- Ethereum’s value confirmed a possible decoupling from DeFi tokens.

- TVL metric, nonetheless, confirmed the contribution of DeFi to the TVL of Ethereum.

Ethereum [ETH] rose to fame by introducing an progressive idea referred to as sensible contracts, which revolutionized the world of decentralized finance (DeFi).

Nonetheless, in keeping with latest experiences, the worth of ETH, Ethereum’s native cryptocurrency, has been gaining floor on the established tokens of DeFi’s main tasks. This growth signifies a possible decoupling between Ethereum and these blue-chip tokens.

Ethereum value decouples from DeFi tokens

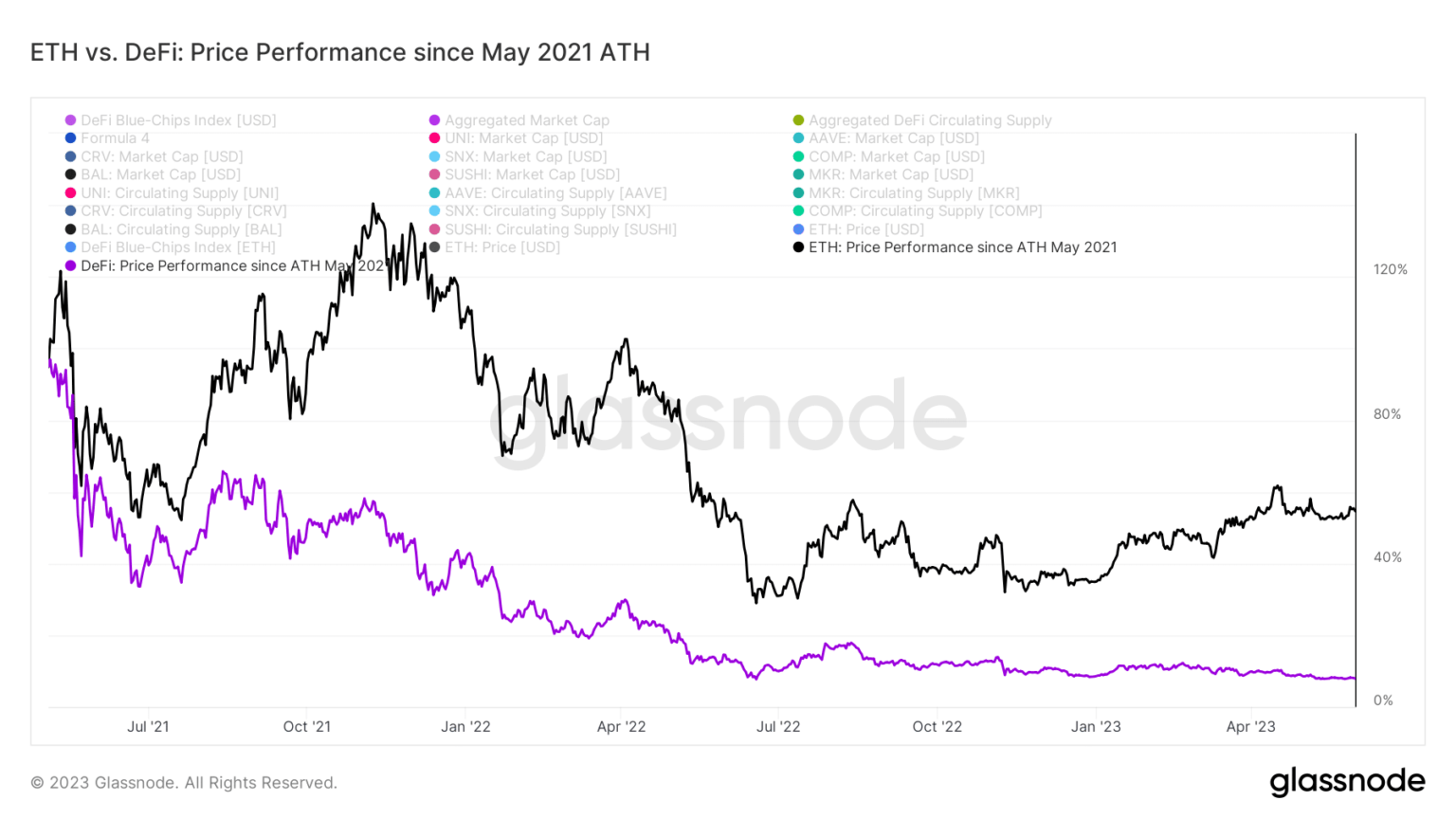

In keeping with latest Glassnode information, a notable divergence in value developments between Ethereum’s DeFi tokens and ETH has come to mild.

The info revealed that following the “DeFi Summer time” in January 2021, DeFi tokens launched into a extra fast upward trajectory than ETH. Nonetheless, this surge was short-lived, as a big drop occurred in Could 2021, adopted by a steady decline.

Even in the course of the latter a part of the 2021 bull market, DeFi tokens exhibited much less responsiveness to optimistic market actions. This is perhaps as a result of market’s rising choice for NFTs throughout that interval.

Supply: Glassnode

Moreover, it was price noting that the DeFi index did not surpass its earlier all-time excessive in Could. It remained -42% under it, regardless of ETH costs reaching new report ranges in November 2021.

As of January 2023, a breakdown within the correlation between Ethereum and DeFi tokens emerged. It indicated a detachment between the actions surrounding DeFi tokens and the general ETH market efficiency to this point this yr.

Pockets Addresses decreases

Since March, there was a big and fast decline in new addresses for DeFi tokens. Primarily based on the noticed chart, it was seen that solely round 600 new wallets holding DeFi tokens have been being created every day.

This indicated a continued battle for DeFi tokens to draw investor consideration. Apparently, this battle endured whilst ETH costs began to get well in the course of the first quarter of 2023.

Supply: Glassnode

Moreover, the month-to-month common of latest addresses has constantly remained under the yearly common, apart from a notable spike that occurred across the time of the FTX collapse.

Nonetheless, you will need to notice that this spike doesn’t point out new demand for DeFi tokens. As an alternative, it was primarily related to divestment from DeFi tokens because the market notion of danger elevated.

Ethereum TVL showcases the decline of Defi

As of this writing, the Complete Worth Locked (TVL) of Ethereum per DefiLlama was $26.84 billion. What was notable concerning the TVL was that Lido, a liquid staking platform was liable for over 40% of the TVL.

Different DeFi platforms comprised the highest 5 largest TVL contributors to Ethereum’s TVL. A have a look at the final pattern of the TVL confirmed that it was experiencing common actions with no vital uptrend or downtrend.

Learn Ethereum (ETH) Worth Prediction 2023-24

Weak bullish pattern flash in value pattern

Analyzing the every day value pattern of Ethereum, it was evident that it was presently experiencing a downtrend. Nonetheless, when contemplating the general efficiency of ETH all year long, the worth has elevated by greater than 50% year-to-date.

On the time of writing, ETH was buying and selling at roughly $1,856, reflecting a decline of almost 1%. Whereas the pattern was nonetheless technically bullish, it appeared comparatively weak. Additionally, an additional drop in value might result in a shift within the present pattern.

Supply: TradingView