The Monetary Stability Board (FSB), the Worldwide Financial Fund (IMF), and the Financial institution for Worldwide Settlements (BIS) will ship papers and proposals establishing requirements for a world crypto regulatory framework, the group of the 20 greatest economies of the world — collectively generally known as G20 — introduced on Feb. 25.

In line with a doc summarizing the outcomes of the assembly with finance ministers and central financial institution governors, the FSB will launch by July suggestions on the regulation, supervision and oversight of worldwide stablecoins, crypto belongings actions and markets.

The subsequent steering is predicted for September, when the FSB and the IMF collectively ought to submit “a synthesis paper integrating the macroeconomic and regulatory views of crypto belongings.” In the identical month, the IMF may also report on the “potential macro-financial implications of the widespread adoption” of central financial institution digital currencies (CBDCs). In line with the G20 assertion:

“We stay up for the IMF-FSB Synthesis Paper which is able to assist a coordinated and complete coverage method to crypto-assets, by contemplating macroeconomic and regulatory views, together with the total vary of dangers posed by crypto belongings.”

The BIS may also submit a report on analytical and conceptual points and potential danger mitigation methods associated to crypto belongings. This report’s deadline is just not talked about within the doc. A G20 monetary activity power may also take a look at the usage of crypto belongings to fund terrorist actions.

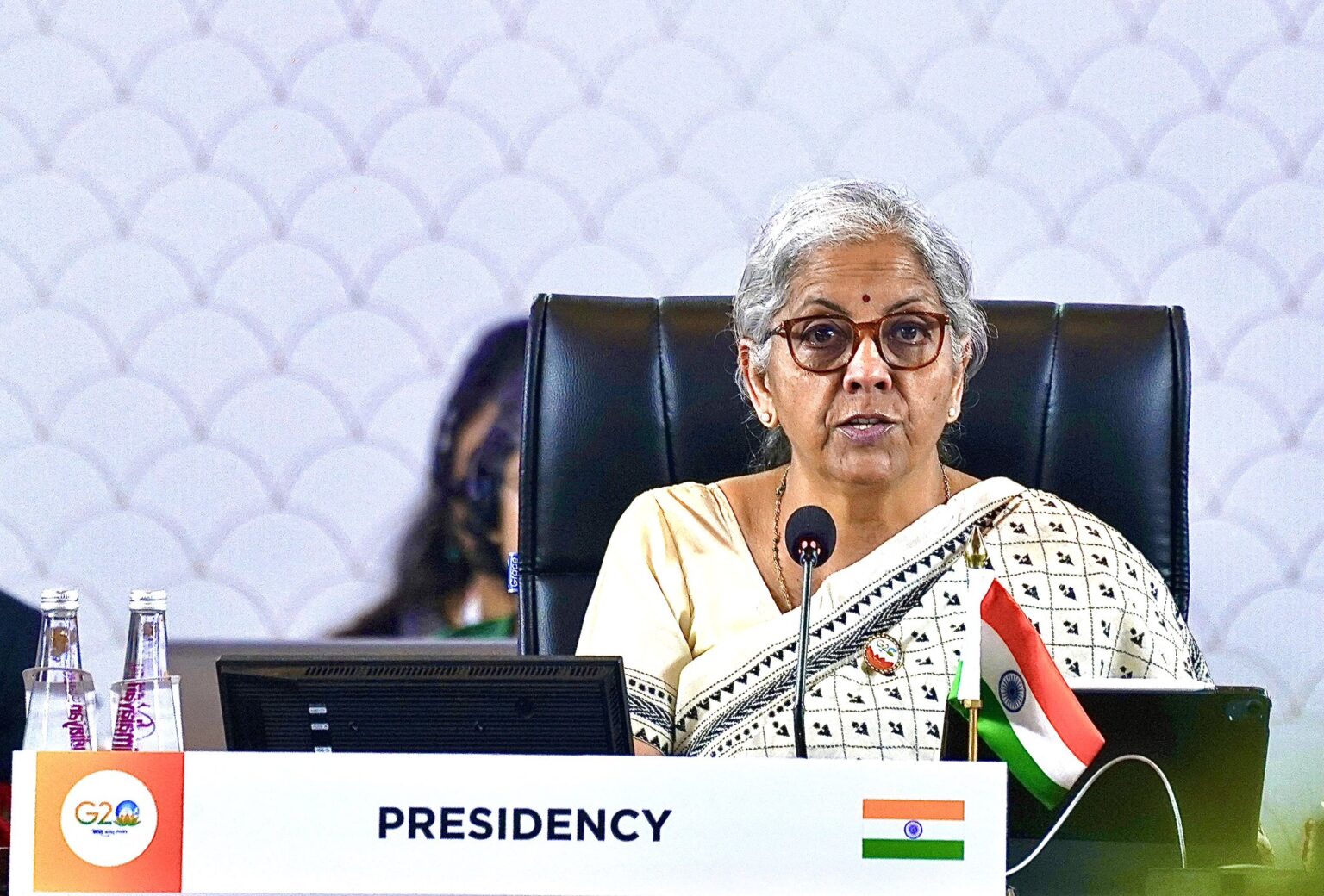

The announcement got here after two days of official conferences in Bengaluru, India. Within the first monetary assembly underneath India’s presidency, the group addressed key monetary stability and regulatory priorities for digital belongings, Cointelegraph reported.

Through the occasion, United States Treasury Secretary Janet Yellen stated it was “vital to place in place a powerful regulatory framework” for crypto-related actions. She additionally famous that the nation is just not suggesting an “outright banning of crypto actions.“ Talking to reporters on the sidelines of the occasion, IMF managing director Kristalina Georgieva said that banning crypto ought to be an choice for G20 nations.