Discover the tumultuous journey of cryptocurrencies from 2022’s crashes to 2023’s cautious optimism amidst market volatility and regulatory shifts.

Since their inception, crypto property have been commanding headlines, with their unstable nature portray a wide ranging, but typically terrifying, image for traders worldwide.

Nevertheless, beneath this market’s faсade of utmost ups and downs lies an intricate tapestry woven by components far past simply numbers on a display.

Are they merely victims of their inherent boom-and-bust cycles, or do they bear the brunt of regulatory overreach?

Crypto market cap in 2022-2023 | Supply: CoinMarketCap

Increase and bust cycles in crypto business

The cryptocurrency panorama of 2022 was a whirlwind. Tokens like Celsius (CEL) and Terra (LUNC) reached dizzying heights, using the wave of investor optimism.

Nevertheless, as these digital entities crumbled into obscurity, they symbolized the turbulent nature of the crypto markets.

The autumn of the Celsius Community was dramatic, because it suspended all operations, resulting in chapter, and its token’s worth collapsed to a mere $0.16, marking a 98% drop from its all-time excessive of $8.02.

Equally, Terra’s native token, LUNA, skilled a downfall, triggering accusations of defrauding traders towards Terraform Labs’ chief, Do Kwon, and resulting in a determined rebranding try.

You may also like: What occurred to Terra Luna: one yr after collapse

These incidents led to a serious dent in investor confidence, fostering an air of warning across the crypto business. But, it’s vital to keep in mind that these increase and bust cycles are usually not distinctive to digital property.

From the gold rush to the dot-com bubble, historical past is suffering from related euphoric highs adopted by sobering corrections. They’re merely a part of the evolution of any new market, an indication of rising pains as they chart a course towards maturity.

Crypto market in 2023

As 2023 has simply ended, it seems that the teachings from the previous yr haven’t been in useless. A way of cautious optimism pervades the crypto market. Regardless of the trials and tribulations of the earlier yr, the market has picked itself up, dusted off the particles of the previous, and is as soon as once more charging ahead.

As of Jan. 12, the market was rallying, with Bitcoin (BTC) and Ethereum (ETH) reaching native peaks at $48,900 and $2,690, respectively. The foremost property’ value was affected by the long-awaited Bitcoin ETF approval.

You may also like: Bitcoin ETF approval: crypto quantity spiked, market cap rose

BTC has impressively gained round 105% year-to-date (YTD), buying and selling at a sturdy $42,896. ETH, too, has seen an approximate 64% achieve YTD, buying and selling at $2,534.

The general market cap, a key indicator of the business’s well being, can also be experiencing an upward motion. Regardless of the adversities confronted, the resilience of this market underlines the potential that cryptocurrencies maintain for the way forward for finance.

The crypto market’s fluctuating trajectory from the challenges of 2022 to the developments in 2023 showcases its ever-changing nature.

This progress and decline cycle signifies the market’s ongoing transformation, suggesting a future formed by new developments, cooperative efforts, and an ongoing shift towards decentralization.

You may also like: Crypto’s skeptics have a harder case to argue in 2024 | Opinion

Inherent crypto volatility: causes and implications

The crypto-verse has all the time been synonymous with volatility. Its spectacular swings between bearish slumps and bullish runs may be as daunting as thrilling. This inherent volatility, whereas unsettling for some, is a perform of many components that set cryptocurrencies aside from conventional markets.

Firstly, the crypto market remains to be comparatively younger and extra prone to giant value swings. In distinction to conventional monetary markets which have been round for hundreds of years, cryptocurrencies have simply over a decade beneath their belt.

This relative infancy and a restricted market dimension result in higher value sensitivity. In easy phrases, a relatively smaller commerce quantity may end up in substantial value shifts. Secondly, the crypto market operates 24/7 throughout the globe, devoid of conventional buying and selling hours. This steady operation means information or occasions can set off rapid reactions, inflicting sharp value fluctuations at any given time.

Moreover, hypothesis performs a big position on this market. As a result of lack of established strategies to evaluate the “honest worth” of those digital property, costs are largely pushed by investor sentiment. It will probably swing dramatically in response to components starting from regulatory information and technological developments to macroeconomic tendencies.

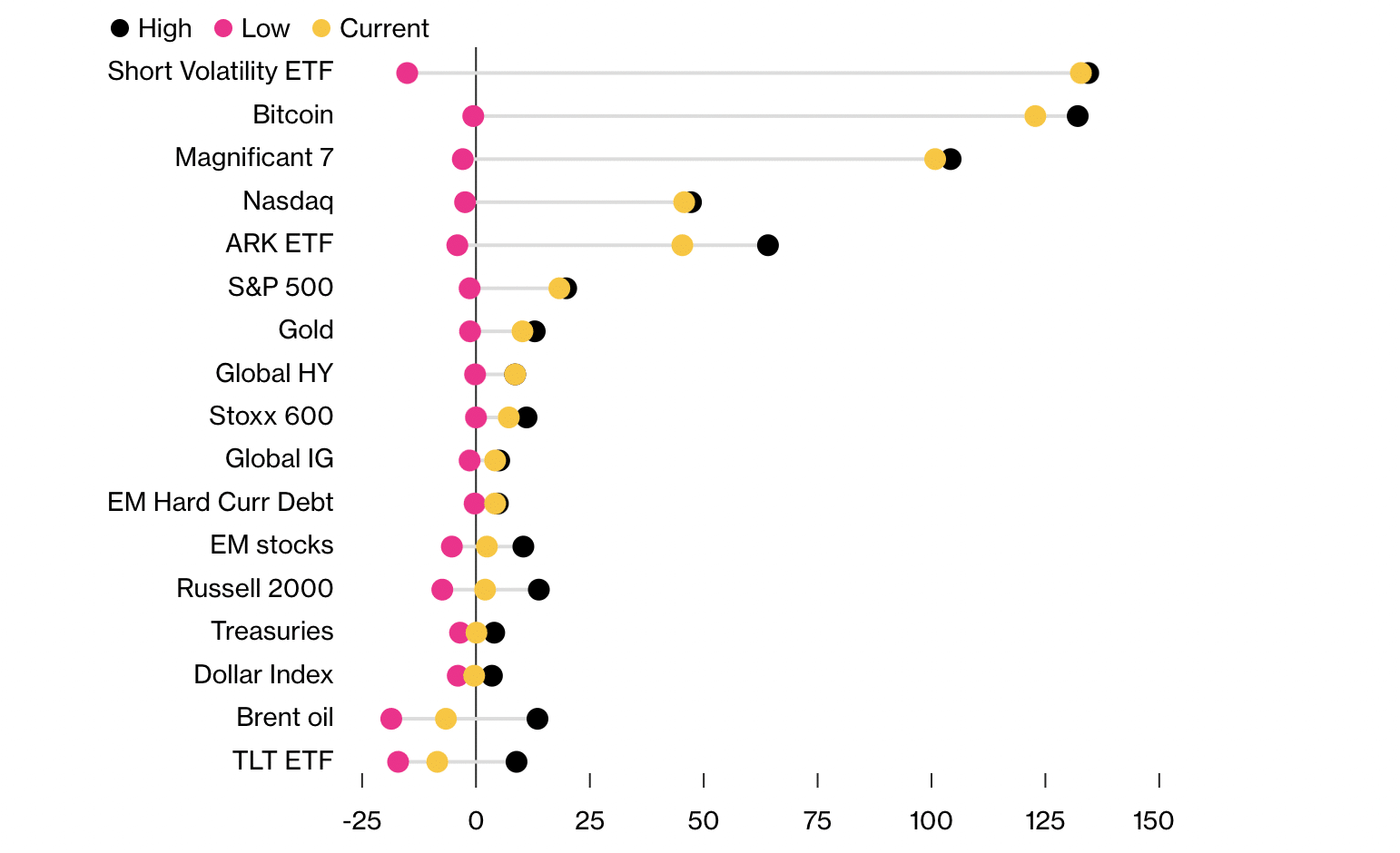

Whereas these components contribute to market instability, the 2023 expertise has proven that such volatility additionally presents alternatives. In line with Bloomberg, Bitcoin leads this yr’s efficiency chart that features conventional property, fiat and crypto.

Bitcoin efficiency in 2023 compared to different property | Supply: Bloomberg

The surprising market tendencies of 2023 contrasting sharply with the predictions made on the finish of the earlier yr. Per Bloomberg, whereas specialists anticipated a difficult yr for high-risk property as a result of rising rates of interest, looming recession, and protracted excessive inflation, the truth proved fairly totally different. Dangerous market segments, surprisingly, yielded essentially the most important returns.

One of the profitable investments was betting towards inventory market volatility, which noticed a staggering 150% return. Bitcoin additionally emerged as an unexpectedly worthwhile funding, adopted carefully by shares in main tech companies, which usually react negatively to rate of interest hikes.

Conventional investments just like the U.S. S&P 500 and gold additionally carried out properly, with positive aspects of 19% and 10%, respectively. Nevertheless, the slowing economic system adversely affected oil costs, marking their worst efficiency for the reason that 2020 pandemic. Lengthy-term U.S. Treasuries additionally suffered important losses.

Waiting for 2024, market analysts anticipate the pattern of risk-taking to proceed, with equities seemingly outperforming bonds. Nevertheless, a lot is determined by the character of the financial recession, whether or not will probably be delicate and short-lived, doubtlessly resulting in extra correct forecasts this time round.

You may also like: Bitcoin’s sturdy restoration in 2023 outshines gold and S&P 500

Сrypto business and regulatory overreach

The cryptocurrency business’s interactions with regulatory our bodies, particularly in the USA, have been fraught with competition and uncertainty.

As the brand new yr unfolds, analysts predict a rise in regulatory actions within the crypto house, notably regarding anti-money laundering, counter-terrorist financing dangers, and the conduct of corporations working within the sector.

In the USA, regulatory actions are intensifying, with the SEC and CFTC utilizing present authorized constructions to manage digital asset actions. Over 200 enforcement proceedings have been initiated towards crypto companies in 2023. Regardless of requires clearer crypto legal guidelines, the SEC has maintained a stringent method, as evidenced by its latest denial of Coinbase’s petition for brand spanking new crypto sector guidelines.

You may also like: Binance founder Changpeng Zhao grounded once more by U.S. court docket

The appointment of Gary Gensler because the SEC chairperson marked a interval of elevated scrutiny of the cryptocurrency business. Gensler, likening the crypto world to the “Wild West,” has made clear his intent to manage it extra strictly, believing most cryptocurrencies to be securities.

🇺🇸 SEC Chair Gensler says #crypto is the wild west and most tokens will fail.

— Watcher.Guru (@WatcherGuru) January 12, 2023

The European Union is ready to enact complete legal guidelines governing the crypto sector in 2024, with the Markets in Crypto Belongings Regulation (MiCA) aiming to determine uniform EU crypto regulation. This transfer is anticipated to offer authorized certainty for digital property past present monetary providers laws.

Within the UK, crypto corporations should register with the Monetary Conduct Authority (FCA) and adjust to particular laws. The federal government additionally desires to manage a broader vary of digital property and align crypto promotions with monetary promoting requirements.

Asia presents a different regulatory panorama. Whereas China has banned crypto use, Singapore and Hong Kong are adopting extra welcoming approaches, with Singapore introducing guidelines to guard particular person merchants and Hong Kong establishing a complete regulatory framework.

You may also like: Are crypto companies transferring to Asia?

Globally, over 40 jurisdictions have some type of crypto laws, with international locations like Australia and the UAE actively creating complete frameworks. The article additionally touches on the potential influence of the 2024 election season on digital asset laws within the U.S. and the growing significance of Bitcoin ETFs.

Specialists predict that upcoming laws will refine measures to foster a sturdy and sustainable crypto market. They foresee uniform anti-money laundering insurance policies throughout the EU and anticipate modifications in different components of the world, like Indonesia and India, in the direction of a extra crypto-friendly stance.

This notion contrasts starkly with crypto companies’ perspective, which argue that they’re designed to function exterior the normal monetary system. Furthermore, the stress between regulatory our bodies and the crypto business largely stems from a scarcity of consensus over cryptocurrencies’ classification. Are they securities, commodities, or neither?

This confusion has led to a smoother regulatory panorama. Within the phrases of Charles Elson, a company governance chair on the College of Delaware:

“Federal companies all the time search to increase their scope of jurisdiction, so the SEC wish to name this stuff securities, and going after the exchanges is one technique to stake out their declare.”

Charles Elson, a company governance chair on the College of Delaware

The present lawsuits towards Binance and Coinbase don’t resolve this debate however push the business nearer to a definitive regulatory framework. Whereas Gensler has made his perspective clear, stating, “we don’t want extra digital forex … we have already got digital forex — it’s known as the U.S. greenback,” this viewpoint is way from common.

In line with latest analysis, roughly 14% of the U.S. inhabitants owns crypto investments. Regardless of the SEC’s actions and Gensler’s feedback, the crypto market’s ongoing increase and widespread perception in digital currencies’ potential counsel that the demand for crypto investments will persist.

Regulatory oversight influence on crypto market

Elevated regulatory scrutiny within the crypto business is impacting extra than simply the businesses going through lawsuits or investigations. Heavy regulation is seen as a barrier to progress in a sector that depends on innovation and risk-taking. This fixed authorized stress can restrict creativity and deter new entrepreneurs from getting into the crypto market.

Startups, that are essential for the sector’s progress, is perhaps reluctant to hitch an business clouded by regulatory uncertainty. This hesitation can decelerate the business’s improvement and innovation. Moreover, regulatory actions can create worry amongst traders, each retail and institutional, resulting in market volatility and sell-offs.

The business’s repute can also be affected by high-profile authorized instances and accusations of malpractice, reinforcing a notion of the crypto market as unregulated and dangerous. This detrimental picture can discourage funding and hinder mainstream acceptance.

For crypto corporations, complying with laws calls for important sources, which may in any other case be used for innovation. This compliance burden is particularly difficult for smaller corporations and might create an uneven enjoying discipline that favors bigger, established entities.

Whereas regulation is important to stop fraud and shield traders, the present extent and nature of those laws may suppress innovation and progress within the crypto business. The way forward for the sector will depend upon how properly regulators and crypto companies can navigate this complicated setting.

Potential situations for crypto business in 2024

As we enter 2024, the crypto business is ready to endure additional transformations formed by a confluence of technological developments, evolving laws, and market dynamics.

Regulatory readability

The continued saga of regulatory scrutiny is prone to attain a pivotal level quickly. We might even see complete crypto-specific laws that might outline the business’s trajectory for years.

Regulatory readability can enhance investor confidence, cut back the worry of sudden coverage shifts, and, in flip, cut back the probability of extreme boom-bust cycles.

Technological innovation

Crypto and blockchain expertise proceed to evolve quickly, with an ever-increasing variety of use instances and functions throughout varied sectors.

This might drive the subsequent increase section, with new modern tokens, corresponding to synthetic intelligence (AI) tokens, capturing investor curiosity and conventional cryptocurrencies cementing their market positions.

You may also like: Crypto and AI: how the 2 industries will emerge in 2024

Mainstream adoption

As regulatory and technological points resolve, we are able to anticipate elevated mainstream adoption of cryptocurrencies. This might contain higher acceptance of crypto as a type of cost, wider use of blockchain expertise, and extra institutional funding. This might seemingly add stability to the business, dampening the severity of boom-bust cycles.

Asset diversification

Diversification inside the crypto house can also be anticipated to extend. As extra refined monetary merchandise corresponding to ETFs and futures contracts develop into prevalent, traders could possibly higher handle danger and doubtlessly cut back the influence of the business’s infamous volatility.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.