- Bitcoin’s worth stabilized round $29,000-$30,000 amidst market volatility

- Vendor-taker quantity and declining miner income surfaced as potential causes for worth suppression

Amidst the backdrop of serious worth fluctuations and heightened volatility, Bitcoin [BTC] has in the end discovered some extent of stability, hovering throughout the vary of $30,000 to $29,000. This current interval of relative calm has prompted hypothesis amongst numerous specialists concerning the potential for this subdued volatility to increase over a extra extended length.

Learn Bitcoin’s Value Prediction 2023-2024

Hike in promoting stress

One noteworthy statement comes from analyst Maartunn at CryptoQuant, who highlighted a major disparity between Promote Taker Quantity and purchaser exercise. This ongoing discrepancy in buying and selling volumes might result in sustained downward stress on the value, thereby stopping a decisive breakthrough above the $30,000-mark.

For context, sell-taker volumes are the ratio of promote quantity divided by the purchase quantity of takers in perpetual swap markets. It displays the pre-eminence of promoting stress available in the market.

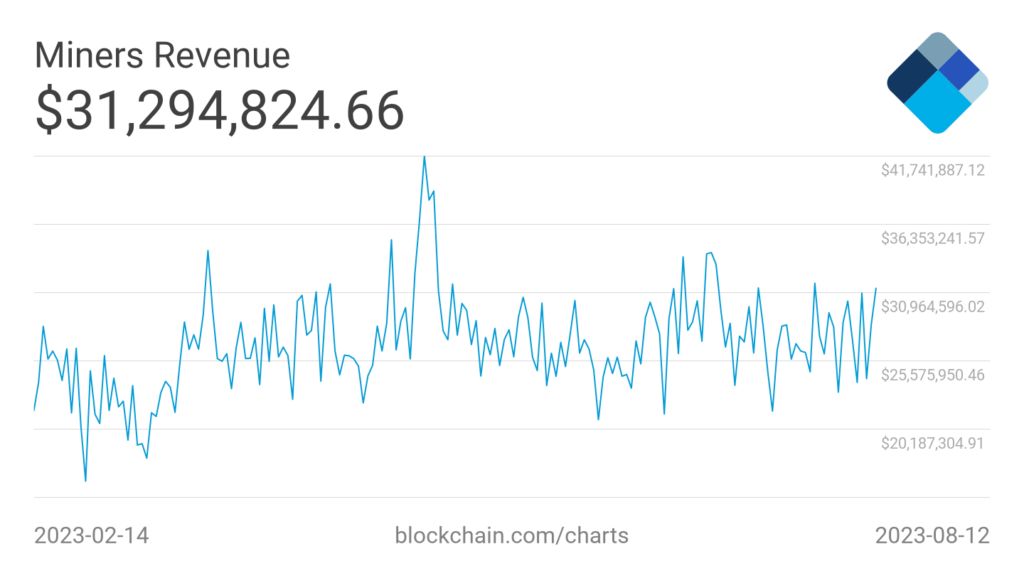

The impression of this sustained promoting stress is additional underscored by the context of declining miner income. Actually, current knowledge revealed a discount in miner earnings, with figures dropping from $41 million to $31 million over the previous couple of months. This decline in income can probably incentivize miners to dump their Bitcoin holdings to stay worthwhile.

Supply: BTC.com

Apparently, regardless of the challenges posed by lowered miner income, different metrics urged an underlying resilience throughout the community. Each hashrate and community progress have proven indicators of enchancment throughout this era, reflecting the power of the Bitcoin ecosystem.

Supply: BTC.com

Whales present curiosity

Opposite to those elements, whale conduct indicated a constructive future for Bitcoin. For instance, Glassnode’s knowledge indicated that the variety of addresses holding 10 or extra BTC cash just lately hit a three-year peak at 157,012.

This uptick in whale exercise suggests a rising urge for food for Bitcoin accumulation amongst bigger buyers.

Supply: glassnode

A parallel growth concerned HODLing conduct noticed from BTC addresses. Notably, figures for the quantity of HODLed or misplaced cash achieved a five-year excessive at press time.

This revealed a propensity amongst present buyers to retain their holdings over an prolonged interval. This conduct additionally mirrored a way of confidence and long-term conviction in Bitcoin, regardless of an absence of constructive worth motion on the charts.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Supply: glassnode

At press time, Bitcoin’s worth stood at $29,300. Moreover, the rate of transactions had fallen, implying a discount within the frequency of BTC transfers.

Supply: Santiment