Coinbase Prime, the crypto platform explicitly designed for institutional buyers, trusts, and high-net-worth people, has seen a dramatic improve in buying and selling exercise following the U.S. spot Bitcoin ETFs launch.

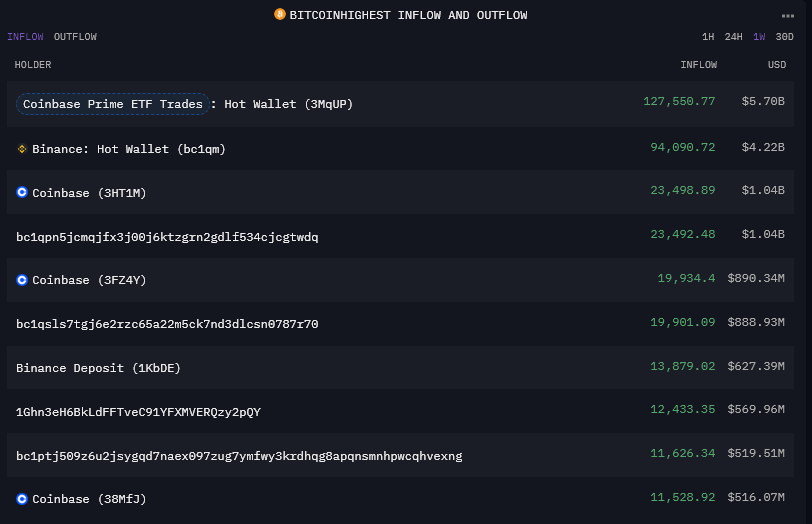

CryptoSlate evaluation recognized a sizzling pockets at Coinbase Prime that has surged to the highest of the Bitcoin influx chart over the previous week. This pockets, used for buying and selling actions inside the platform, noticed modest inflows and outflows within the lots of of hundreds of thousands over the course of a month all through 2023. Nonetheless, over the previous week, it has seen $5.7 billion in inflows and an equal quantity of outflows. Traditionally, Binance’s sizzling pockets has dominated the stream leaderboard, and from the info analyzed, this seems to be the primary time Coinbase Prime has surpassed Binance over 7 days.

Over the previous 30 days, Binance nonetheless leads with round $14 billion in inflows and outflows, whereas Coinbase Prime flags barely behind at round $12 billion. It’s price noting that different buying and selling wallets are tagged as belonging to Coinbase Prime on Arkham Intelligence. Nonetheless, this pockets seems to deal with giant transactions.

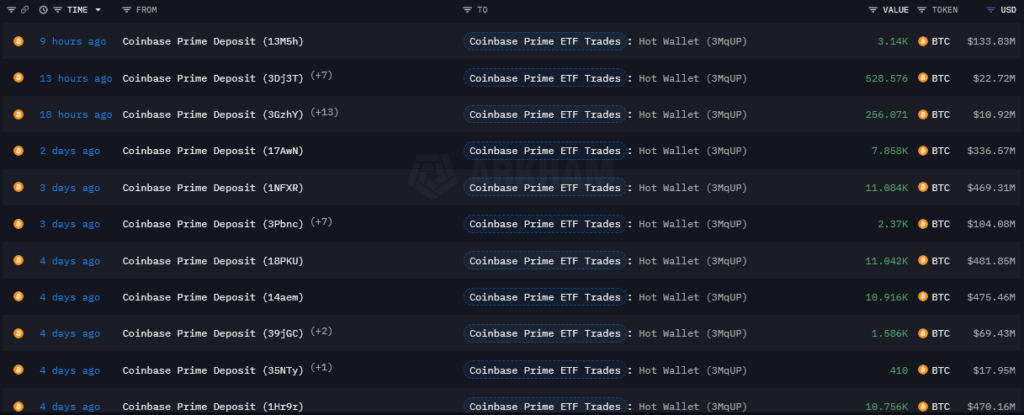

The surge in exercise may be seen via the desk under, which reveals solely transactions better than $10 million. Previously 4 days alone, there have been a number of deposits of over $400 million in a single transaction.

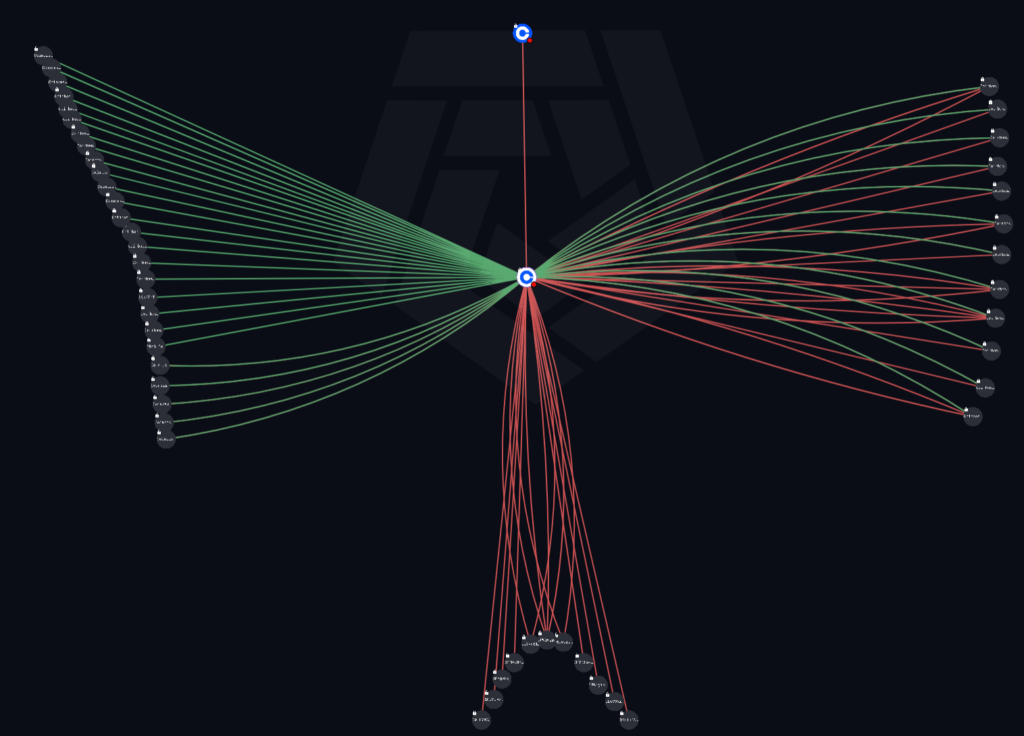

The under visualization reveals the stream of transactions over $50 million for the Coinbase Prime sizzling pockets. The left cluster is tagged as Coinbase Prime deposit addresses, which all stream into the new pockets. The cluster to the suitable comprises wallets additionally tagged as Coinbase Prime deposit addresses however reveals inflows and outflows. The wallets within the backside cluster are untagged and present solely outflows from the new pockets. The highest outlier is the Coinbase trade, which reveals a single $78 million outflow.

Speculatively, the left cluster could present deposit addresses for establishments, the suitable wallets often is the buying and selling wallets, and the underside wallets may very well be chilly storage. At current, none of that is verifiable, however it might doubtlessly align with the info acknowledged within the ETF prospectuses relating to how Bitcoin buying and selling works for the funds. Bear in mind, the above solely reveals transactions better than $50 million, or round 1,100 BTC.

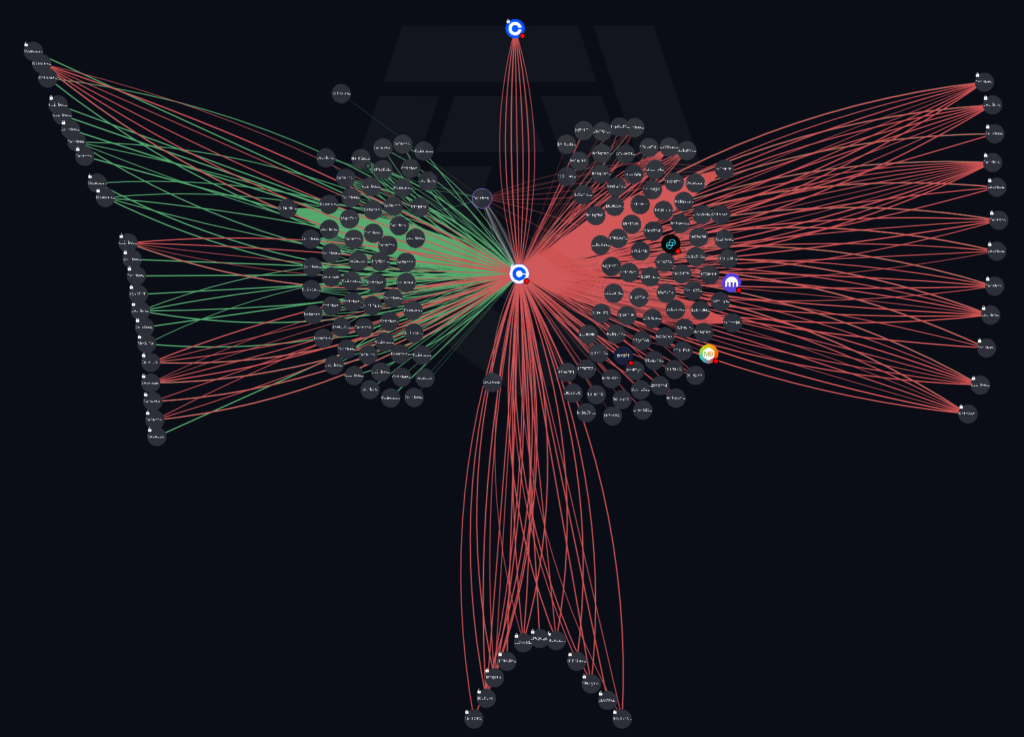

The under diagram consists of transactions as little as $1,000 with all of the above wallets locked into place. Notably, the underside cluster nonetheless reveals no inflows, whereas dozens of latest wallets have entered the world at these decrease values.

Trying to establish and analyze wallets associated to ETF exercise could give essential insights into the Bitcoin market ought to buying and selling volumes proceed to comply with the launch information. With CoinShares reporting round $17.5 billion in buying and selling quantity amongst crypto monetary merchandise final week, this exercise will impression the spot Bitcoin value in another way.

The worth at which the ETFs worth Bitcoin day by day is calculated via the CF Benchmarks Index, BRR, which stands for the Bitcoin Reference Charge. This charge is calculated between 3 pm and 4 pm GMT each day by analyzing a spread of transactions throughout a number of exchanges. The BRR is then used to calculate the web asset worth for the funds and, thus, the worth of the Bitcoin it holds. This charge and the truth that share creations and redemptions occur exterior of ordinary buying and selling hours add a brand new dynamic to Bitcoin buying and selling that has not been an element till now.