Over the previous week, inscriptions minted on quite a few blockchains have caught the eye of crypto merchants and builders alike resulting from massive transaction volumes that generated uncommon quantities of gasoline charges. On Layer 2 (L2) chains like Arbitrum and Layer 1 chains like Avalanche and Solana, there was a proliferation of inscriptions: on-chain items of knowledge which might be saved inside transaction calldata.

On the Solana community, transactions reached greater than $1 million in cumulative worth since November 13, 2023; Solana exercise additionally spiked on December 16, with 287,000 new inscriptions created in a single day. These inscription-based NFTs and tokens comply with an analogous construction to Bitcoin’s BRC-20 normal primarily based on Bitcoin Ordinals, with Solana adopting the SPL-20 token format.

On Avalanche, inscription-related transactions have been recorded to have reached over $5.6 million in a single day for gasoline prices, as recorded on December 16, 2023. This document is adopted by Arbitrum One at $2.1 million for gasoline prices spent on inscriptions.

On December fifteenth, Arbitrum skilled a two-hour outage. Arbitrum continues to be investigating the precise trigger, however its preliminary evaluation discovered a surge in community visitors stalled the sequencer, reversing batch transactions and draining the sequencer’s Ether reserves. Whereas compromised in the course of the outage, Arbitrum’s core performance was restored shortly after.

A current evaluation by the pseudonymous Twitter account Cygaar, a core contributor at Ethereum L2 community Body, sheds mild on the inside workings of inscriptions and the way these started to get spammed into L2 networks and L1 chains in current weeks.

Persons are in a position to spam these txns as a result of they’re extraordinarily low-cost in comparison with good contract txns.

This has led to Arbitrum being taken down, and resulting in degraded expertise on different chains like zkSync and Avalanche.

It stays to be seen when this craze will finish.

— cygaar (@0xCygaar) December 18, 2023

What are Inscriptions?

Inscriptions are items of knowledge recorded or ‘inscribed’ onto a blockchain. This knowledge can embody transaction particulars, good contract codes, metadata, and extra. The addition of inscriptions to a blockchain not solely provides complexity and richness to the know-how but in addition will increase its potential for securing and managing all varieties of knowledge.

In response to Cygaar, inscriptions retailer token or NFT metadata in on-chain transaction calldata. This permits low-cost transactions for “xRC-20” tokens – the place “x” represents requirements like BRC-20, ZRC-20, and many others. – for the reason that bulk of the logic and enforcement occurs off-chain. Against this, good contacts retailer important knowledge on-chain and require extra computational assets and thus, increased charges. Different inscription token requirements embody PRC-20, BSC-20, VIMS-20, and OPRC-20.

“Sensible contracts have to execute logic and retailer knowledge on-chain. Inscriptions solely contain sending calldata on-chain, which is less expensive to do,” Cygaar explains.

Inscriptions are being spammed on networks like Avalanche, Arbitrum, and Solana more likely to safe an early place for buying and selling speculative, low market capitalization alternatives. Nevertheless, these repetitive automated mints and transfers provide little utility and have precipitated congestion and outages. If these inscription transactions proceed to dominate exercise, modifications to those protocols could also be required to restrict their disruption.

Chain Analytics: Prime networks minting inscriptions

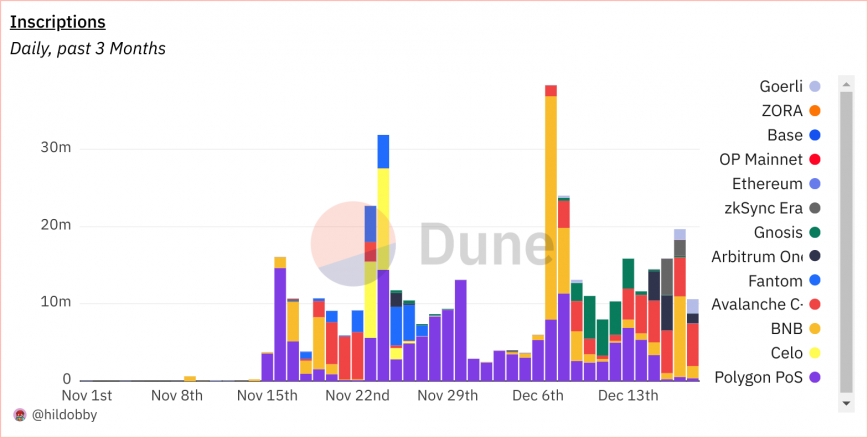

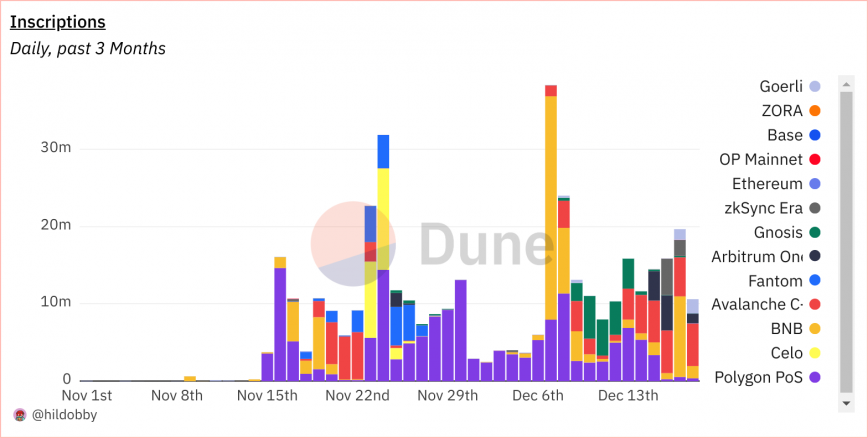

A dashboard on Dune Analytics printed by Hildobby, an on-chain analyst at crypto enterprise capital agency Dragonfly, supplies some insights into the impression of inscriptions on EVM chains.

In response to the dashboard, inscriptions have exploded throughout all main EVM-compatible blockchains over the previous week.

Between November 15 and December 18, chains like Polygon, Celo, BNB Chain, Arbitrum, and Avalanche are seeing every day inscription transaction volumes within the hundreds of thousands, with the highest six chains representing over half of all 13 listed chains.

Polygon PoS has probably the most variety of inscriptions (161 million), whereas BNB Chain has probably the most variety of inscriptors (217k). Ethereum has probably the most variety of inscription collections, regardless of solely having 2 million inscriptions minted by 84,000 inscriptors.

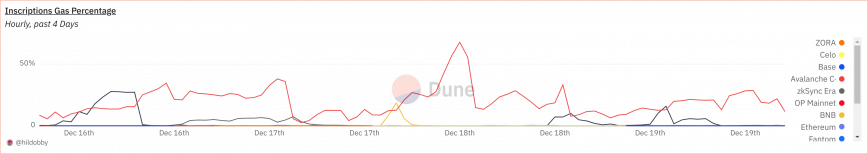

Many of the gasoline prices are claimed by the Avalanche C Chain, which topped all different chains, claiming 68% of all transactions on December 18.

Prospects for inscriptions

Although some protocols profit from the exercise spikes due to earnings from gasoline reimbursements, analysts argue that systemic modifications like adjusting gasoline pricing algorithms, limiting which transactions qualify for reimbursement, or outright blocking identified spam accounts will likely be important to make sure these don’t impair community performance.

Alternatively, the proliferation of inscription-related exercise additionally incentivizes miners. Miners profit from elevated quantity and cumulative charge income regardless of minimal per-transaction fees. Notably, on Avalanche, transaction charges are paid in AVAX, and the transaction charge is mechanically deducted from one of many addresses managed by the person. The charge is burned (destroyed eternally) and never given to validators.

The current spike in low-cost inscription transactions on EVM-compatible blockchains seems to be pushed extra by short-term earnings than actual utility. Arguably, coverage modifications round transaction charges or restrictions could also be crucial to stop the incidence of network-disrupting transaction volumes from meaningless exercise. For inscriptions to mature as a scalability answer somewhat than only a fad, they need to allow worthwhile purposes as a substitute of repetitive token minting.