Bitcoin appears to be present process a interval of consolidation and profit-taking after eight weeks of phenomenal worth progress. The world’s largest crypto has had unbelievable progress this 12 months, with a particular surge beginning in the midst of October.

Nevertheless, after hitting a yearly excessive of $44,500 on December 8, the value of Bitcoin has pulled again about 6% as some buyers look to be taking income. Based on on-chain information supplier Glassnode, a number of of its on-chain pricing fashions recommend Bitcoin’s truthful worth is presently between $30,000 and $36,000.

Bitcoin’s Worth Rally Pauses As After A Resistance At $44,500

Bitcoin’s worth appreciation this 12 months led to a 150% acquire which pushed it above $44,500, however on-chain information exhibits the new streak has cooled off a bit after forming a resistance at this worth stage.

This has led to many short-term buyers taking revenue from their holdings. Based on information from Whale Alerts, there have additionally been varied situations of huge BTC transactions into crypto exchanges up to now few days, suggesting some whale addresses may additionally be collaborating within the selloff.

🚨 🚨 658 #BTC (26,893,152 USD) transferred from unknown pockets to #Binancehttps://t.co/QzyF0MRiHT

— Whale Alert (@whale_alert) December 13, 2023

A brief-term correction was inevitable, in line with crypto information agency Glassnode’s truthful worth fashions. Their evaluation based mostly on the investor price foundation and community throughput suggests the truthful worth is lagging behind the present market spike.

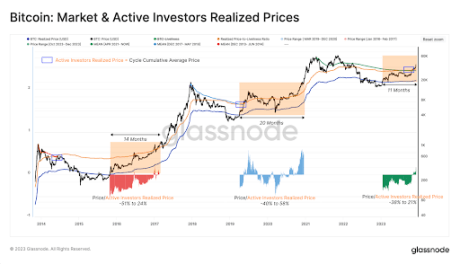

A metric cited was the Energetic Investor Realized Worth, which displays the diploma of HODLing throughout the community. Based on this mannequin, Bitcoin’s spot costs are presently buying and selling above its realized worth (truthful worth).

Looking at historic developments exhibits it has taken between 14 to twenty months between the realized worth and the creation of an all-time excessive. The trail to the creation of a brand new ATH has additionally at all times concerned main spot worth fluctuations of ±50% across the Energetic Buyers Realized Worth.

Supply: Glassnode

The crypto asset is now 11 months into the break, with spot costs fluctuating between -38% and 21% of the realized worth. If historical past repeats itself, we may see one other few months of actions across the present truthful worth of $36,000.

This worth level correlates with a social media submit by crypto analyst Ali Martinez. Whereas noting IntoTheBlock information, the analyst famous robust assist between $37,150 and $38,360, backed by 1.52 million addresses holding 534,000 BTC.

In case of a deeper correction, #Bitcoin finds strong assist between $37,150 and $38,360. This zone is backed by 1.52 million addresses holding 534,000 $BTC.

Additionally, be careful for 2 resistance partitions that might preserve the #BTC uptrend at bay: one at $43,850 and one other at $46,400. pic.twitter.com/NGm1XpMOLf

— Ali (@ali_charts) December 11, 2023

BTC bulls attempt to recuperate losses | Supply: BTCUSD on Tradingview.com

One other technical pricing mannequin cited by Glassnode was the Mayer A number of. The Mayer A number of indicator is now at a worth of 1.47, near the 1.5 stage which regularly types a stage of resistance in prior bull cycles.

Glassnode’s report additionally checked out varied different pricing fashions, together with the NVT Premium indicator which evaluates the utility of the community throughput when it comes to a USD worth. Based on the NVT Premium, the current rally is likely one of the greatest spikes since Bitcoin’s all-time excessive in November 2021, suggesting an overvaluation in relation to the community throughput.

What’s Subsequent For Bitcoin?

Bitcoin is buying and selling at $40,963 on the time of writing. Though the crypto is now down by 6% in a 7-day timeframe, it’s nonetheless monitoring good points of 8.5% from its December open of $37,731. The $44,500 stage is now a vital stage for the asset, because the trade continues to attend for a bullish run after the approval of spot Bitcoin ETFs within the US.

The crypto market continues to be in bullish sentiment, with Coinmarket’s Worry & Greed Index pointing to a 73 greed. An influence via $44,500 would sign the resumption of the bullish pattern for Bitcoin. One other resistance stage to observe after the break could be the $46,400 stage.

Featured picture from Chainalysis, chart from Tradingview.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site solely at your individual danger.