- BTC’s Coinbase Premium Hole has elevated because the 12 months started.

- This exhibits that there’s extra demand for the coin on Coinbase than on Binance.

The primary few days of 2024 have seen a surge of institutional curiosity in Bitcoin [BTC] on Coinbase, with the trade’s Premium Hole reaching new highs, CryptoQuant analyst Maartunn famous in a brand new report.

BTC’s Coinbase Premium Hole compares the value at which the coin is traded on Coinbase to how a lot it’s traded on Binance. When it rises, it signifies that traders are prepared to pay a premium to accumulate the coin on Coinbase.

In accordance with Maartun:

“This premium fluctuates, starting from a couple of {dollars} to exceeding $50, underscoring sturdy shopping for exercise.”

This comes amid Binance’s latest troubles within the US and the worldwide decline in its market share in consequence.

Binance Vs Coinbase

AMBCrypto reported earlier that firstly of 2023, Binance commanded a spot buying and selling market share of 65%, whereas Coinbase trailed behind in a distant second with roughly 8.2%.

As regulatory stress mounted on the trade in the course of the 12 months, its market share plummeted by 20%, and by December, Binance’s market share had dropped to round 44%.

The latest rise in BTC’s Coinbase Premium Hole could possibly be institutional traders aping in on the main coin forward of a possible spot ETF approval.

In accordance with Maartun, the expansion of this metric “has sparked hypothesis about whether or not MicroStrategy is buying further Bitcoin or if these purchases are a part of preparations for an ETF approval.”

A collection of predictions surfaced in December 2023 that the U.S. Securities and Trade Fee (SEC) would grant its first approval by tenth January.

Nonetheless, a report printed by crypto funding companies supplier Matrixport on third January acknowledged that the regulator would reject all functions as a result of they “fall in need of a crucial requirement that have to be met.”

In latest information, Jacquelyn Meline, a senior reporter at TechCrunch, confirmed the potential for approvals for “a number of companies’ functions” coming in very quickly.

heard from sources extraordinarily near the matter that the bitcoin spot ETF goes to be authorised by the SEC for *a number of* companies’ functions

— Jacquelyn Melinek (@jacqmelinek) January 4, 2024

Learn BTC’s Value Prediction 2023-24

That isn’t all

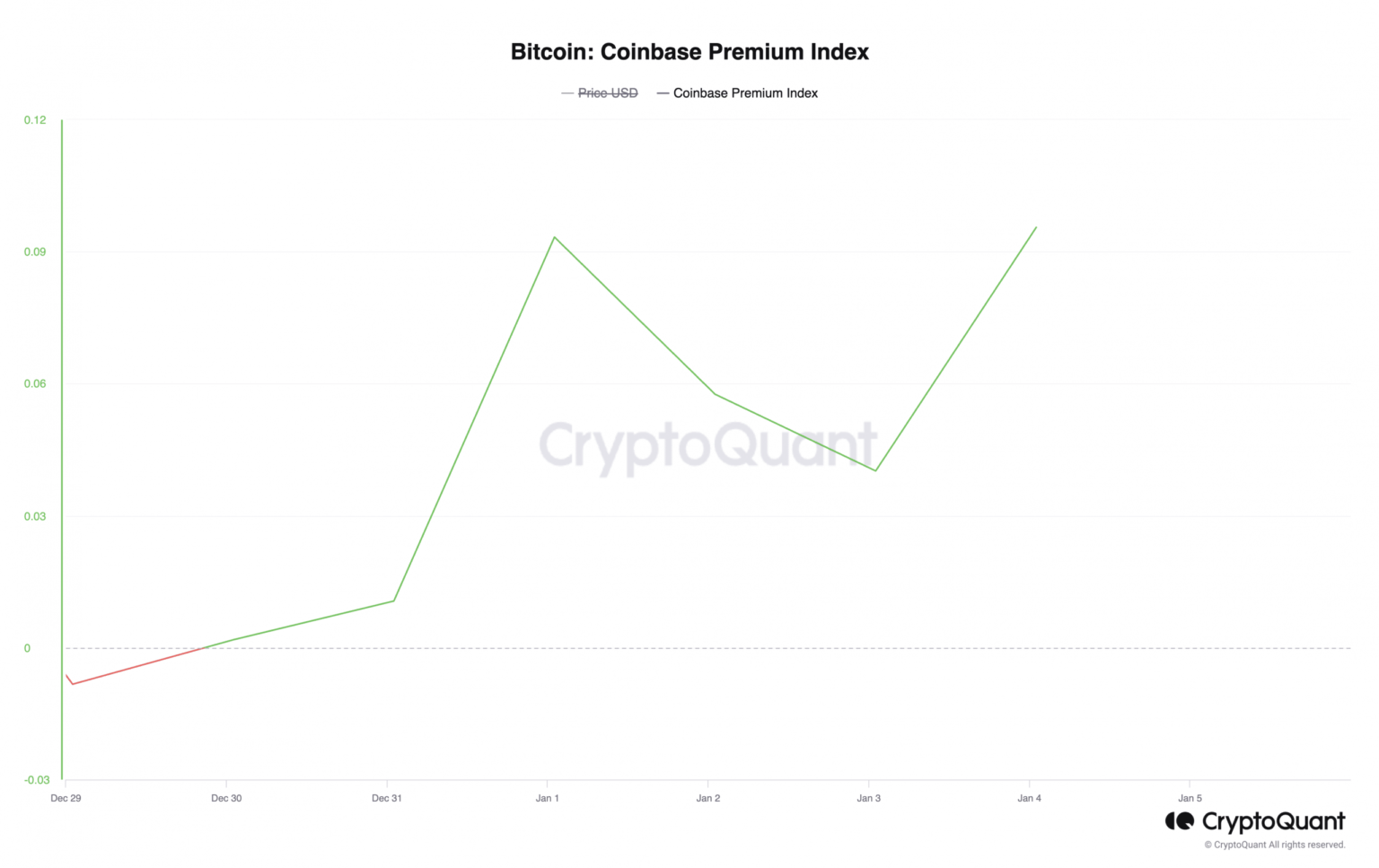

Aside from its Coinbase Premium Hole, BTC’s Coinbase Premium Index (CPI) has additionally trended upward because the 12 months started. At 0.095 at press time, it has since risen by 2%, in line with knowledge from CryptoQuant.

Supply: CryptoQuant

The CPI is a metric that measures the distinction between the value of an asset on Coinbase and on Binance. When an asset’s CPI worth is optimistic and in an uptrend, it signifies robust shopping for stress amongst institutional traders on Coinbase.