On March 24, zkSync formally introduced the mainnet. There may be additionally Layer 2, which has acquired a big funding from buyers. After Arbitrum, many individuals are trying ahead to the following main airdrop of this venture. Let’s be taught extra about zkSync with Coincu on this article.

What’s zkSync?

zkSync is a Layer 2 scaling answer that gives cheaper and faster transactions than the Ethereum community itself (Layer 1). Layer 2 options shift nearly all of exercise away from Layer 1 whereas retaining its safety and finality.

zkSync is a scaling answer created by Matter Labs that makes use of ZK Rollups expertise to chop prices, pace up transactions, and guarantee safety on Ethereum.

The quick growth of the Ethereum ecosystem has resulted in community congestion, and there may be an pressing want to handle the problem of transaction pace and price. Consequently, a number of Layer 2 tasks utilizing varied applied sciences, resembling zkSync, Arbitrum, Optimism, and Polygon…, have been created to handle the aforementioned difficulties.

zkSync, like Arbitrum and Optimism, is a Layer 2 scaling answer for Ethereum. The excellence is that Arbitrum and Optimism – the market’s greatest Layer 2 ecosystem – are each based mostly on Optimistic Rollup, whereas zkSync is predicated on zk Rollup.

Let’s take a fast have a look at the variations between the 2 types of options. They’re, in essence, logically opposed. zk doesn’t belief all validators and depends on zero-knowledge proofs to validate every final result, whereas Optimistic Rollup – proof of fraud trusts everybody and waits for others to object.

Optimistic, in different phrases, is a extra lax verification approach that minimizes the complexity of verification and computation effort. In the meantime, ZK appears to be harder, but the complexity and improvement cycle is prolonged.

How does it work?

ZkSync’s working methodology is predicated on Rollups.

zkSync is Matter Labs’ first product constructed on the ZK Rollups structure, serving as an Ethereum Layer 2. On zkSync, monies are held on the principle community (on-chain) on the good contract, however computation and knowledge storage is finished off-chain.

To validate the correctness of the Rollup block on the principle chain, a zero-knowledge proof – SNARK kind zero-knowledge proof shall be constructed. Due to this fact zk-SNARK is principally a Zero Information verification approach.

SNARK verification is considerably cheaper than every transaction verification, and preserving the state off-chain is loads cheaper than storing on EVM. Consequently, scalability (100-200 instances major community capability) and price reductions are potential.

The next assurances are supplied by the zkRollup structure:

- Validators can by no means be corrupted or stolen (not like Sidechains).

- Even when the validator stops cooperating as a result of knowledge availability, customers might at all times purchase cash by way of the zkRollup good contract (not like Plasma).

- To keep away from fraud, customers or trusted third events don’t must be on-line (not like anti-fraud options resembling cost channels or Optimistic Rollups).

To place it one other means, zkRollup strictly inherits L1’s safety.

On the zkSync ecosystem, the price of every transaction has two elements:

- Off-chain: The price of storing state and producing a SNARK (zero-knowledge proof).

- On-chain: For every zkSync block, validators should pay Ethereum gasoline to confirm SNARK. This payment relies on the present gasoline worth within the Ethereum community.

Matter Labs’ merchandise

zkSync Lite

This can be a product that was launched in June 2020 below the title zkSync 1.0, with the aim of simply offering a cost mechanism, and didn’t but embody good contracts. zkSync issued an replace (v1.x) in Could 2021 that provides NFT and swap functionality.

This Ethereum scaling mechanism is able to processing as much as 3000 transactions per second (TPS). However, when the community expanded in measurement, the need for elevated throughput necessitated the creation of a brand new model: zkSync 2.0.

zkSync Period

That is model 2.0. Period’s first model included new options resembling Account Abstraction and EVM help by way of Solidity and Vyper. It already helps good contracts, in addition to its personal programming languages, Zinc and zkPorter.

zkPorter

zkRollup with on-chain knowledge provisioning and zkPorter with off-chain knowledge provisioning are included in zkSync 2.0. This can be a Matter Labs byproduct that raises community TPS extra rapidly.

Excellent options of zkSync

Among the following frequent points might clarify why the zkSync answer has gotten a lot consideration in the neighborhood:

- Mainnet-level safety with out third social gathering dependencies.

- Switch ETH and ERC-20 tokens to L1 with on the spot affirmation and a time restrict of not more than 10 minutes.

- Extraordinarily low transaction charges (roughly 1/100 of the mainnet price for ERC-20 and 1/130 for ETH).

- No registration is required to obtain cash.

- Cost for present Ethereum addresses (together with good contracts)

- Charges are conveniently payable when tokens are transferred.

- Withdraw to mainnet in simply 10 minutes. Asset deposit and withdrawal instances are a lot shorter than Arbitrum’s Optimistic Rollup expertise and Optimism.

- EVM permissionless appropriate good contract.

- Multisig help.

ZkSync Period

To grasp Period, we should first grasp the notion of zkEVM. That is an Ethereum digital machine compatibility approach designed to make sure that the expertise and utility performance on Layer 2 just isn’t considerably totally different from these on Layer 1. EVM eliminates the necessity for builders to replace the code or keep away from utilizing EVM (and good contract) instruments whereas growing or migrating good contracts to extra scalable options that keep Layer 1 decentralization and safety.

zkEVM is a partly developed approach based mostly on Zero-Information Proof that’s separated into 4 classes relying on compatibility with EVM, with classes 1–4 more and more reducing compatibility with EVM.

The crew highlighted the usage of zkEVM expertise to advertise interoperability with EVM good contracts after altering the title to zkSync Period. The Matter Labs crew has been exploring the implementation of zkEVM on the pilot community for over a 12 months and on the official community since October 2022 and has additionally been subjected to a number of audits.

Options

Superior to Optimistic Rollups

Tasks utilizing Optimistic Rollups resembling Arbitrum and Optimism, in addition to tasks utilizing Zk Rollups resembling zkSync and Starkware, are all main open options for Ethereum. Nonetheless, the zkSync crew claims that ZK Rollup has many advantages over Optimistic Rollup, together with:

- Transaction Validation Time: ZK Rollups are faster than Optimistic because it doesn’t have to attend 7 days to validate the transaction’s validity.

- Capital effectivity: Not like Optimistic Rollup, deposits, and withdrawals of property on ZK Rollup shouldn’t have a 7-day wait, leading to elevated capital effectivity.

Account Abstraction (AA)

Account Abstraction permits a personal account to be transformed into a wise contract with its personal logic by changing Externally Owned Accounts (EOA) into Sensible Contract Accounts (CA).

This zkSync function gives the next advantages:

- There isn’t a want for a seed phrase to keep away from shedding or hacking your pockets. AA helps biometric authentication by way of household or pals.

- Pay Charges in Any Token: Allows one pockets to help or sponsor different wallets by buying and selling for them and changing different tokens to ETH for charges. Paymasters are the title given to this kind of account.

- Signing many transactions directly: Allows customers to pool transactions in a batch and signal them abruptly, saving time on processing every transaction one after the other.

- Prospects might use the AA operate to plan computerized cash transfers, renew membership funds, and so forth in a decentralized means.

zkEVM

zkEVM is a brand new ZK-Rollup expertise that was created in early 2021 and is extraordinarily appropriate with EVM.

There are nonetheless a number of limitations to the ZK programming language. One of the crucial important impediments is the number of varied programming languages, which makes it tough for builders to program in lots of languages.

This makes it tough to create dApps with constant code or migrate dApps between layers 1 and a couple of. General, the usual zk-Rollup is sort of complicated to implement and has sure sensible restrictions.

Due to the unification of programming methods in zkEVM, the composability in layer 2 shall be larger, making it simpler for Ethereum-based dApps to transition to the zk-Rollup chain with little alteration to the supply code.

Roadmap

At present, the venture has reached the Alpha mainnet section of Period. It’s anticipated that the crew will give attention to decentralization and anti-censorship. That’s, zkSync will intention to be a decentralized and censorship-free venture by fully eradicating the management of Matter Labs. As an alternative, these rights shall be given to the neighborhood.

Core crew

- Marco Cora: Head of Enterprise Improvement at Matter Labs.

- Alex Gluchowski: Founding father of Matter Labs.

Buyers & Companions

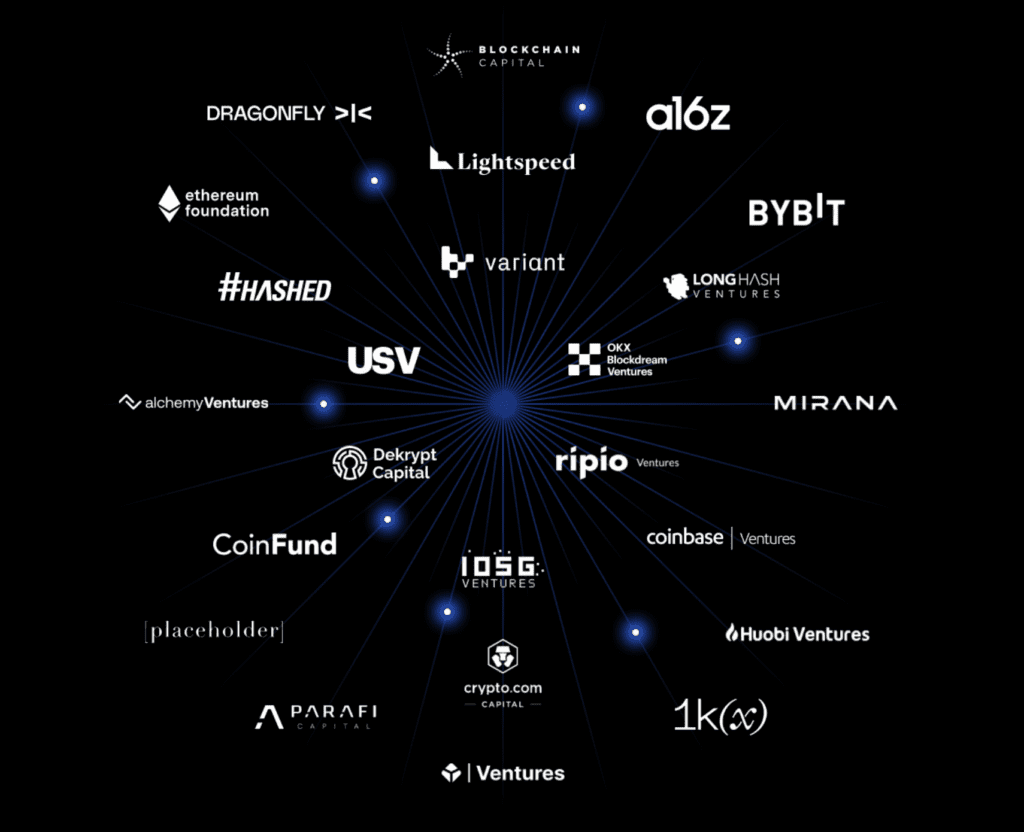

Buyers

zkSync is invested by many respected funds within the blockchain trade resembling Binance, Cb Ventures, Balancer, Curve. In November 2021 in a collection B funding spherical, zkSync acquired $50 million in funding from Horowitz, Placeholder, Crypto.com, and extra.

In January 2022, Matter Labs was permitted for a $200 million funding from BitDAO to construct the zkSync ecosystem.

The corporate additionally efficiently raised a $200 million fund led by Blockchain Capital and Dragonfly, together with different buyers resembling Mild Velocity Enterprise Companions, Variant, and a16z… in November 2022.

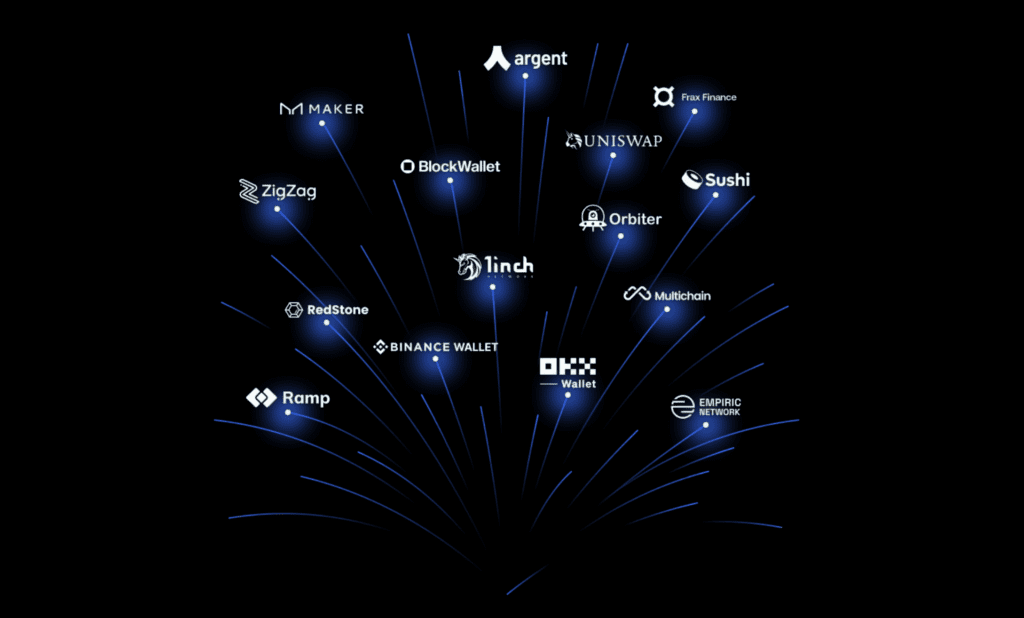

Companions

Conclusion

It may be seen that, amongst many Layer 2 tasks on Ethereum, zkSync is proving itself to the neighborhood that it’s a good candidate. Sooner or later, with many enhancements and token launches (only a prediction), this may most definitely be the brand new bomb of the crypto market after Arbitrum and Optimism.

DISCLAIMER: The Data on this web site is supplied as normal market commentary and doesn’t represent funding recommendation. We encourage you to do your personal analysis earlier than investing.