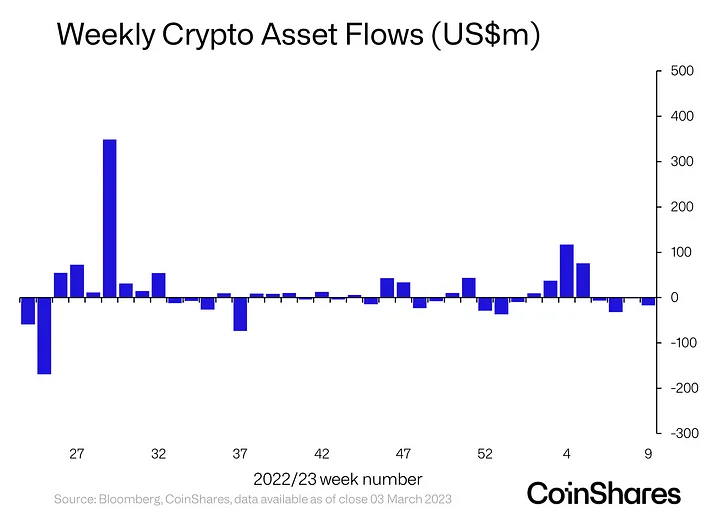

Digital property supervisor CoinShares says institutional crypto funding merchandise suffered their fourth consecutive week of outflows final week.

In its newest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional crypto funding merchandise suffered outflows of almost $20 million final week, together with minor inflows into brief funding merchandise.

“Digital asset funding merchandise noticed minor outflows totaling US$17m final week, marking the 4th consecutive week of unfavorable sentiment.”

Bitcoin (BTC) merchandise took the heaviest hit of outflows at $20.1 million. In the meantime, short-Bitcoin merchandise noticed minor inflows of $1.8 million. Brief-BTC merchandise have loved the second highest year-to-date inflows, about $50 million to Bitcoin’s $126 million.

Coinshares says it believes regulatory uncertainty could also be the reason for traders speeding to short-BTC merchandise.

“Regardless of the latest inflows into short-bitcoin, whole property below administration (AuM) have risen by solely 4.2% YTD [year-to-date] in comparison with long-bitcoin AuM having risen by 36%, suggesting brief positions haven’t delivered the returns some traders anticipated this yr up to now. Nonetheless, it seemingly represents continued investor issues over regulatory uncertainty for the asset class.”

Most altcoin funding merchandise loved minor inflows final week. Multi-asset funding autos, these investing in a basket of digital property, raked in $0.8 million in inflows final week. Ethereum (ETH) merchandise took in $0.7 million, whereas Solana (SOL) autos took in $0.3 million. Binance (BNB) and Cosmos (ATOM) merchandise each suffered minor inflows, $0.4 million and $0.2 million, respectively.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Featured Picture: Shutterstock/Aleksandr Kukharskiy