MakerDAO, creator of the DAI stablecoin, has a very good drawback: Demand for its product is excessive.

SparkLend, a borrowing and lending platform organized as a sub-DAO inside Maker, has issued a lot DAI in current weeks that it wants authorization to lend extra.

In a governance vote authorized Thursday at 12:00 pm ET, Maker voted unanimously to double the D3M most debt ceiling to 2.5 billion DAI.

“D3M” stands for Decentralized Debt Markets Module, a mechanism designed to optimize the DAI liquidity throughout completely different DeFi platforms. The module robotically adjusts the DAI borrowing charges on exterior platforms (like Aave) to be in keeping with the Dai Stability Charge throughout the MakerDAO system.

Learn extra: MakerDAO steadiness sheet now majority crypto-backed loans

Motivating the change is the quickly accelerating demand for loans at SparkLend previously week, which left out there DAI falling to 250 million. Maker’s threat specialists lobbied in favor of the rise, arguing there’s no must preserve it so constrained.

“With current bull market circumstances, it’s changing into more and more tough to maintain up with borrowing demand,” Monet-Provide, analyst with Block Analitica wrote on the Maker discussion board, noting that the protocol blew via its final debt ceiling enhance and is rising at a median price of round 20 million DAI per day.

“This poses a threat of unintentionally hitting the D3M most debt ceiling and artificially limiting Spark’s development,” he wrote.

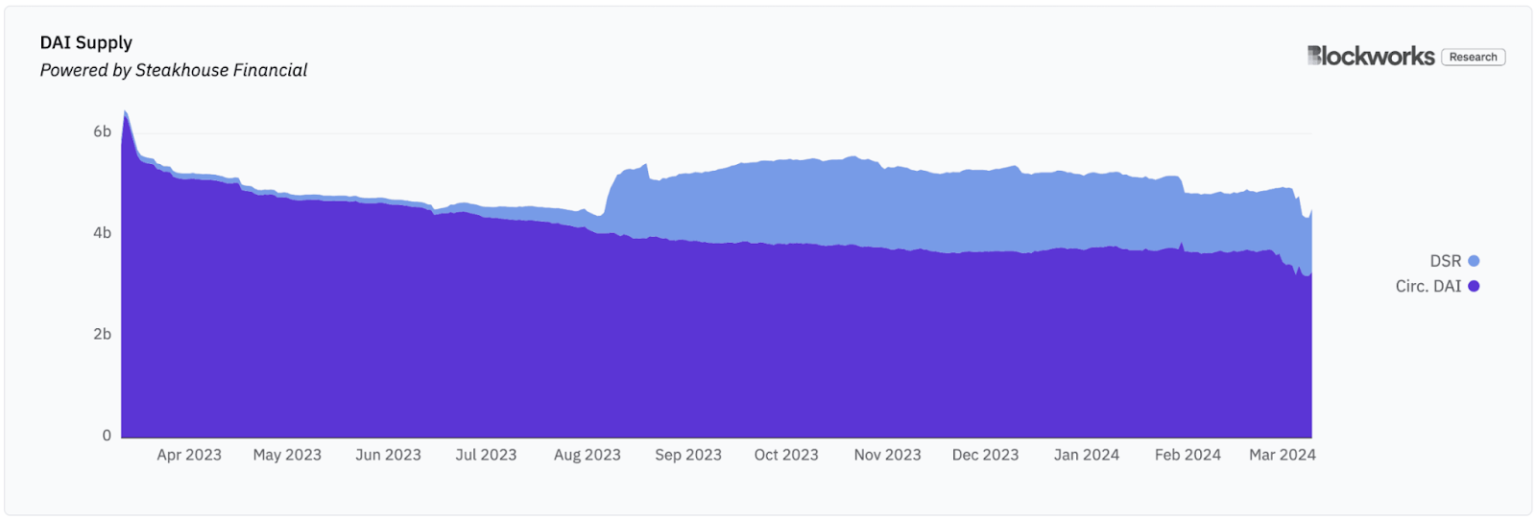

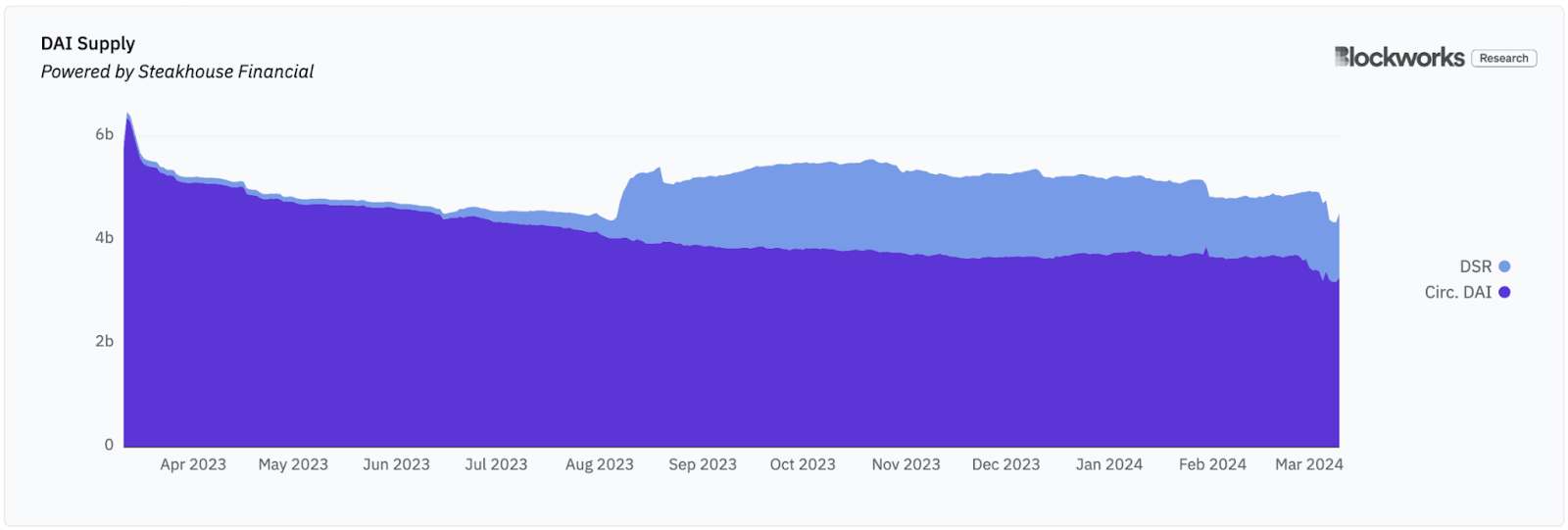

MakerDAO lately greater than doubled stability charges throughout the board on March 10 following an govt vote. The Dai Financial savings Charge (DSR) jumped from 5% to fifteen%.

Stablecoin yield alternatives have been on the rise, main merchants to swap DAI borrowed at low charges for larger yielding USDC or different stablecoins utilized in DeFi.

For example, along with promising excessive yields, a brand new entrant to the stablecoin market (Ethena’s USDe) is incentivized by a points-like system known as “shards.”

Learn extra: Stablecoins must concentrate on liquidity, not decentralization — Ethena Labs founder

That dynamic places downward strain on DAI’s greenback peg and pushed Maker’s PSM module, which permits swaps between DAI and USDC, right down to report lows.

Learn Blockworks Analysis: MakerDAO: Natural demand doesn’t develop on bushes

Ethena co-founder, generally known as Leptokurtic, argued on an X house this week that his protocol’s contribution to Maker’s price enhance was overstated, noting that Ethena had captured lower than 1% of the overall worth locked (TVL) in DeFi to this point.

“I really assume the marginal impression that Ethena has had on these adjustments might be lower than persons are giving credit score for over the previous few weeks,” Leptokurtic mentioned. “These price adjustments had been going to occur with or with out Ethena being there — it’s simply now folks make that connection a bit simpler between charges in [centralized finance] and DeFi.”

Spark developer Sam MacPherson, CEO at Phoenix Labs, mentioned throughout the identical dialogue that present price ranges are “nearly actually not sustainable” in the long term.

Learn extra: Spark Protocol is re-thinking stablecoin stability mechanisms

“Ethena is performing an ideal perform right here in bridging this disjointed charges habits,” MacPherson mentioned. “Maker is on the mercy of the market simply as a lot as everyone else, it’s simply that there’s no good contract doing it, there’s extra of a slower human course of that individuals attribute company to the speed setting inside Maker — however that’s actually not the case.”

For stablecoin holders proper now, occasions are good, with many choices to obtain comparatively secure double-digit yields.

The query is, how lengthy can it final?

“You’ll be able to’t have 30,40, 50% charges on USD that’s sustainable,” MacPherson mentioned. “Ultimately [traditional finance] goes to return in on measurement,” and push charges again down.