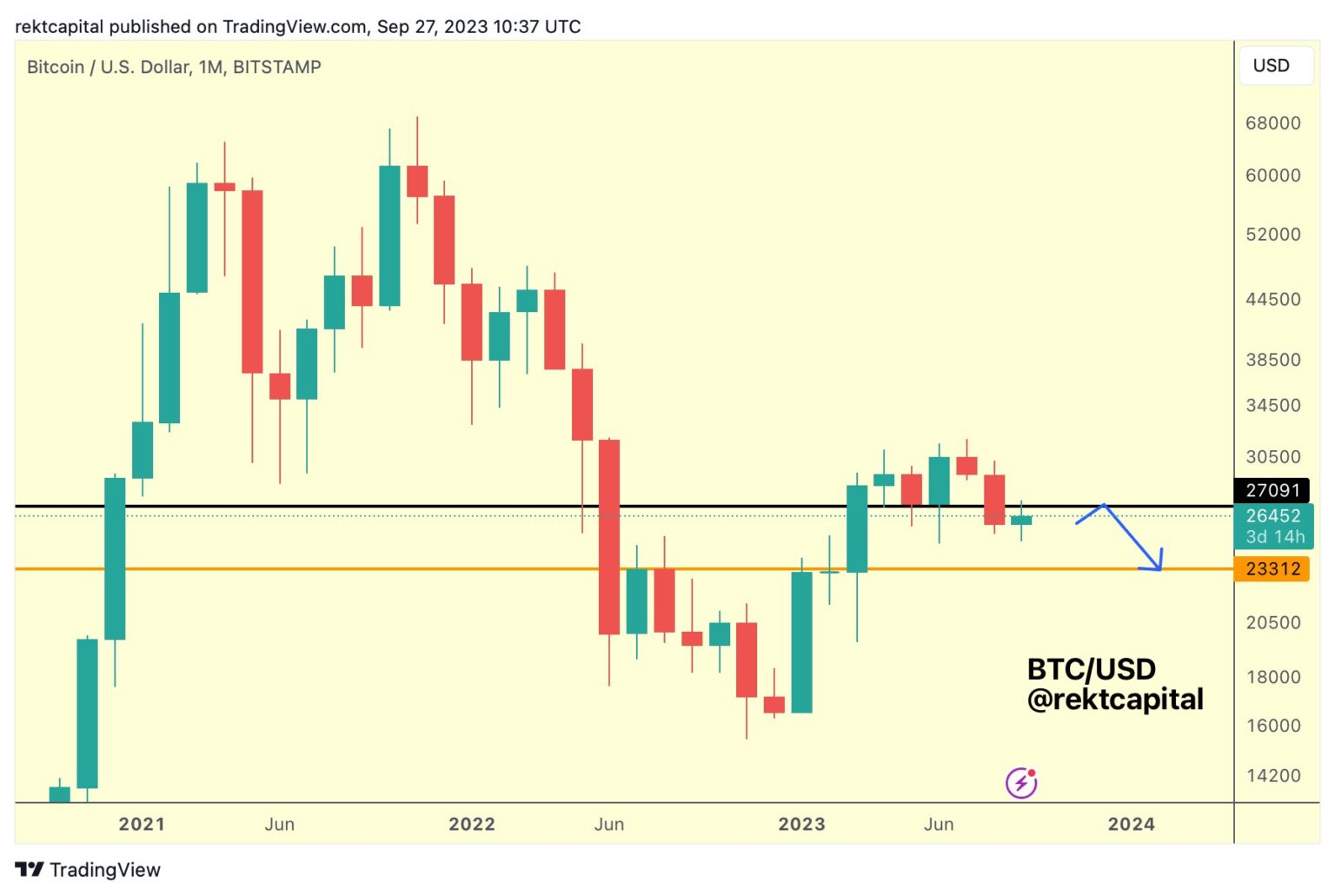

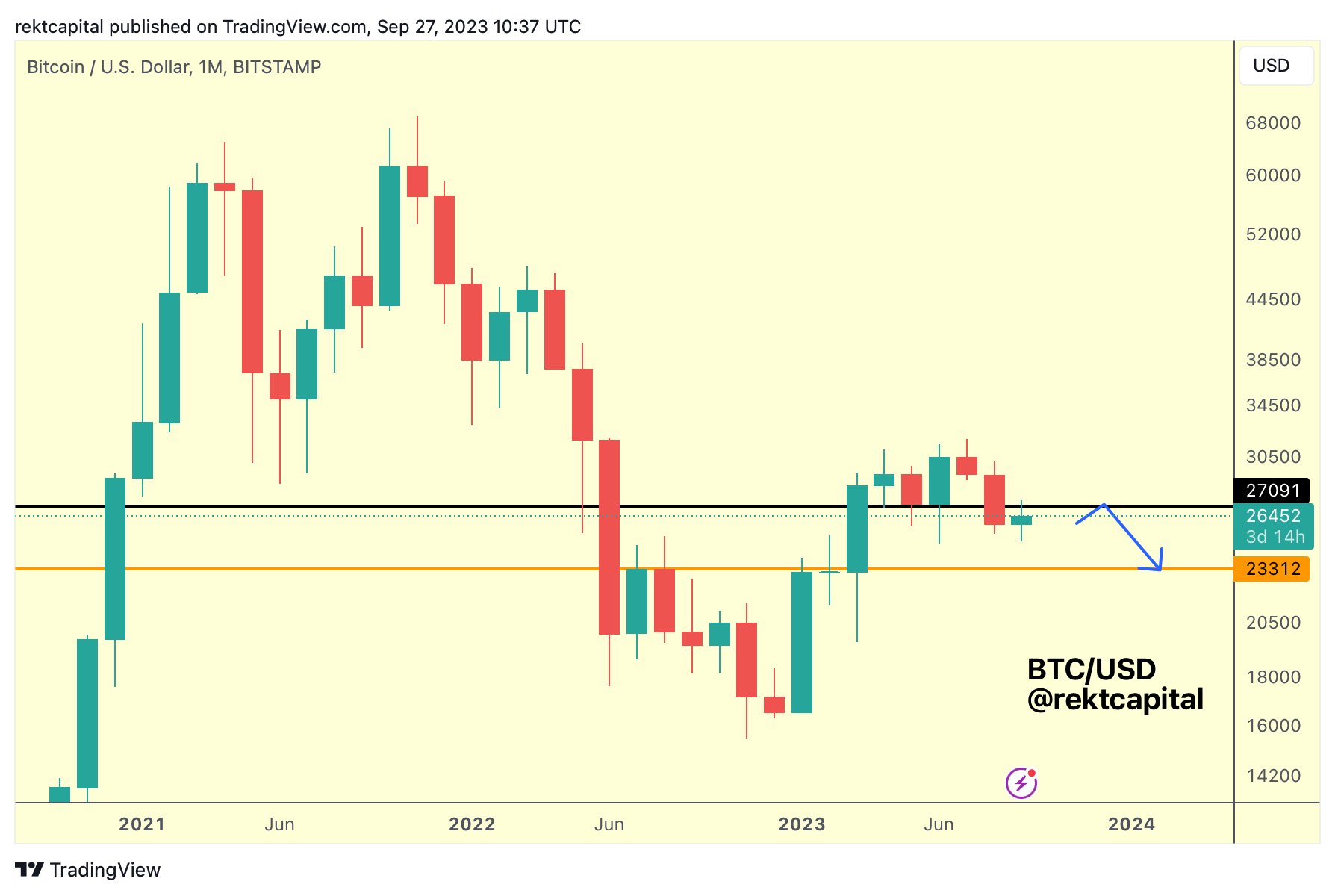

Famend crypto analyst Rekt Capital has not too long ago highlighted the pivotal nature of the Bitcoin value’s imminent month-to-month candle shut. In an announcement by way of X (previously Twitter), he detailed that Bitcoin has tagged the $27,000 month-to-month stage from the underside, that means it’s performing as resistance in the interim.

He defined that “the upcoming month-to-month candle shut is simply across the nook. Bitcoin must month-to-month shut above $27,091 for this to be a fake-breakdown. In any other case, the breakdown can be technically confirmed.”

To present this assertion some historic context, the previous month – August – noticed a major growth for the flagship cryptocurrency. BTC registered a bearish month-to-month candle shut, ending under roughly $27,150. This information level, in line with Rekt Capital, successfully confirmed it as misplaced assist.

Reflecting on this growth on the time, the analyst had conveyed that it’s potential BTC might surge to $27,150, “perhaps even upside wick past it this September. However that may probably be a reduction rally to verify $27150 as new resistance earlier than dropping into the ~$23000 area. $23000 is the following main Month-to-month assist now that ~$27150 has been misplaced.”

Is Bitcoin Following Historic Patterns?

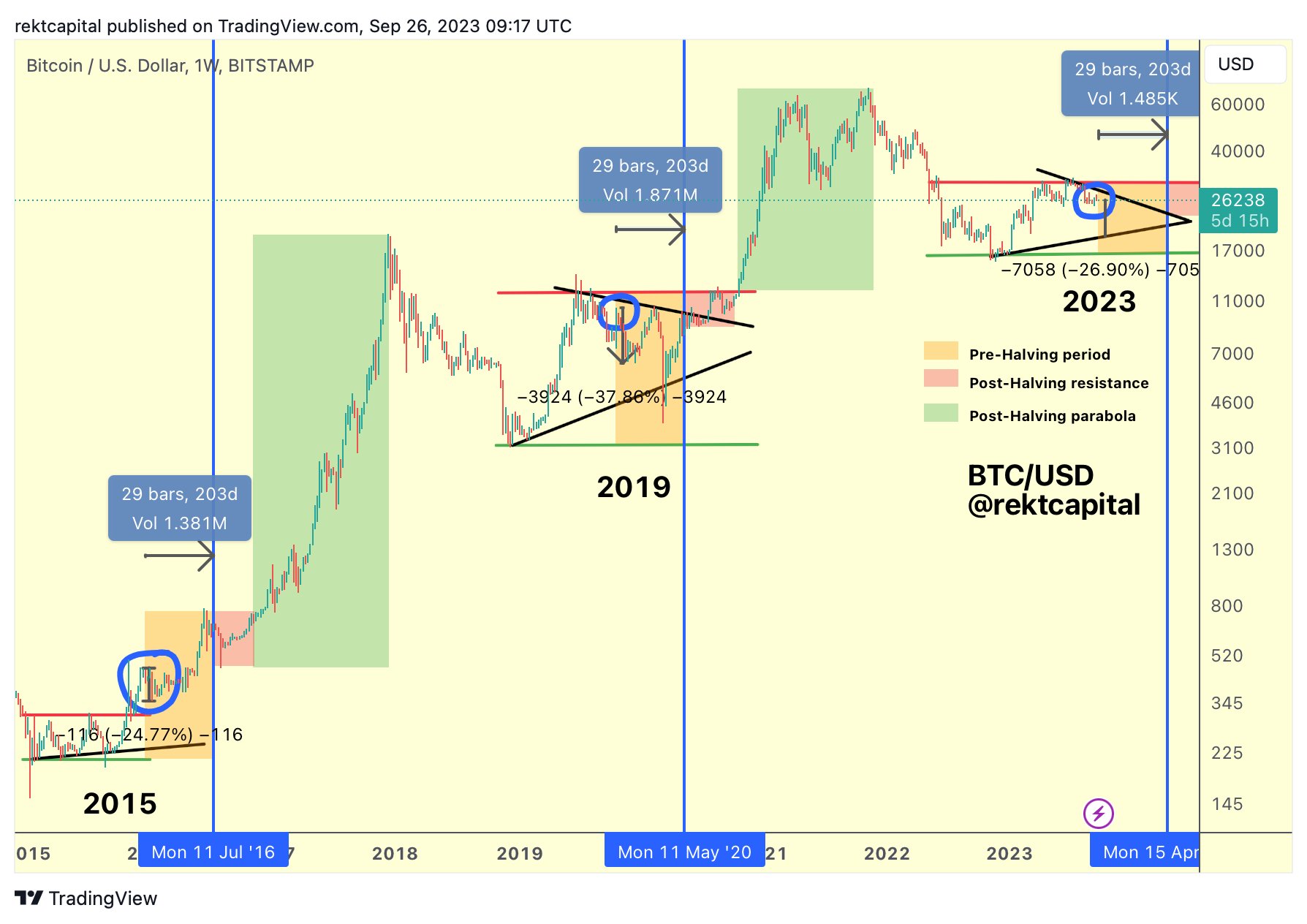

Rekt Capital’s observations about Bitcoin aren’t made in isolation however are deeply rooted in Bitcoin’s historic value and cycle behaviors. Drawing parallels to earlier patterns, he had beforehand make clear Bitcoin’s tendencies round 200 days earlier than a halving occasion.

“At this identical level within the cycle (~200 days earlier than the halving): In 2015, Bitcoin retraced -24% inside a re-accumulation vary, however value consolidated for months going into the halving. In 2019, Bitcoin retraced -37% as a part of a downtrend that continued for months going into the halving.”

These historic retracements at an identical juncture have given rise to 2 important insights, as acknowledged by Rekt Capital. First, a right away retracement has occurred at this identical level within the cycle. Second, a repeated retrace of between -24% to -37% in 2023 would lead Bitcoin to retest its macro increased low, presumably pushing its value underneath the $20,000 threshold.

The analyst didn’t cease there. Accentuating the best accumulation phases for traders, he famous, “The very best time to build up Bitcoin was in late 2022 close to the bear market backside. The second greatest time to build up Bitcoin is upon a deeper retracement within the pre-halving interval.”

Shifting the main focus to potential future outcomes, Rekt Capital made an intriguing hypothesis in regards to the potential of BTC’s value motion post-halving: “If ~$31000 was the highest for 2023. Then the following time we see these costs can be months from now, simply after the halving. Solely distinction between at times? On this pre-halving interval, BTC might nonetheless retrace from right here. However after the halving, BTC would get away a lot increased from present costs.”

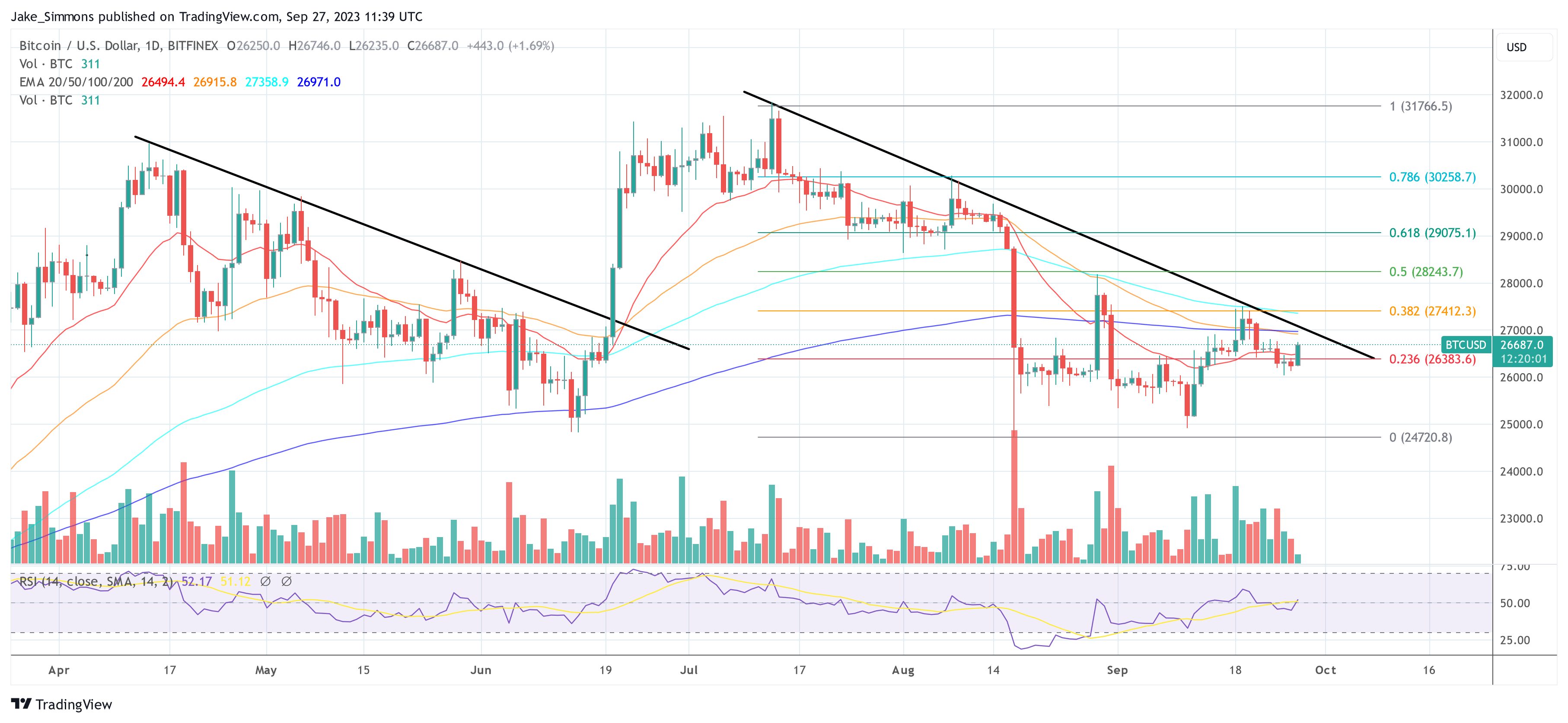

To summarize, the upcoming month-to-month candle shut for Bitcoin might have profound implications for the asset’s short-to-mid-term trajectory. All eyes will now be on whether or not BTC manages to shut above or under the vital $27,150 mark – an indicator that would both affirm a technical breakdown or prevail over a traditionally untypical value rally.

At press time, BTC stood at $26,687.

Featured picture from Shutterstock, chart from TradingView.com