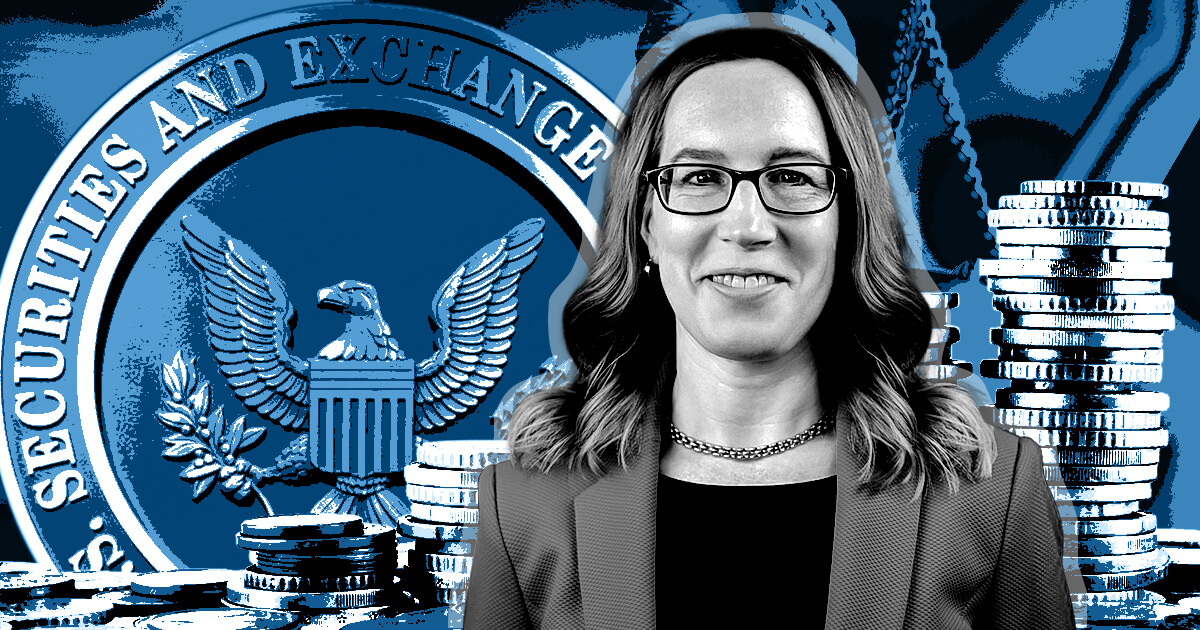

Hester Peirce, a commissioner for the U.S. Securities and Trade Fee (SEC), dissented from the company’s case in opposition to LBRY on Oct. 27.

LBRY Inc., the agency behind the LBRY blockchain and content-sharing community, introduced on Oct. 19 that it could not enchantment its loss within the case, marking a proper finish of proceedings. The agency will as an alternative shut down and enter receivership so as to pay tens of millions of {dollars} of money owed to varied events, together with the SEC.

Peirce questioned the worth of this end result, writing:

“Are traders and the market actually higher off now after the Fee’s litigation contributed to the demise of an organization that had constructed a functioning blockchain with a real-world software working on high of it?”

She added that the case “illustrates the arbitrariness and real-life penalties” of the SEC’s regulation by enforcement strategy towards the crypto sector.

Importantly, Peirce emphasised that the SEC didn’t allege that LBRY dedicated fraud. She famous that, in contrast to many different initiatives, LBRY didn’t fail to fulfill its guarantees. As an alternative, Peirce mentioned, the challenge had a practical blockchain throughout most of its token gross sales, and its content-sharing platform was not solely operational however fashionable.

Peirce added that the SEC took an “extraordinarily hardline” strategy: it sought $44 million in penalties, demanded LBRY burn all tokens in possession, and mentioned that these cures alone wouldn’t be certain that LBRY wouldn’t violate registration guidelines sooner or later. The company ultimately lowered its penalty request to $111,614, she famous.

Peirce criticizes SEC’s whole strategy

Peirce additionally argued in opposition to her company’s broader stance on regulation, stating:

“The appliance of the securities legal guidelines to token initiatives shouldn’t be clear, regardless of the Fee’s steady protestations on the contrary. There isn’t any path for an organization like LBRY to return in and register its practical token providing.”

Peirce added that the SEC’s “scorched earth” techniques within the case at hand had been disproportionate in comparison with any doable hurt that traders could have confronted. She mentioned that the time and assets that her company spent on the LBRY case might have as an alternative been spent on making a regulatory framework for initiatives to stick to. She warned that the SEC’s extreme response will forestall future blockchain experiments.

But she noticed that the choose didn’t rule on the safety standing of the LBRY token itself (LBC) or secondary gross sales of LBRY, which can enable the blockchain to proceed.

Peirce added that she had been against the case from the beginning however was unable to touch upon the case because it was pending.