Galaxy Digital, a number one participant within the digital belongings sphere, has issued a bullish prediction for Bitcoin’s trajectory following the launch of the much-anticipated US-regulated spot Bitcoin ETF. In keeping with a latest examine printed by the agency on October 24, the introduction of the ETF is about to significantly bolster Bitcoin’s adoption, positioning it extra firmly as a acknowledged asset class.

Benefits Of An ETF

Galaxy’s evaluation highlights {that a} spot Bitcoin ETF can be “probably the most impactful catalysts for the adoption of Bitcoin (and crypto as an asset class).” By the tip of September, Bitcoin belongings held throughout various funding merchandise like ETPs and closed-end funds touched a formidable determine of 842,000 BTC, valuing roughly $21.7 billion.

Galaxy Digital’s examine additionally sheds mild on the challenges confronted by these funding avenues, pointing to components like excessive charges, monitoring errors, restricted liquidity, and a considerably constrained attain amongst broader investor teams. The introduction of the spot Bitcoin ETF, the report suggests, is poised to alter this state of affairs dramatically.

Spot Bitcoin ETFs provide a large number of advantages over the present constructions: an improved price system, better liquidity, higher worth monitoring, and a much-needed break from the problems of self-custodying belongings. Because the report explicitly states, “The presence of a US-regulated spot Bitcoin ETF that adheres to strict regulatory compliance not solely offers a safer platform but additionally elevates its transparency, making it a preferable selection over current funding merchandise.”

Why A Spot Bitcoin ETF Issues

Galaxy believes that the introduction of a Bitcoin ETF would improve the digital asset’s “accessibility throughout wealth segments” and set up “better acceptance by formal recognition by regulators and trusted monetary companies manufacturers.”

The report highlights the disparity between age teams in relation to Bitcoin investments. It reveals that whereas Boomers and older generations maintain 62% of US wealth, solely 8% of adults aged 50 and above have invested in cryptocurrency.

Galaxy sees regulatory approval for a Bitcoin ETF as a big step in direction of establishing Bitcoin as a mainstream funding. An ETF may assist cut back market volatility by providing “better worth transparency and discovery for market members.”

Estimating Inflows From ETF Approval

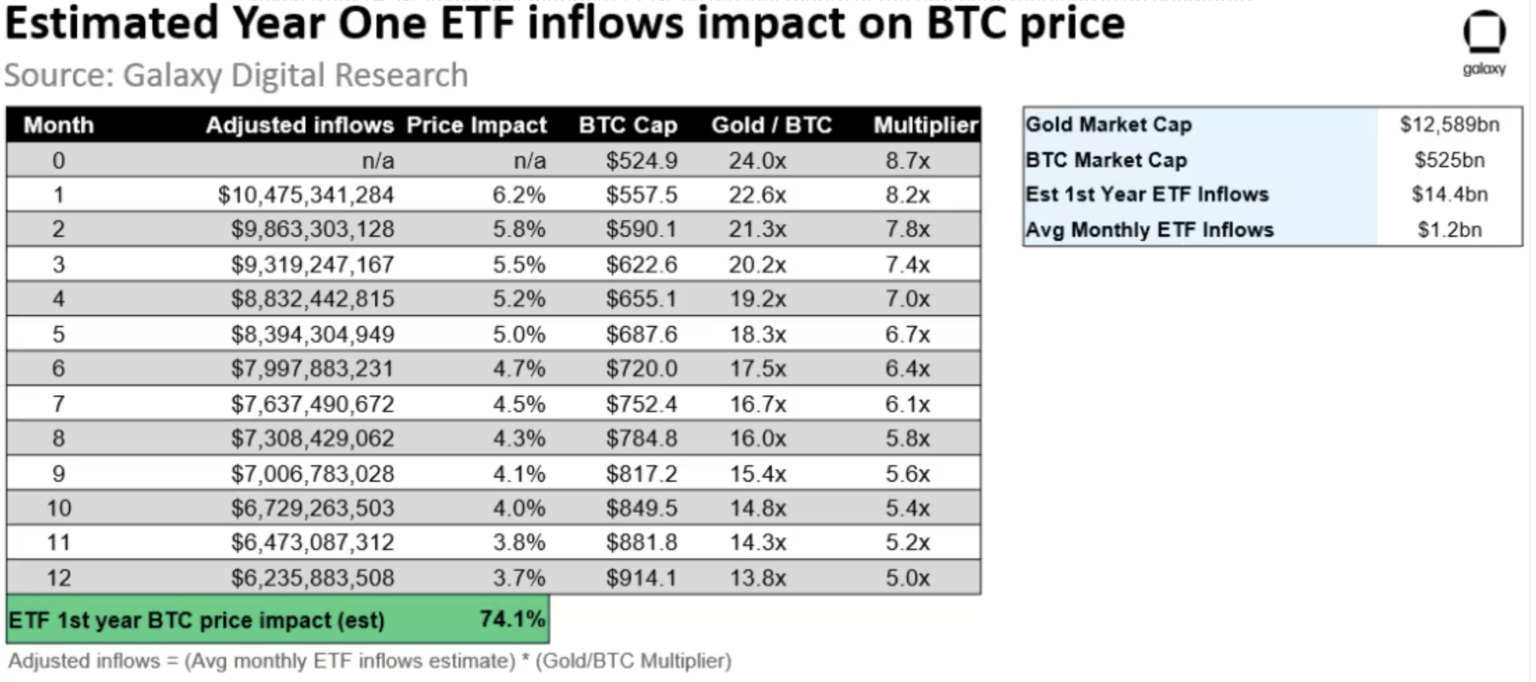

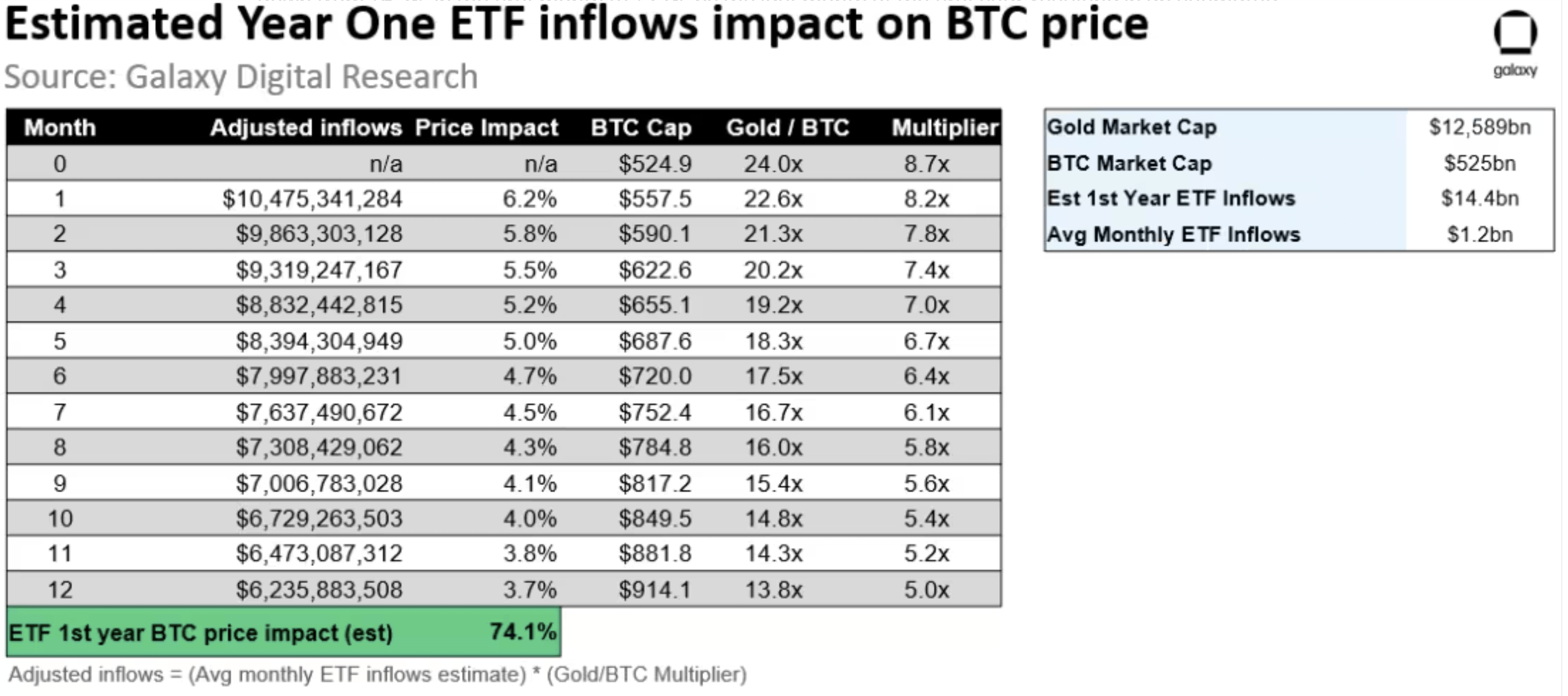

Galaxy’s forecast suggests the US wealth administration sector, managing a mixed asset price $48.3 trillion, would be the most impacted by a Bitcoin ETF’s launch. They estimate potential inflows into the Bitcoin ETF to be round $14 billion within the first yr, escalating to $27 billion within the second yr and reaching $39 billion by the third yr.

Factoring within the historic relationship between gold ETF fund flows and gold worth change, Galaxy predicts a possible worth improve of 6.2% for BTC within the first month after an ETF’s launch. They venture this to taper all the way down to +3.7% by the final month of the primary yr, leading to an estimated +74% improve in BTC within the first yr of an ETF approval. On the present worth, this may imply that BTC may rise above $59,000 within the post-ETF debut yr.

The Greater Image

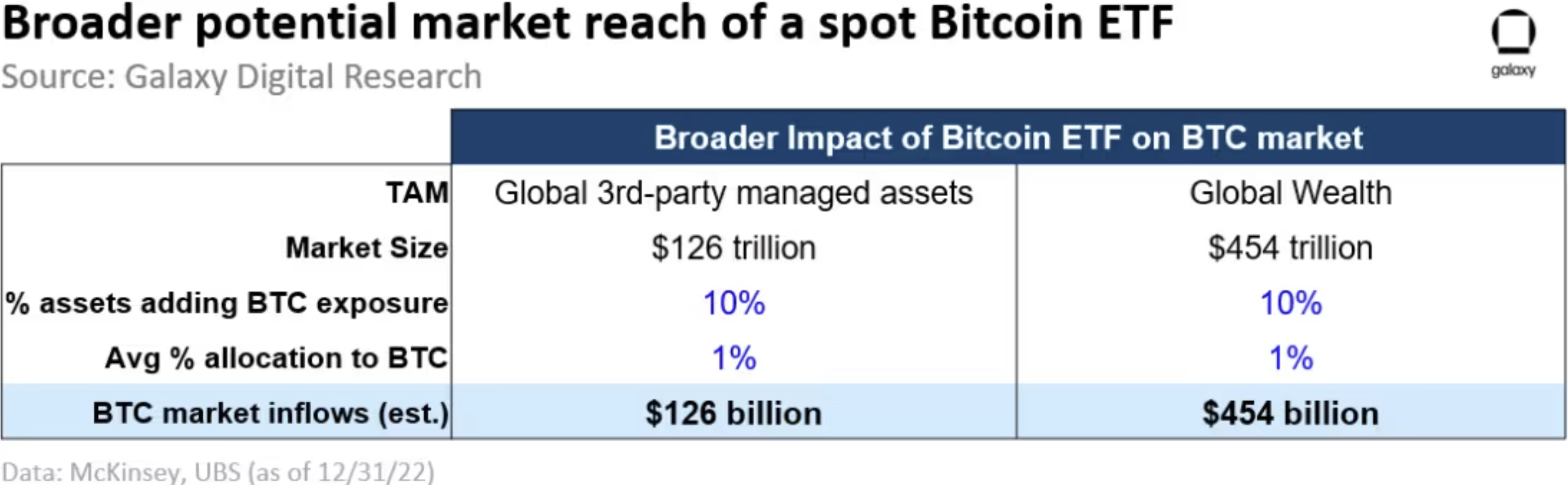

Past the potential inflows right into a US ETF product, Galaxy predicts that there shall be a a lot bigger impression on BTC demand “from second-order results”. The potential approval of a spot ETF within the US may instigate comparable merchandise in different world markets. Furthermore, Galaxy expects that numerous different funding automobiles, like mutual funds and personal funds, will combine Bitcoin into their methods.

Galaxy suggests the potential for Bitcoin’s Complete Addressable Market (TAM) to develop considerably, maybe encroaching on conventional asset sectors like actual property and valuable metals. The estimated potential new inflows into BTC may vary between $125 billion to $450 billion “over an prolonged interval.”

Featured picture from Shutterstock, chart from TradingView.com