- BTC futures month-to-month quantity on CME Group closed at a one-year excessive in July.

- Constructive funding charges revealed that the majority futures contracts opened up to now few months have been in favor of BTC’s value.

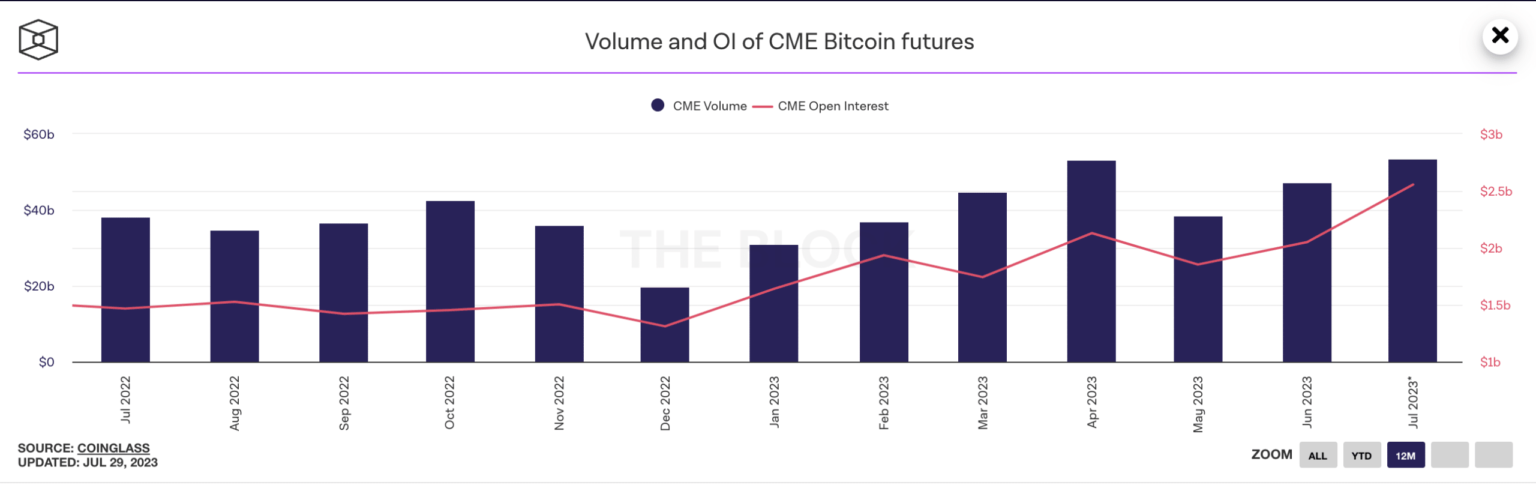

Bitcoin [BTC] futures month-to-month quantity on derivatives market Chicago Mercantile Change Group (CME Group) closed July at a one-year excessive, information from The Block’s dashboard confirmed.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

BTC futures buying and selling permits merchants and buyers alike to take a position on the longer term value actions of the main coin by inserting bets on whether or not it will go up or down over a particular interval sooner or later.

With over 120,000 energetic customers unfold throughout 60 nations, CME Group is among the world’s largest derivatives marketplaces. It boasts of excessive patronage from many institutional buyers, together with BlackRock, which just lately made its Bitcoin futures ETF submitting. This makes buying and selling exercise on the trade one to pay attention to.

The buying and selling quantity of BTC futures on the trade throughout the final 30 days totaled $53.3 billion at press time. Comparatively, a 12 months in the past, this determine stood at $1.47 billion. This represented a outstanding surge of greater than 3500% in CME Group’s BTC futures month-to-month buying and selling quantity over the previous 12 months.

Supply: The Block

In BTC we belief

The main coin’s future markets revealed that the majority bets positioned final month had been made in favor of a value rally. This has occurred regardless of the coin’s persistence throughout the $29,000 and $32,000 value ranges and raging unfavorable market sentiments.

In response to information from Coinglass, BTC funding charges throughout exchanges remained considerably optimistic up to now few months.

Supply: Coinglass

In futures contracts, funding charges seek advice from the recurring charges which can be exchanged between lengthy (purchase) and quick (promote) place holders. These charges assist be sure that the futures contract’s value intently tracks the underlying asset’s spot value (precise market value).

When that is optimistic, it signifies that extra lengthy positions are being opened and sometimes displays the market’s common sentiments. A unfavorable funding fee, however, suggests declining pursuits with extra quick buying and selling positions being entered into.

With the previous few months marked by a rising depend of lengthy BTC buying and selling positions, and BTC’s momentary buying and selling above $30,000, quick merchants have been plunged into losses.

Supply: The Block

How a lot are 1,10,100 BTCs price right this moment

Some merchants can not abdomen losses

At press time, BTC exchanged fingers at $29,320.87, in response to information from CoinMarketCap. Because the king coin’s value continues to face resistance on the $30,000 value stage, new tackle momentum has declined.

At press time, BTC’s new tackle depend was 491,514. Per information from Glassnode, on a 30-day transferring common, it started its descent in April and has since dropped by 7%.

Supply: Glassnode