- The variety of Bitcoin wallets with a stability decreased.

- If the CLLD turns into adverse whereas BTC’s value falls, the coin would possibly reverse upward.

In response to on-chain analytic supplier Santiment, Bitcoin [BTC] holders need to have a share of the lately authorised ETFs. The agency made this identified on the eleventh of January by way of X (previously Twitter).

When the 12 months began, there have been about 52.64 million Bitcoin wallets with cash in them. Nonetheless, AMBCrypto confirmed that this quantity had declined.

Additionally, that was not the one factor. There has additionally been a dearth within the creation of recent addresses.

📊 With the approval of #BitcoinETF‘s yesterday, we might proceed to see a slight decline in energetic wallets on #Bitcoin‘s #blockchain. Although this seemingly will not influence value, a portion of merchants might vacate their current $BTC wallets in favor of #ETF publicity to

(Cont) 👇 pic.twitter.com/l5Q8OmOP5O

— Santiment (@santimentfeed) January 11, 2024

Merchants take Bitcoin’s quantity to the ETFs

Moreover, it was value noting that 40,000 wallets liquidated all of their BTC. So, this might solely imply one factor— publicity to the Bitcoin ETFs. Whatever the motion, the BTC value may not be affected.

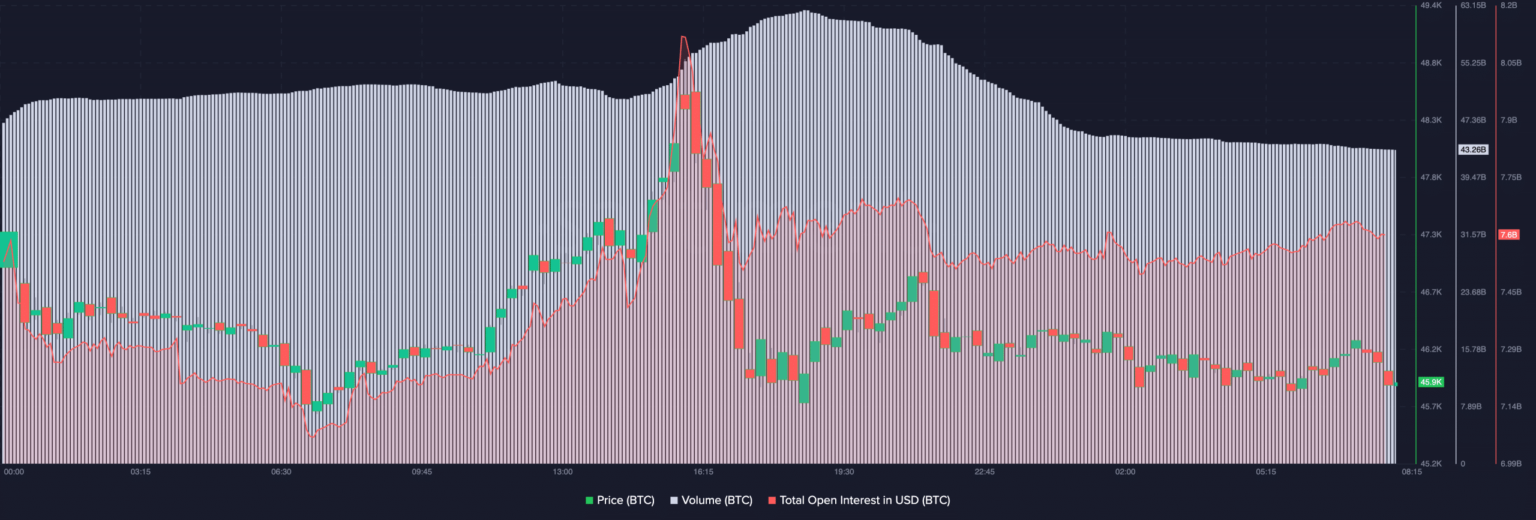

Nonetheless, the primary day of buying and selling the ETFs reside occurred on the eleventh of January. This introduced a rise in volatility to BTC. Inside the first hour, Bitcoin jumped from $47,000 and traded above $49,000.

But it surely didn’t take lengthy for the coin to erase all its positive aspects, and fall under $46,000.

At press time, the worth of Bitcoin modified fingers at $46,029, suggesting that the preliminary storm had turn into calm. On the identical day, AMBCrypto noticed that the Bitcoin quantity elevated. In some unspecified time in the future, on-chain information confirmed that the amount climbed to $62.07 billion.

The quantity exhibits the quantity of cash throughout all transactions on the community. So, which means there was loads of shopping for and promoting of BTC in the course of the interval.

Nonetheless, it didn’t take lengthy for the amount to fall under $50 billion. This means that curiosity waned inside a short while. The notion was additionally confirmed by the Open Curiosity (OI) in BTC.

Supply: Santiment

Shorts worn out and it may very well be longs flip

Regarding the value motion, the decline in OI and quantity implies that the downtrend was getting weak. Additionally, if each metrics proceed to say no alongside the Bitcoin value, then a return to the upside is likely to be doable.

On this occasion, Bitcoin may not fade returning to $48,000 for a begin.

Moreover, a have a look at the Liquidation Ranges confirmed that Bitcoin headed towards the Magnetic Zones when it moved as much as $49,000. For context, Liquidation Ranges are estimated value ranges the place a liquidation occasion can happen.

Utilizing Hyblock Capital’s information, we found that the worth moved in that route due to the excessive liquidity there. Additionally, merchants with high-leverage brief positions would have had their Cease Loss triggered at that time.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Nonetheless, the bias has modified as indicated by the Cumulative Liquidation Ranges Delta (CLLD). As of this writing, longs with excessive leverage had been prone to liquidation.

Supply: HyblockCapital

This was as a result of the Bitcoin value had absolutely retraced and the CLLD had turn into constructive. But when the BTC value sharply falls and the CLLD strikes within the adverse route, a return to the upside is likely to be confirmed.