NFT

Blur takes the lead

On February 15, Blur’s native token BLUR was launched for buying and selling, and the transaction quantity exceeded $1 billion in lower than 24 hours. Maybe profiting from this sturdy momentum, Blur started to confront OpenSea in a brand new chapter of the NFT royalty battle.

On February 16, someday after the BLUR token was launched, Blur issued an official announcement saying the replace of the royalty coverage, which straightforwardly recommends that customers block OpenSea; so long as they don’t use OpenSea, they will take pleasure in full royalties.

NFT tasks set non-compulsory royalty settings. If OpenSea cancels this coverage, NFT tasks will have the ability to acquire royalties on each platforms on the identical time. Blur emphasizes that at the moment, NFT undertaking creators can not acquire royalties on two platforms on the identical time and may solely acquire full royalties on both OpenSea or Blur, however not on the identical time.

In actual fact, it was not unintentional that Blur confirmed his sword this time. In November 2022, OpenSea introduced that with a view to implement full creator charges on the platform, people who create NFT sensible contracts after January 2, 2023, should take on-chain actions to make royalties enforceable.

In different phrases, OpenSea requires creators to make use of on-chain instruments to ban the sale of NFTs on marketplaces that don’t implement royalties for creators — an apparent transfer in opposition to Blur, which is a royalty-free platform the place creators must ban NFTs bought on Blur can take pleasure in full royalties on OpenSea. If this isn’t finished, OpenSea will mechanically set the royalties of those NFT collections to “non-compulsory,” which in flip impacts creator earnings.

Blur took situation with OpenSea’s use of a “blacklist” to suppress it, claiming that creators ought to resolve the place and the way their merchandise are bought – not corporations – however had little success, after which additionally had to make use of the Seaport settlement Bypass restrictions.

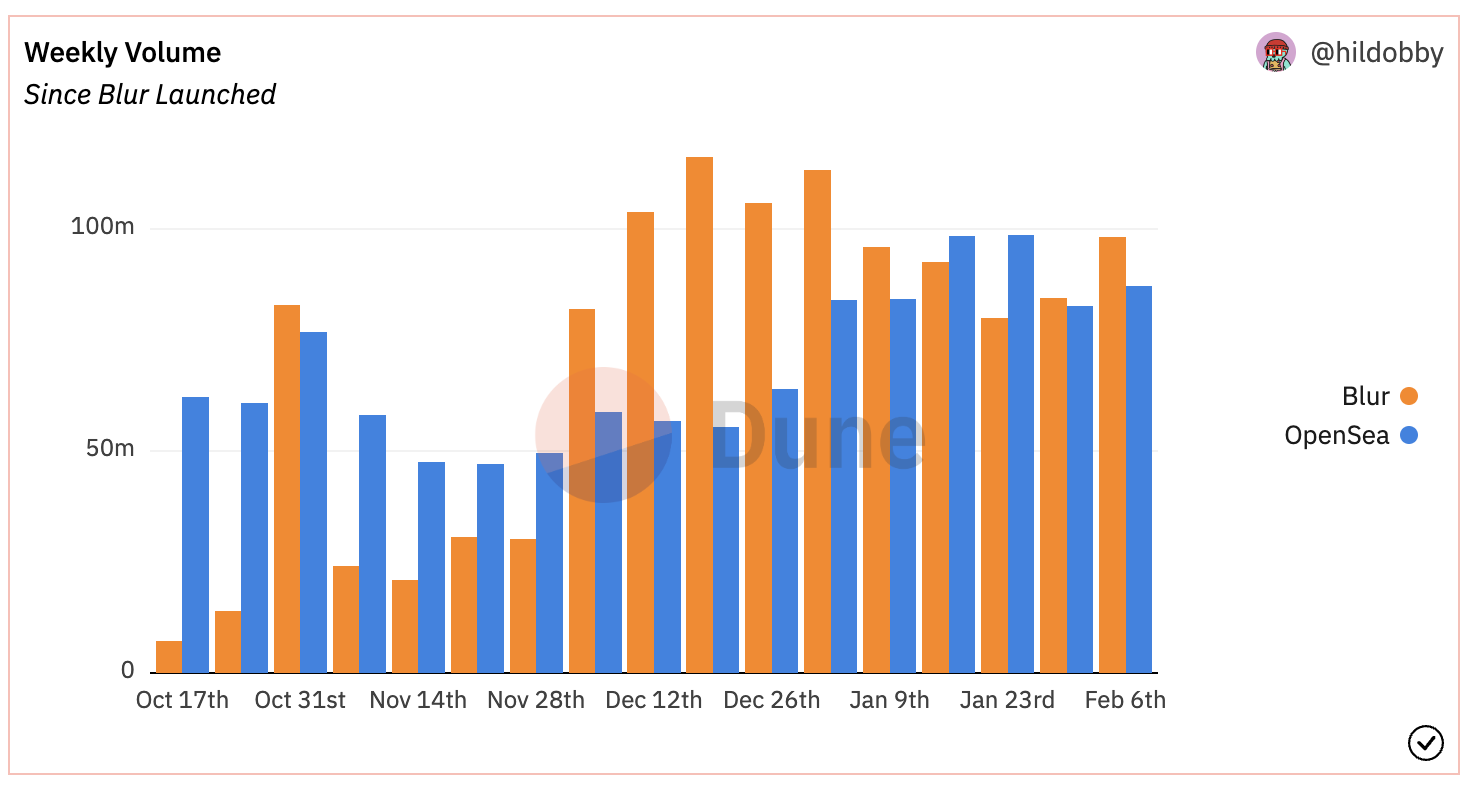

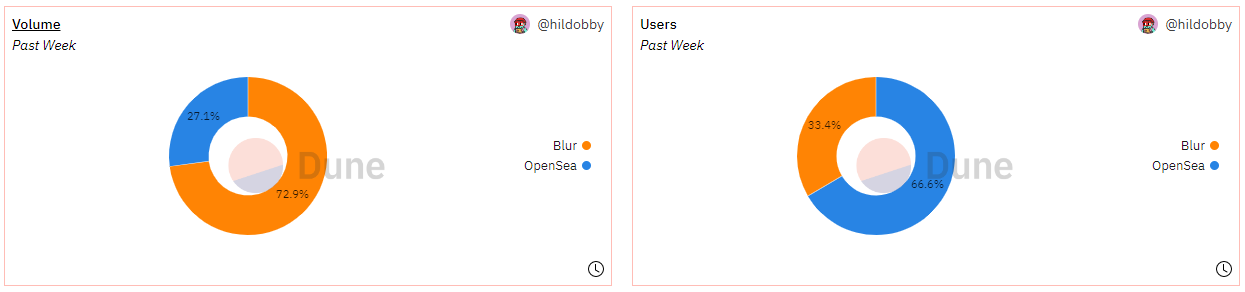

Nonetheless, OpenSea’s wishful pondering didn’t reach suppressing the fast growth of Blur however brought on customers to defect. The determine beneath is a comparability of two platforms’ single-week transaction quantity. It may be seen from the determine that because the starting of December 2022 (that’s, OpenSea started to limit Blur), OpenSea’s transaction quantity was larger than that of Blur in solely two weeks, and it lagged behind in the remainder of the time.

NFT ecosystem “massive reversal”? OpenSea has given up

Within the early hours of February 18, OpenSea introduced the launch of a time-limited 0-fee transaction, offered an non-compulsory copyright service with a minimal customary of 0.5% and relevant to all NFT sequence that don’t implement royalties on the chain, and in addition up to date the operator filter This permits NFT markets with the identical coverage to work collectively to extend market liquidity.

We’re making some massive adjustments right now:

1) OpenSea payment → 0% for a restricted time

2) Transferring to non-compulsory creator earnings (0.5% min) for all collections with out on-chain enforcement (previous & new)

3) Marketplaces with the identical insurance policies won’t be blocked by the operator filter— OpenSea (@opensea) February 17, 2023

Lastly, OpenSea bowed its head and gave in.

The NFT market defined the rationale for this choice, purportedly due to “dramatic adjustments within the NFT ecosystem,” of their phrases:

“In October, we began to see significant quantity and customers transfer to NFT marketplaces that don’t totally implement creator earnings.

At present, that shift has accelerated dramatically regardless of our greatest efforts.

We’ve labored to defend creator earnings on ALL collections when others didn’t. And after we launched the Operator Filter, it was our perception that on-chain enforcement was one of the best ways for creators to safe their income stream from the continued resale of their work.

We thought we might catalyze widespread enforcement of creator earnings, and we hoped others would possibly provide you with extra resilient options – this hasn’t occurred.”

The fast growth of Blur has exacerbated OpenSea’s considerations. In keeping with Dune Analytics information, the transaction quantity of its platform has exceeded 1 million ETH, reaching 1,028,378 ETH, which is about $1.75 billion in accordance with the present value, and the entire gross sales quantity has additionally exceeded 200 million ETH. 10,000, at the moment reaching 2,027,752. As well as, the variety of unbiased consumers on the Blur platform is 109,655.

Did Blur win massive?

Frankly, it’s too early to say Blur has received the turf battle with OpenSea.

Blur’s latest surge in transaction quantity is basically associated to its airdrop of BLUR tokens, and it’s unsure whether or not it may keep longer-term natural progress. It ought to be famous that the variety of customers of OpenSea is nearly twice that of Blur (as proven within the determine beneath), which implies that they nonetheless have a powerful consumer base, and extra importantly, OpenSea has not launched its personal governance token or platform to date as soon as it tries Blur’s forex issuance technique, it’s sure to have an effect on all the NFT market construction.

Galaxy researchers identified that NFT merchants ought to pay shut consideration to the continued “battle” between OpenSea and Blur. In actual fact, most of Blur’s prime merchants have carried out wash gross sales with a view to get hold of airdrop tokens, which exhibits that the connection with OpenSea In distinction, the transaction quantity on Blur’s platform will not be natural.

Then again, maybe with a view to go away extra retreats for itself, Blur’s counterattack technique is definitely not too radical as a result of its up to date royalty coverage additionally offers the choice to not block OpenSea and block Blur if the creator doesn’t set blocking.

Blur will cost a 0.5% royalty (sellers may also select a better royalty), whereas OpenSea is an non-compulsory royalty; if blocking Blur or different NFT tasks within the zero-royalty/royalty non-compulsory market will probably be enforced on OpenSea royalty, transactions, and listings can nonetheless be carried out on Blur, topic to a minimal 0.5% royalty.

The Galaxy analyst added:

“Clearly, Blur is utilizing their affect to power OpenSea to work with them slightly than present hostility to them, time will inform if Blur’s technique will work, however each by way of metrics and merchandise By way of each, they’re by far probably the most profitable OpenSea rivals.”

Moreover, Galaxy researchers additionally said in a brand new report on Friday:

“With regard to Blur, there are two key points to concentrate on. Before everything is how a lot market share Blur can retain as their BLUR token has Liquidity. Second is buying and selling quantity, Blur buying and selling quantity will not be anticipated to see a critical decline within the quick time period as a result of their token incentive plan will proceed for at the very least one other 30 days within the second quarter, however it’s price seeing whether or not this mannequin can work in the long term.”

Briefly, because the turf battle between two NFT marketplaces continues to warmth up, the competitors within the NFT market will solely intensify. Maybe after this battle is over, we will discover a growth path that’s best suited for NFT creators and merchants.

DISCLAIMER: The Info on this web site is offered as normal market commentary and doesn’t represent funding recommendation. We encourage you to do your personal analysis earlier than investing.