the final two days, Ether’s (ETH) value fell beneath the resistance line of its descending wedge sample, however the bears did not capitalize on this momentum, indicating demand at cheaper price factors.

Following the bearish breakout, bullish merchants pushed the worth again above the transferring averages, however they confronted important promoting stress close to the $1,895 degree. At present, sellers try to maintain the ETH value beneath the resistance line, and if profitable, this might result in an additional drop in ETH’s value to the help line of the sample.

As of writing, ETH value trades at $1,851, declining over 0.5% within the final 24 hours. At present, the RSI degree hovers close to the 50-level, making a steady area for Ethereum. Nonetheless, if the ETH value fails to carry its present development, it might drop to the speedy help degree of $1,760, beneath which the following help can be $1,610.

Conversely, if the worth breaks above the resistance line, it will suggest that the bulls have transformed this line right into a help degree. Ethereum value could then provoke an upward momentum towards $2,000 and finally contact the resistance at $2,115.