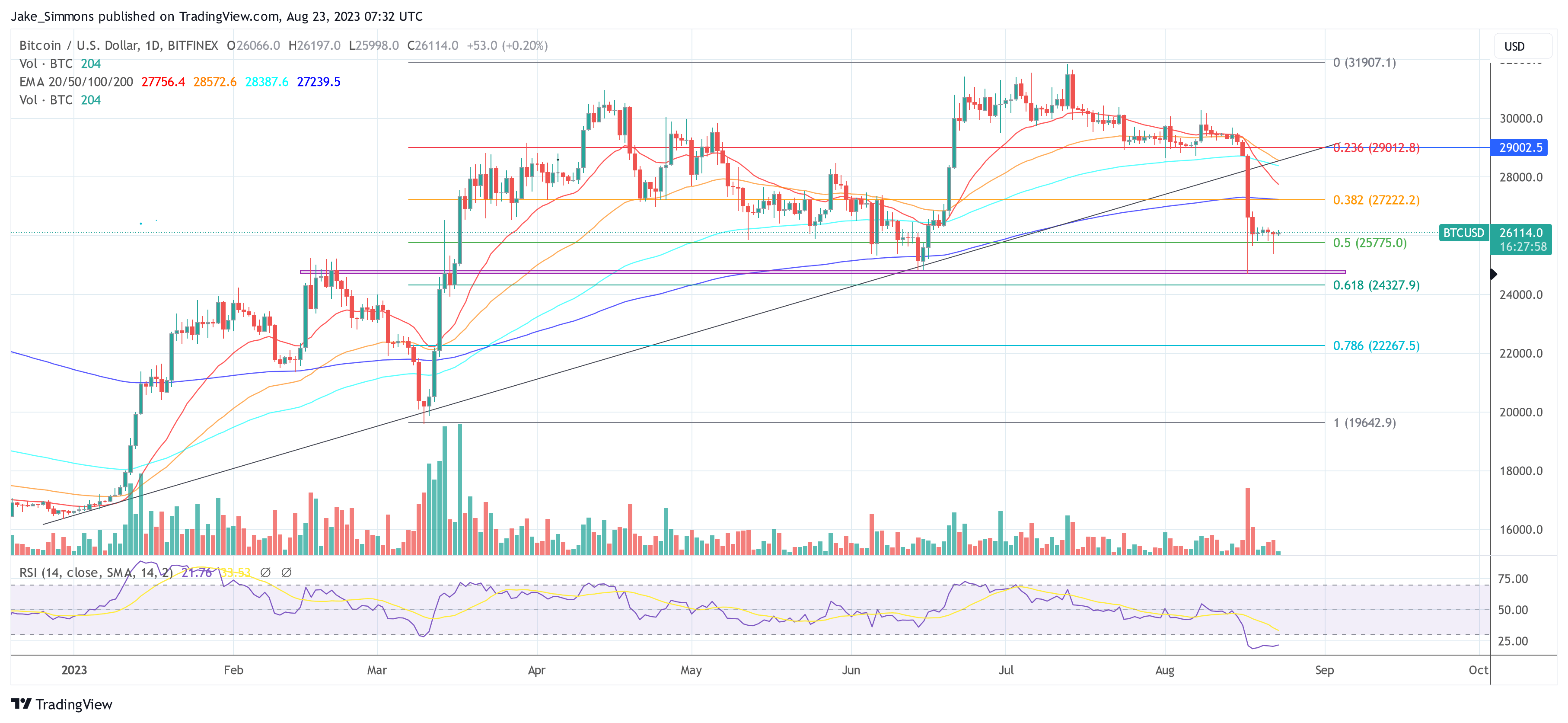

Because the Bitcoin market navigates the uneven waters round $26,000, there are a number of metrics to regulate. After hitting a low of $25,374 yesterday, the bulls have managed to push the worth again up, though the market stays in a weak state following final Thursday’s worth crash.

At present, the Concern and Greed Index for Bitcoin sits at 37, which is indicative of sturdy concern permeating the market. Usually, such a low stage on this index means that market contributors are apprehensive concerning the near-term future, usually resulting in a self-fulfilling prophecy of types the place the promoting stress will increase.

An In-Depth Look At Bitcoin CVDs & Delta

Famend analyst Skew has highlighted the position of Cumulative Quantity Delta (CVD) in understanding the present market dynamics as we speak. “BTC Mixture CVDs & Delta reveal restrict spot sellers right here with shorts pushing for management.” Because of this at the same time as merchants wish to purchase at market costs (takers), these prepared to promote are setting limits, including a ceiling to any short-term bullish momentum.

The precise worth level to notice right here is $26,100. “This stage has acted as a magnet for restrict sellers,” Skew notes, “and is backed by the sample seen in spot CVD versus worth thus far.” In different phrases, spot takers are being absorbed by restrict sellers at this worth, constraining upward motion.

Perpetual CVD (Perp CVD) additionally deserves consideration because it “strikes decrease in keeping with longs closing out and new shorts coming in.” This implies that merchants are usually not solely protecting their lengthy positions but in addition opening new brief positions, in keeping with the present bearish worth motion.

Inspecting particular exchanges like Binance and Bybit provides additional granularity to the evaluation. In accordance with Skew, “Longs received rinsed in that sweep under $25,800, thereby marking that stage as a key pivot level.” Open Curiosity (OI) on Binance noticed a discount of 6,000 BTC, and Bybit OI was down by 3,000 BTC – all in lengthy positions that had been liquidated.

The liquidation of longs at these ranges presents a transparent threat for any bullish eventualities. “Clear threat for longs is under $25,800,” Skew asserts, making it an important stage to look at for merchants who’re internet lengthy.

MacroCRG, a famend market analyst, added to the evaluation that enormous quantity of longs had been liquidated once more throughout yesterday’s BTC dip: “Extra ache for #Bitcoin longs as one other $300M+ of open curiosity was worn out in a single day by a draw back sweep. When will it finish?”

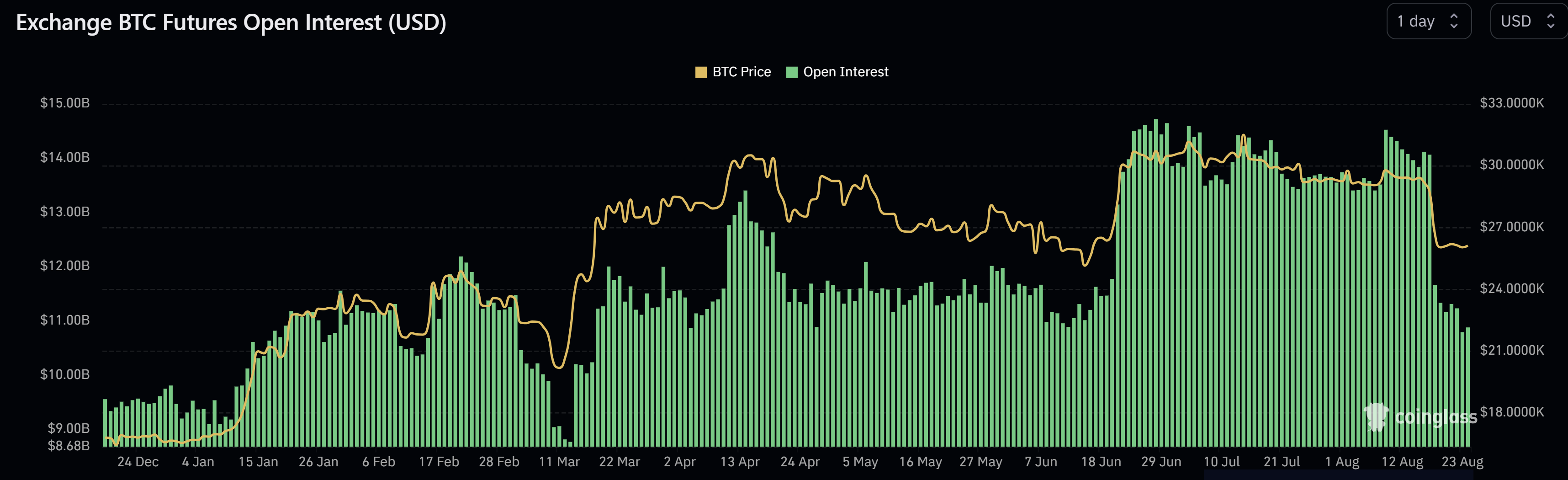

Nonetheless, there may very well be a silver lining, as Skew places it: “More likely to see apes rage shorting this quickly.” However thus far, Bitcoin’s open curiosity (OI) stays flat after Thursday’s flush. OI at present stands at $10.88 billion (after being above $14 billion).

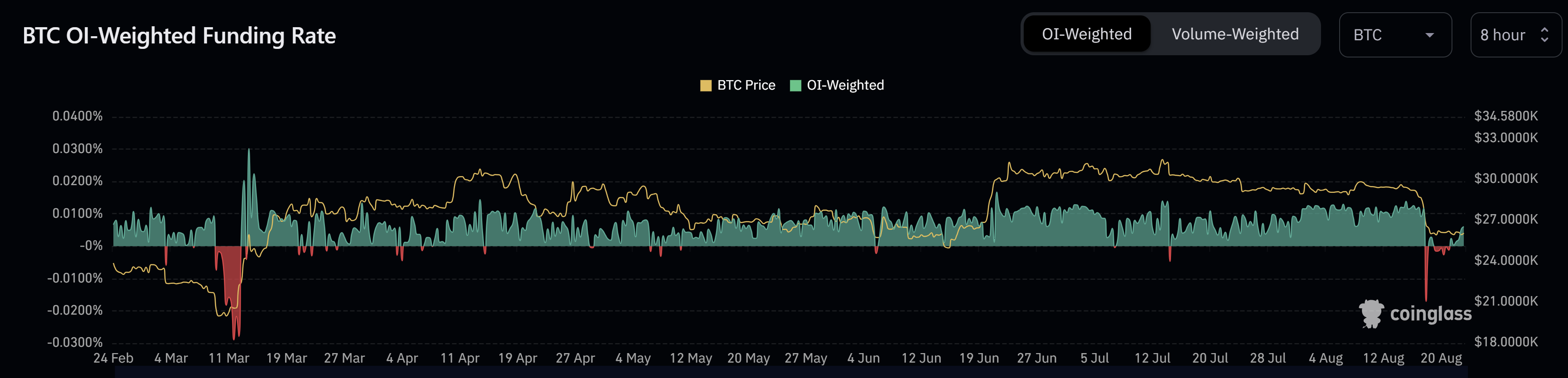

BTC’s OI-weighted funding price has already turned optimistic once more at +0.0060. If the worth turns destructive for a number of days, because it did earlier than the March 2023 rally, it may very well be an indication {that a} brief squeeze is on the playing cards. Nonetheless, after Thursday’s crash, the metric remained in destructive territory just for a short while.

BTC Quick-Time period Holders and Velocity

On-chain specialist Axel Adler Jr. factors out that the short-term Bitcoin holders (STH) cohort has decreased their holdings by a big 400,000 BTC. This mass exodus has put appreciable promoting stress available on the market, rendering many STHs “underwater” and thereby much less prone to have interaction in bullish conduct.

Furthermore, Adler emphasizes the BTC Velocity metric, stating, “Originally of this 12 months, the BTC Velocity metric dropped to its minimal stage.” This extraordinarily low velocity signifies not simply low volatility, but in addition an absence of market participant exercise – a regarding signal for any imminent bullish flip. Subsequently, Adler concludes:

Making an allowance for these two elements, in addition to the truth that the STH cohort has historically been the first participant creating volatility within the BTC market, restoration after this drop would require extra time than standard and should take an indefinite interval.

At press time, BTC traded at $26,114.

Featured picture from iStock, chart from TradingView.com