Defi Insurance coverage market overview

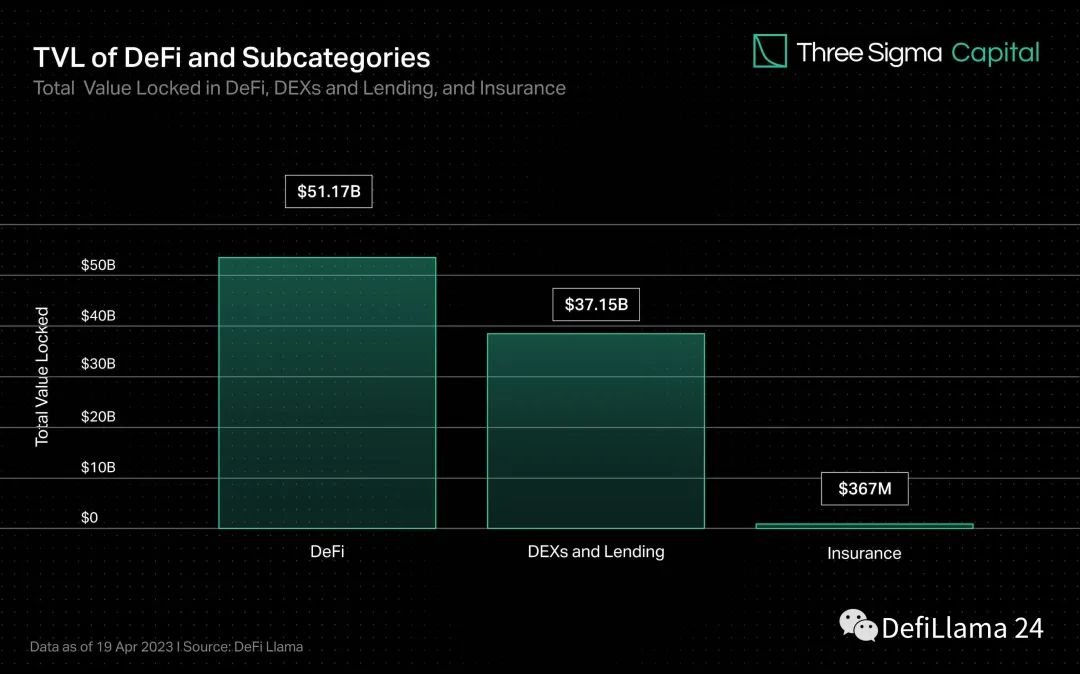

Whereas DEXs and lending account for a lot of the worth locked in DeFi, insurance coverage accounts for lower than 1% of the entire worth. Nonetheless, as TVL grows, so does the potential for sensible contract vulnerabilities or different assault vectors. Insurance coverage options are much like security nets within the conventional monetary markets, and a thriving answer will encourage traders, particular person customers, and establishments to confidently enter the net market.

Trade pioneer Nexus Mutual has dominated the insurance coverage market since its launch, accounting for over 78% of TVL however solely 0.15% of DeFi’s complete TVL. The remainder of the insurance coverage market is fragmented, with the three insurance policies behind Nexus accounting for about 14% of TVL.

Whereas the worldwide conventional insurance coverage market is huge and anticipated to develop considerably over the following few years, the DeFi insurance coverage trade has grow to be a small however promising offshoot of the blockchain trade. Because the DeFi insurance coverage trade matures and upgrades, we are able to anticipate extra innovation, with new protocols rising and present protocols enhancing their merchandise to satisfy the wants of DeFi customers.

What’s Defi Insurance coverage?

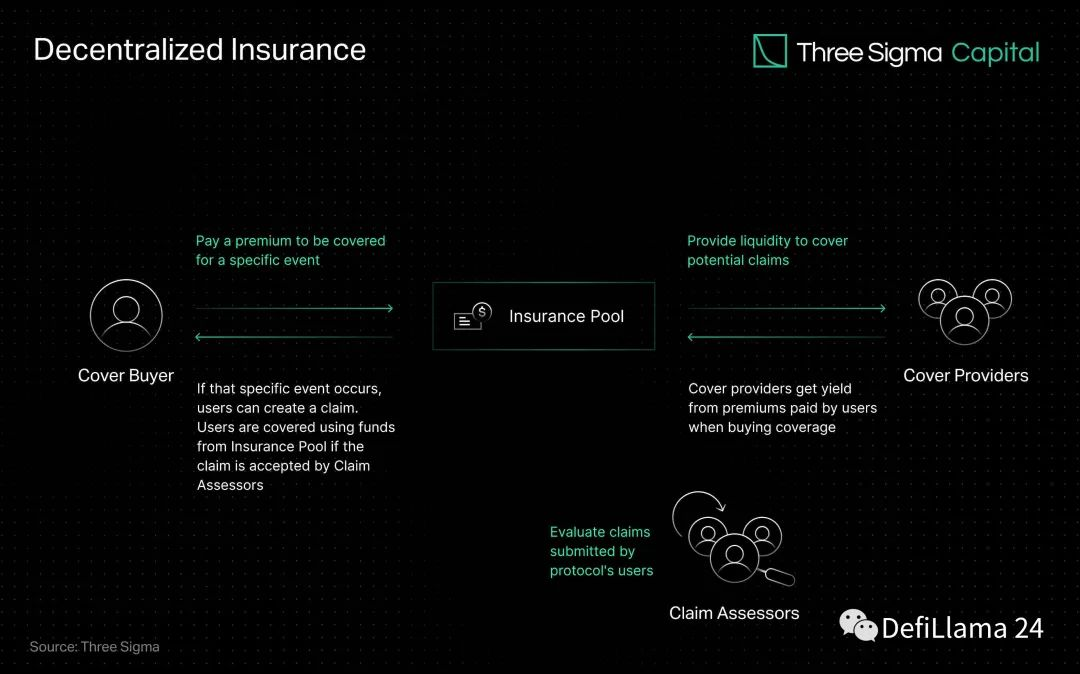

In DeFi terminology, these “Defi insurance coverage suppliers” are liquidity suppliers (LPs) or, extra appropriately, Insurance coverage Liquidity Suppliers. These LPs will be any firm or particular person locking their capital right into a decentralized danger pool with different comparable suppliers.

DeFi insurance coverage serves to guard you from sudden losses like hacks, halted withdrawals, and stablecoin crashes. These insurance coverage merchandise are extremely customizable, and your protection (and premium) will rely upon precisely what occasions you select to get coated.

In true DeFi trend, insurance coverage swimming pools are crowd-funded. The essential premise is that folks put collectively insurance coverage cash for various occasions, and this quantity of protection is reserved for individuals who buy insurance coverage towards that occasion.

If a coated occasion happens, akin to an change hack, the funds you pledge to pay for that occasion can be despatched to the affected events. If the occasion doesn’t occur, your cash stays within the pool, incomes a return over time.

Essentially the most outstanding a part of any dialogue of DeFi protection defined intimately will deal with its workings. Insurance coverage works via the pooling of dangers. Folks search insurance coverage to cowl the chance of economic penalties as a result of potential occasions of their lives. Now, insurance coverage firms work by pooling danger by requiring every consumer to pay a premium. Each buyer’s premium is considerably decrease than what’s payable on claims.

How DeFi Insurance coverage Works

As a substitute of receiving insurance coverage from a centralized establishment, DeFi insurance coverage permits people and companies to hedge their capital towards danger via decentralized liquidity swimming pools. In return, the insurance coverage supplier earns a return on locked-in capital generated from a proportion of the premium paid, making a hyperlink between the compensation and the chance of the deal.

Overlay suppliers make investments their funds within the protocol’s riskier and extra rewarding swimming pools. Which means people commerce occasion outcomes primarily based on their estimate of the chance of the potential danger occurring. Suppose a protocol underwritten by an insurance coverage firm experiences an adversarial occasion, akin to a hack. In that case, the funds within the fund that cowl the protocol will compensate customers who’ve bought insurance coverage towards the potential for that particular.

Pooling sources and spreading danger amongst a number of gamers is an efficient technique for coping with uncommon or excessive occasions with vital monetary affect. A pool of mutual funds can offset many instances the chance with much less cash, offering a collective mechanism for fixing large-scale issues.

The recognition of parametric insurance coverage in DeFi is because of its automated and clear mechanism. A wise contract with preset parameters and real-time knowledge from oracles can allow computerized declare settlement primarily based on these parameters. This automation hastens the claims course of, will increase effectivity, and reduces the potential for bias or human error.

The flexibility for anybody to take part, and the transparency of on-chain operations, is usually highlighted as the primary benefit of a decentralized insurance coverage system. As DeFi grows, the necessity for options that shield customers’ funds turns into more and more important.

Professionals and Cons

Professionals

Cons

- It’s sophisticated: DeFi is a notoriously tough space for rookies. There are such a lot of sensible contracts, exchanges, and coated occasions that even selecting the proper insurance coverage choice can get sophisticated.

- Issuer advantages: Insurers (and protocols, on this case) will solely be in enterprise in the event that they earn money. Like with casinos, everytime you purchase insurance coverage, you’re betting on a danger mannequin that claims it’s going to earn money by offering you with an insurance coverage coverage. For some folks, setting apart their cash for a wet day could also be a greater insurance coverage technique than shopping for insurance coverage.

How do you purchase DeFi insurance coverage?

To buy DeFi insurance coverage, you need to first discover an insurance coverage protocol that gives protection for the occasion you need to be coated for — whether or not it’s a particular sensible contract mining, a de stablecoin – peg, or anything.

Taking a look at vital insurance coverage suppliers like Nexus Mutual, Etherisc, InsurAce, and Bridge Mutual is an efficient start line.

Is DeFi Insurance coverage Price It?

As DeFi continues to develop, it turns into extra susceptible to safety assaults. To guard customers from such dangers, viable insurance coverage protocols have to emerge. It’s not at all times clear whether or not DeFi protection is value it. In case you are involved in regards to the security of a selected sensible contract, change, or stablecoin and are coping with some huge cash, insurance coverage is usually a good funding.

However, in case you are coping with a small amount of money or utilizing massive established platforms, DeFi insurance coverage will be an pointless expense. Finally, the selection to make use of insurance coverage depends upon your private danger tolerance.

DISCLAIMER: The Info on this web site is supplied as basic market commentary and doesn’t represent funding recommendation. We encourage you to do your individual analysis earlier than investing.