On the earth of Bitcoin, silence isn’t at all times golden. The latest weeks have seen Bitcoin’s value volatility drop to historic lows, with the BTC value buying and selling principally between $29,000 and $30,000. Nonetheless, beneath this placid floor, quite a lot of intriguing market dynamics are at play.

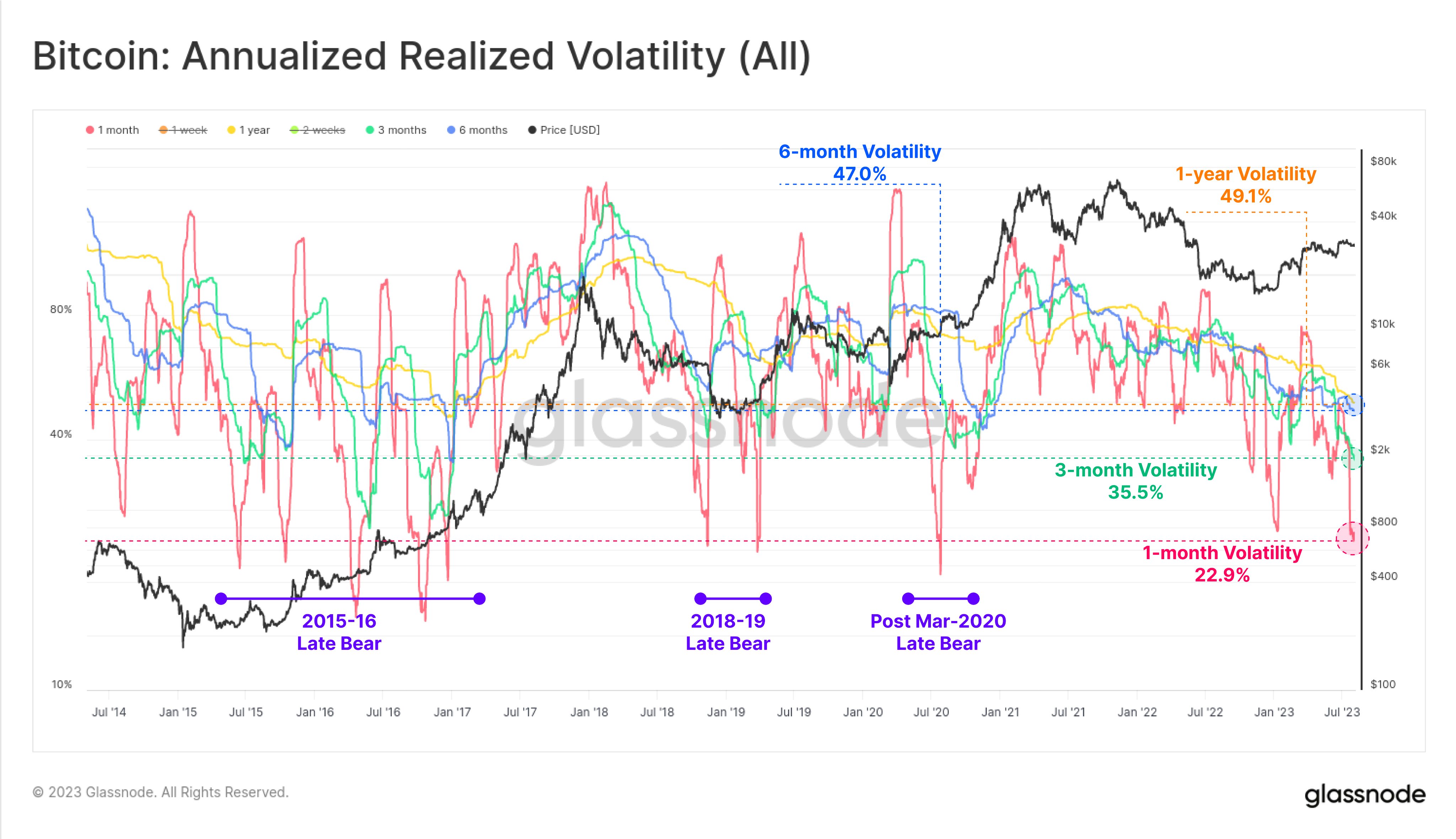

“Realized volatility for Bitcoin has collapsed to historic lows. Throughout 1-month to 1yr timeframes, that is the quietest we’ve seen the corn since after March 2020. Traditionally, such low volatility aligns with the post-bear-market hangover intervals (re-accumulation part),” said Checkmate, lead on-chain analyst at Glassnode.

The chart shared by Checkmate reveals that annualized realized volatility resembles the post-bear period for Bitcoin from March 2020 when volatility was at 47%. At present, 1-year volatility sits at 49.1%, 3-month volatility at 35.5%, and 1-month volatility at 22.9%.

Give up Earlier than The Storm For Bitcoin

Nonetheless, the low volatility isn’t the one story. Checkmate additionally highlighted a brand new all-time excessive for Bitcoin’s long-term holder provide, now at 14.59M BTC, which accounts for 75% of the circulating provide. This reveals that an more and more excessive variety of Bitcoin buyers are satisfied of a future rally, resulting in a provide scarcity, whereas excessive threat merchants are washed out of the market attributable to missing volatility.

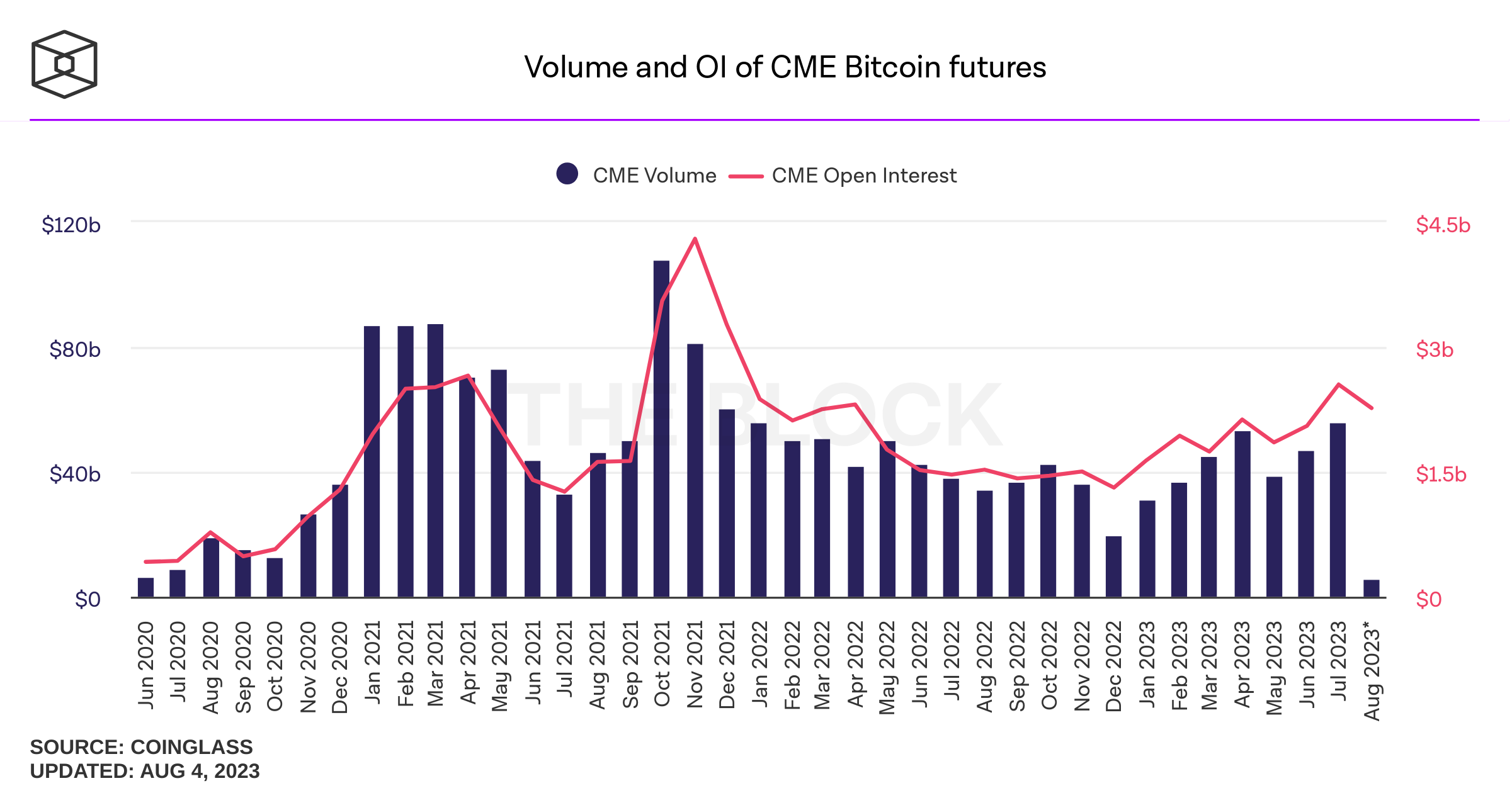

Concurrently, there’s a surge in institutional positioning; quantity and open curiosity of the CME Bitcoin futures have reached a 20-month excessive in July. Regardless of the Bitcoin spot markets recording low volumes, the CME futures noticed the very best quantity since January 2022, with $55.8 billion in July.

The CTFC knowledge reveals a captivating slugfest between two investor teams. Asset managers are $1.2 billion web lengthy, whereas hedge funds are web brief by -$980 million. This standoff suggests an imminent breakout in Bitcoin’s value, doubtlessly leaving one among these teams with burnt fingers.

On-chain analyst Ali Martinez provided additional perception: “At the same time as Bitcoin dropped from $32,000 to $29,000, the variety of new BTC addresses steadily rose! This bullish divergence between value and community progress hints at a secure long-term BTC uptrend. Purchase the dip!”

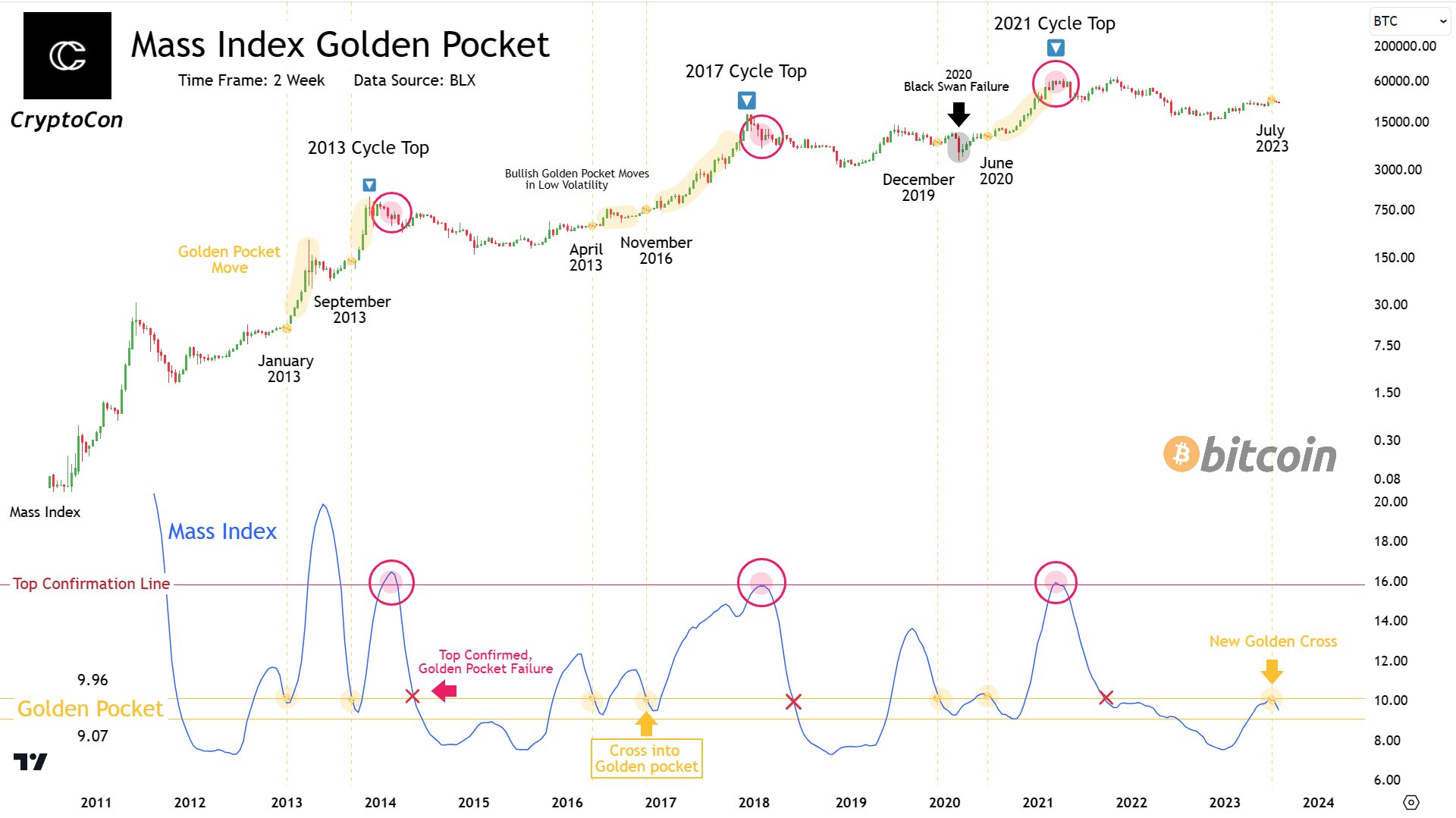

Certainly, the present low volatility part isn’t with out precedent or predictive energy. Famend analyst @CryptoCon gives a compelling perspective on this, stating that such intervals of sideways value motion will not be solely regular however doubtlessly bullish.

“Bitcoin sideways value motion at this level within the cycle is totally regular! The two Week Mass Index crosses into the golden pocket on the most stagnant cycle factors, simply earlier than large bullish strikes. Knowledge in every single place factors to the identical conclusion: Low volatility is bullish,” CryptoCon tweeted.

Chris Burniske, associate at Placeholder VC, additionally shared his perspective on the present market dynamics. “At present, vacationers are inactive whereas residents are accumulating swiftly, proudly owning 74.8% of all provide. That’s per an early-stage bull market. Thirty % of BTC has left for chilly storage since 2020, leaving exchanges with 2.26 million. Bitcoin appears pretty valued relative to the variety of lively entities on the community.”

Burniske’s simplified value/cycle mannequin tasks Bitcoin to achieve close to $39,000 by the fourth quarter of 2023 and $92,000 (base situation) by This fall 2025 with entities above 600,000.

In conclusion, the present low volatility part of Bitcoin could appear uneventful on the floor, however the underlying market dynamics recommend a unique story. The tug-of-war between asset managers and hedge funds, the regular rise in new BTC addresses, and the swift accumulation by long-term holders all trace at a brewing storm.

At press time, the Bitcoin value was at $29,076.

Featured picture from iStock, chart from TradingView.com