- MakerDAO’s DAI was safely collateralized, however curiosity in it was declining at press time.

- Energetic improvement affords hope for MakerDAO’s future.

Following the collapse of SVB and the stablecoin saga, many have misplaced religion in crypto-backed stablecoins.

Learn Maker’s [MKR] Value Prediction 2023-2024

In an try to revive religion in DAI, on 17 March, MakerDAO posted information demonstrating how DAI is safely collateralized. The 5.7 billion DAI in circulation is backed by $8.7 billion value of collateral at a 161% collateralization ratio, in keeping with MakerDAO’s tweet. It’s largely supported by USD Coin [USDC], adopted by Ethereum [ETH] and Actual-World Belongings.

5.7 billion DAI in circulation backed by $8.7 billion value of collateral at a 161% collateralization ratio.

Knowledge is at all times publicly and transparently obtainable in real-time.

→ https://t.co/365P0aZXZM pic.twitter.com/e6SKTjWFvt

— Maker (@MakerDAO) March 17, 2023

In DAIre want of positivity?

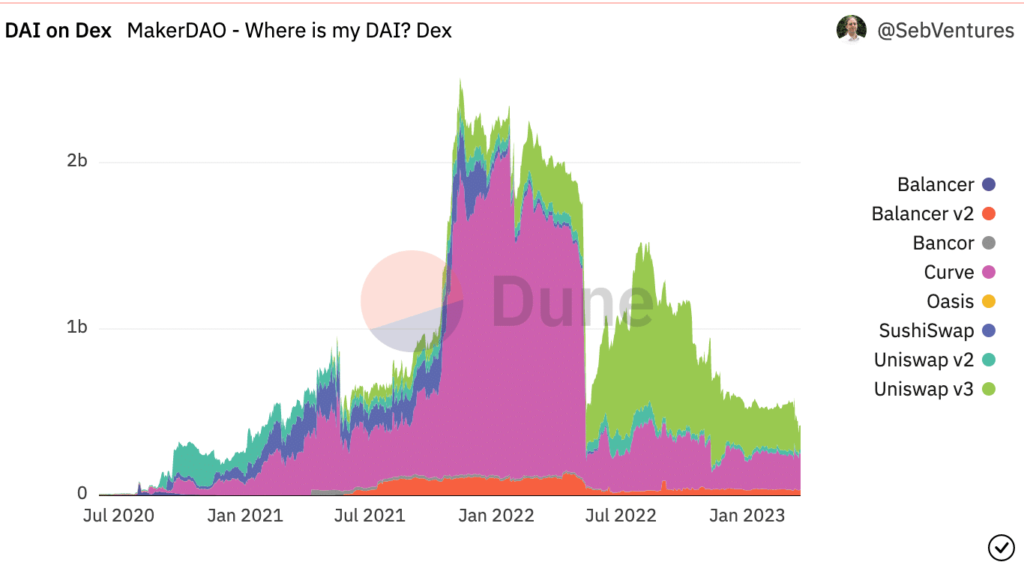

Regardless of this announcement, DEXes confirmed a decreased curiosity in DAI.

Supply: Dune Analytics

Furthermore, the stablecoin’s market cap decreased from $6.3 billion to $5.6 billion from 16 March to press time. Its velocity and every day energetic addresses additionally dropped, indicating that the utilization of DAI had slowed down.

Supply: Santiment

Affect on Maker

The poor well being of DAI additionally impacted the MakerDAO protocol, with Messari’s information revealing a 17.84% lower in income generated by the protocol over the previous week. Its TVL fell from $8.3 billion to $7.78 billion throughout this era.

Nonetheless, issues might change for the higher for MakerDAO going ahead. Token Terminal’s information confirmed a considerable enhance within the variety of energetic builders and code commits to the MakerDAO protocol on the time of writing.

This spike in improvement may point out the addition of recent options and updates to the protocol, which may entice extra customers to the community sooner or later.

Supply: token terminal

As for the protocol’s token, MKR, there wasn’t a lot promoting stress on holders, because the MVRV ratio declined within the aforementioned time interval. This steered that long-term MKR holders are nonetheless holding onto their tokens, regardless of the current decline in DAI’s well being.

Practical or not, right here’s MKR market cap in BTC’s phrases

Supply: Santiment

Moreover, a lot of short-term MKR holders have offered their holdings, as proven by the declining lengthy/quick distinction.

Because the charges collected by MakerDAO continued to fall at press time, it will likely be troublesome for the protocol to maintain up with making enhancements on the community as time goes on.