The property of bankrupt crypto trade FTX and its related buying and selling arm Alameda Analysis was seen transferring nearly $20 million in crypto property over the weekend.

First noticed by blockchain monitoring agency Lookonchain, wallets belonging to FTX and Alameda moved a complete of $19.4 million value of crypto property, largely made up of Solana (SOL) and a number of other different altcoins.

“UPDATE:

FTX/Alameda transferred $19.4 million in property once more at present, together with:

309,185 SOL ($10 million)

2.03M BAND ($3.15 million)

3.82M PERP ($2.3 million)

46.67M TRU ($1.78 million)

4.39M BICO( $1 million)

915,048 KNC( $686,000)

5.47M CVC ($479,000)

7,275 BOND ($30,000).”

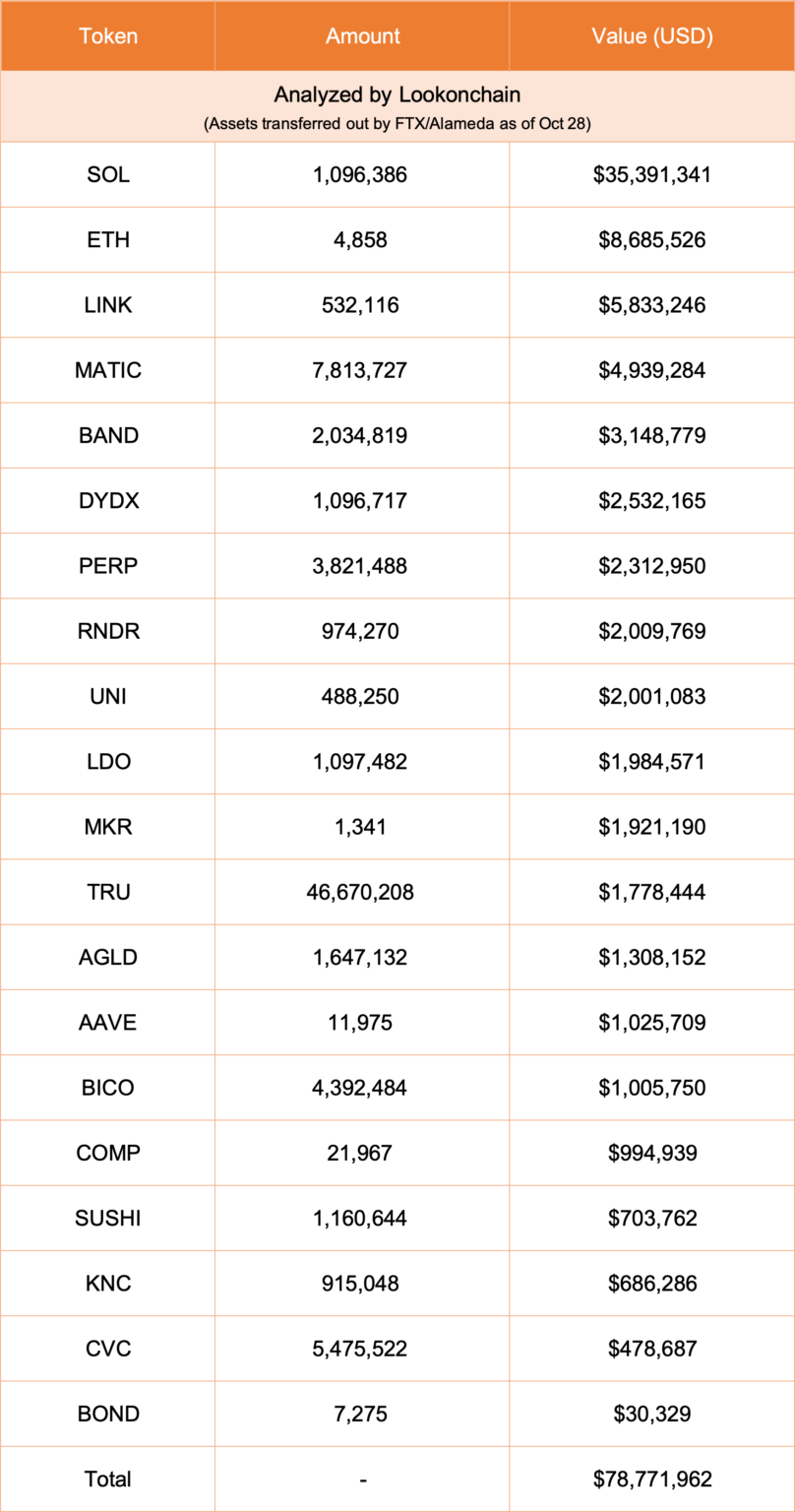

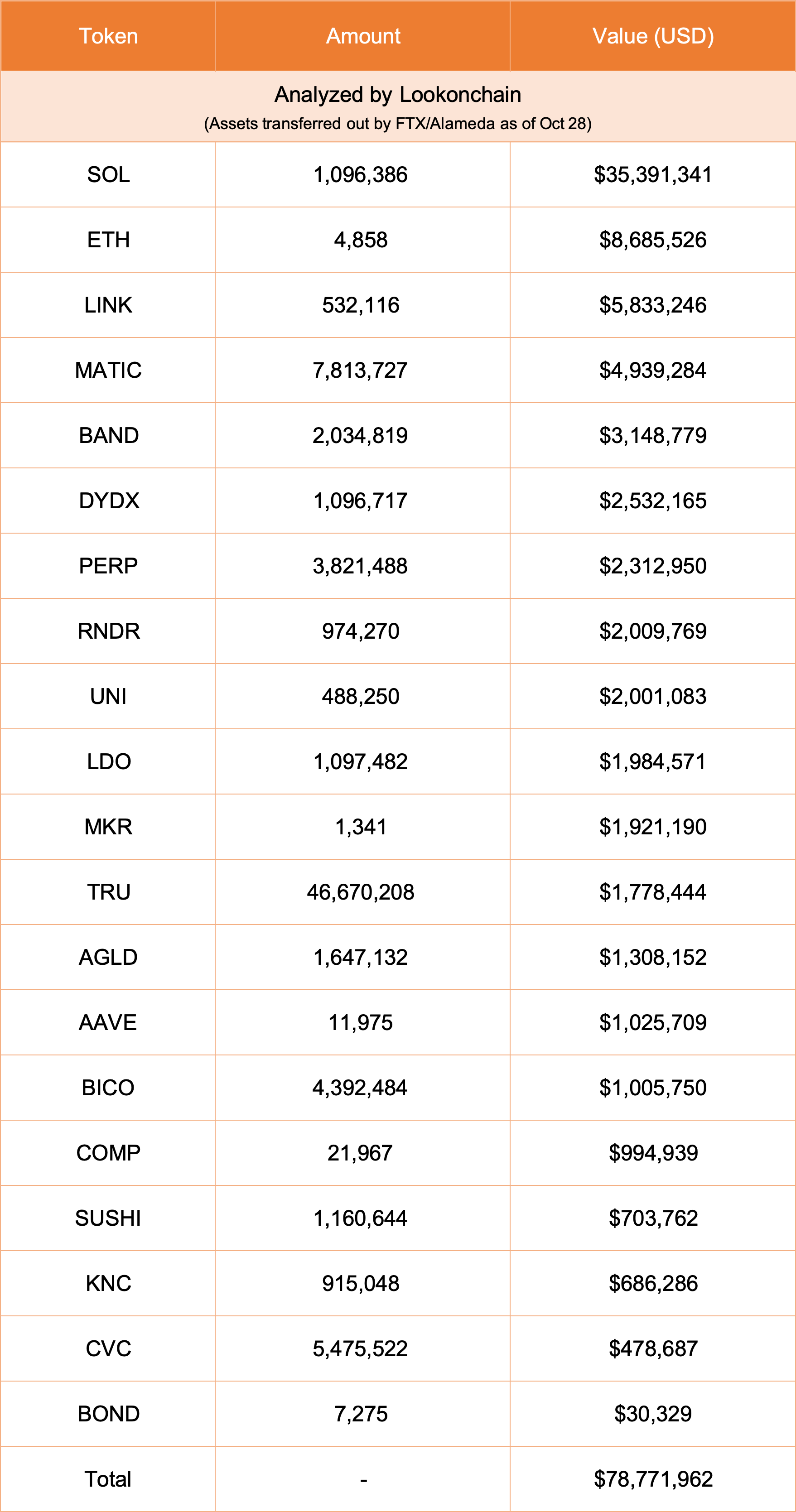

Lookonchain is maintaining observe of all of the crypto property transferred out of the FTX chapter property, which amounted to $78.7 million as of October twenty eighth. The highest crypto property that had been moved out of the wallets managed by the property embody SOL, Ethereum (ETH), Chainlink (LINK) Polygon (MATIC) and the cross-chain information oracle platform Band Protocol (BAND).

Lookonchain notes that the chapter property of the corporations nonetheless holds roughly $600 million in crypto property that haven’t been bought or transferred, together with almost $100 million in ETH.

“We analyzed eight FTX/Alameda addresses which have bought property not too long ago.

These addresses at the moment maintain ~$619 million in crypto property.

Together with:

55,280 ETH ($99 million)

69.7 million FTT ($91.55 million)

25 million WLD( $44.6 million)

53 million MATIC ($33 million)

16.9 million TOMOE ($30.7 million).”

Former FTX CEO Sam Bankman-Fried, who faces a long time in jail, started his testimony final week following quite damning testimonies from a number of of his former colleagues.

Caroline Ellison, the ex-CEO of Alameda, testified that she acquired directions from Bankman-Fried to commit a number of crimes.

In a current interview on the This Week in Startups podcast, Internal Metropolis Press reporter Mathew Russell Lee mentioned that Ellison’s testimony was notably damning for Bankman-Fried.

“I feel Ellison was a really robust witness as a result of… she [described] the way it labored and he or she’s pled responsible – she acknowledges that she knew that Alameda had this unbelievable $65 billion line of credit score with FTX [and] that when folks thought they had been sending in cash to commerce on the FTX platform, it was being diverted to Alameda, however she says very a lot ‘Sam advised me to do that.’”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/carlos castilla