- Bitcoin’s buying and selling exercise was at a low because the market ventured deeper into uncertainty.

- There could also be a brand new wave of accumulation on the horizon.

It’s been virtually two weeks since Bitcoin’s sideways worth motion, which indicators that the market continues to be in a state of uncertainty. It’s because the market is ready for a transparent signal indicating the subsequent market transfer.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

The extent of this final result out there is clearly evident in Bitcoin’s metrics. Community exercise slowed down significantly in the previous couple of days and is especially pronounced in transaction quantity. The latter is now at its lowest stage within the final three years, based on the newest Santiment evaluation.

📉 #Bitcoin‘s #onchain transaction quantity has sunk to 3-year lows. This measures the quantity of peer-to-peer funds, trade deposits & withdrawals, & miner charges. A community exercise decline is not essentially #bearish, however definitely signifies dealer #FUD. https://t.co/0I48I4hMAJ pic.twitter.com/bTz8HgEUK4

— Santiment (@santimentfeed) August 28, 2023

Low quantity interprets to fewer trades/transactions; therefore, miner charges have tanked. Whereas some might even see this as a supply of concern, it’s fairly frequent to see durations the place the extent of BTC buying and selling exercise drops, resulting in sideways worth motion.

Nevertheless, that’s typically adopted by a surge in quantity and a directional worth transfer.

Bitcoin holder accumulation means that volatility is incoming

Though the market remained in limbo at press time, there was one specific metric which will provide insights into the subsequent market transfer. The holder development price has traditionally been a dependable measure of Bitcoin cycles.

The identical holder metric just lately retested the descending development line, and was exhibiting indicators of slowing accumulation on the time of writing.

We’re beginning to strategy the attention-grabbing a part of the Bitcoin cycle.

“Hodler Development Charge”, the 1-year development price of two+ yr Bitcoin holders has accomplished the bear market speedy development part and is plateauing.

Look what occurred each different cycle… pic.twitter.com/aUlB7LF7vP

— Charles Edwards (@caprioleio) August 28, 2023

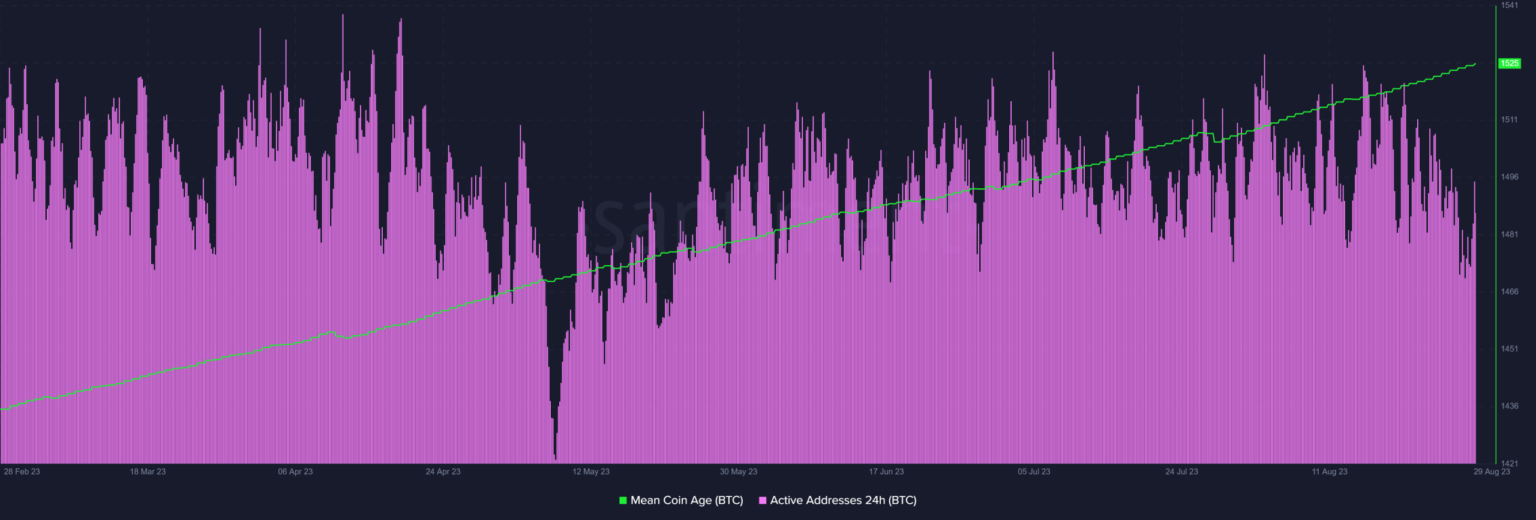

Talking of accumulation, Bitcoin’s imply coin age has been steadily rising and was at a 6-month excessive on the time of publication. This confirmed that long-term hodling was nonetheless going down.

In the meantime. 24-hour energetic addresses declined sharply since mid-August, which aligned with the aforementioned decline in buying and selling exercise.

Supply: Santiment

What ought to Bitcoin merchants anticipate as August concludes?

Bitcoin’s sideways worth motion is often adopted by a resurgence of volatility. We might see that occur, particularly at the beginning of August. Nevertheless, the course of that volatility stays a thriller.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Nonetheless, Bitcoin was nonetheless oversold at press time, which advised the probability that merchants may purchase in anticipation of a restoration.

Alternatively, the market just isn’t out of the woods but, particularly after the U.S.’s current assertion suggesting that it would improve charges. This completely sums up the king coin’s stalemate and underscores the opportunity of one other crash.