DeFi

In accordance with Wu blockchain, the Fantom community accounts for the best proportion of Multichain’s $1.76 billion TVL, reaching 36.7%. The property on the Fantom community are about $1.66 billion, and practically 40% of the property are wrapped property of Multichain.

Among the many $1.76billion TVL of Multichain, the Fantom community accounts for the best proportion, reaching 36.7%; the property on the Fantom are about $1.66 billion, practically 40% of the property are wrapped property of Multichain; the primary stablecoin on Fantom is 191 million, USDC and 82…

— Wu Blockchain (@WuBlockchain) Might 26, 2023

The primary stablecoin on Fantom is 191 million USDC and 82 million USDT property are issued by Multichain. Though Multichain is Fantom’s official cross-chain bridge, most chains function usually, and there’s no signal of a de-peg of USDC and USDT on Fantom.

Beforehand, a Twitter account often known as “Ignas | DeFi Analysis” reported the rumors spreading on Twitter that the Multichain staff had been arrested resulting in a FUD leading to a 5x improve in day by day bridging quantity.

1/ Rumors are spreading that the Multichain staff has been arrested.

The FUD resulted in a 5x improve in day by day bridging quantity.

What does different on-chain information reveal? pic.twitter.com/kqmuAOUxtp

— Ignas | DeFi Analysis (@DefiIgnas) Might 25, 2023

Regardless of this, the bridging volumes don’t present indicators of panic. “An Ape’s Prologue” reported that Fantom is probably the most uncovered to Multichain’s wrapped tokens. 35% of its TVL locked is determined by these wrappers. Multichain points 40% of non-$FTM property ($650M) and handles 81% of Fantom’s complete stablecoin MC.

After the rumors involving the Multichain staff being arrested, we determined to try the protocols with the best publicity to it.

In first place comes Fantom, with 35% of its complete TVL locked in it and a good portion of the chain’s property issued by the bridge. pic.twitter.com/ZTp6TH1bod

— An Ape’s Prologue (@apes_prologue) Might 24, 2023

Though the quantity withdrawn was bigger than deposited by $18M, it’s only 1% of its complete TVL of $1.78B USD. Not a lot panic was seen.

Fantom ought to have skilled a major outflow of TVL as a consequence of its reliance on Multichain. Though TVL has dropped by 9.55% in USD, adjusting for the worth of FTM, the information reveals no important outflow of capital. The clearest signal of panic is the Multichain LPs on Fantom.

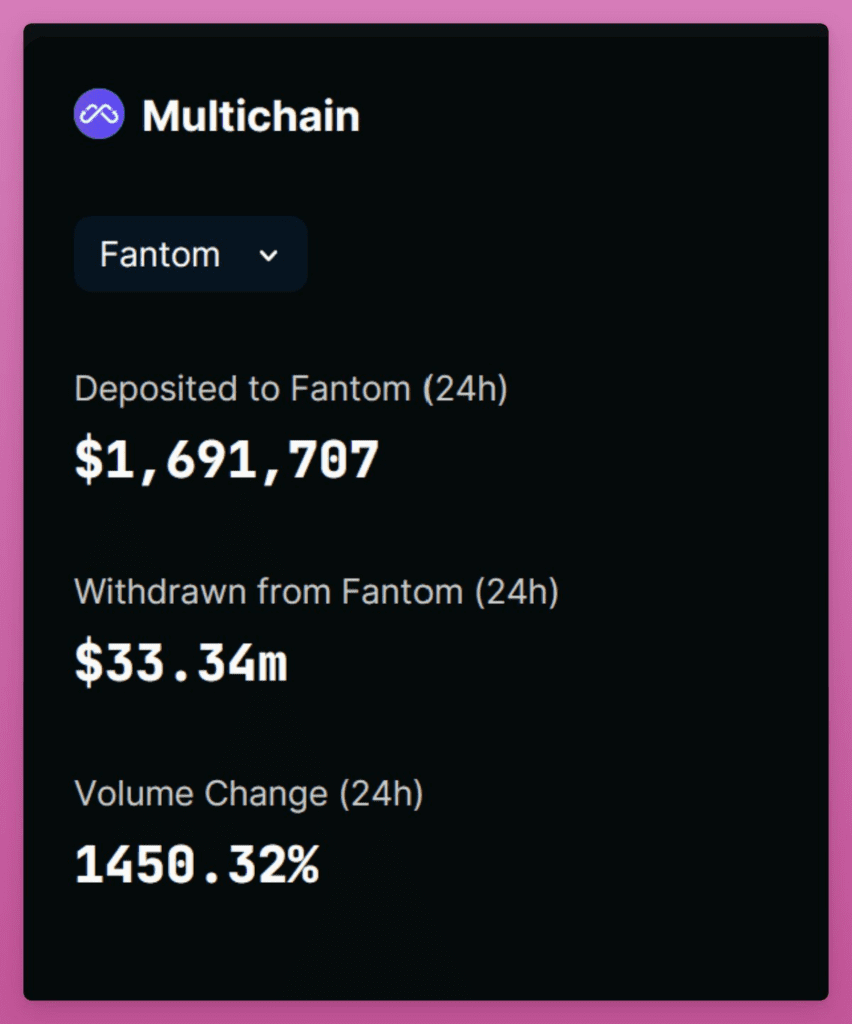

A complete of $33M USD has been withdrawn by LPs from Fantom, with solely $1.7M in deposits. Multichain reported that “among the cross-chain routes are unavailable as a consequence of pressure majeure” and that Kava, zkSync, and Polygon zkEVM routes had been quickly suspended. Eighty-three transactions had been pending for greater than a day.

It is very important notice that on-chain information doesn’t reveal a large capital outflow. Nonetheless, the dearth of communication from the staff is worrying. The present Multichain CEO, Zhaojun, hasn’t been on-line in per week.

DISCLAIMER: The Info on this web site is offered as basic market commentary and doesn’t represent funding recommendation. We encourage you to do your personal analysis earlier than investing.