- BTC receives the highlight after the reveal of the Ordinal NFTs.

- The derivatives market sends combined indicators as volatility slows.

We not too long ago checked out how a JPEG NFT constituted the most important block on the Bitcoin blockchain community. Now it has emerged that roughly 13,000 Ordinal NFTs have been launched on the Bitcoin community.

Learn Bitcoin’s worth prediction 2023-2024

The Ordinal NFTs have acquired combined reactions within the crypto group. Some really feel that this exploration of the Bitcoin community is a step in the precise course which will supply extra alternatives sooner or later.

Others declare that the transfer goes past what Bitcoin stands for. Nonetheless, the ground worth for these NFTs has been rising.

Ordinal Punks are popping off on Bitcoin. 📈

The ground worth has risen to 2.2 BTC ($50K) with a brand new ATH sale of 9.5 BTC ($215K) at this time. pic.twitter.com/mHZ1MUqGnz

— nft now (@nftnow) February 9, 2023

The potential influence of getting NFTs on the community is probably the largest concern. Will it decelerate the community or make it extra congested? The Ethereum community has skilled such challenges prior to now which have impacted the worth of ETH.

Typically, community congestion is translated as excessive demand and this will likely ship a constructive suggestions search for the native cryptocurrency. Is such a situation believable for Bitcoin? Let’s have a look at what we all know to this point. Bitcoin’s imply transaction dimension is at the moment at a 4-year excessive.

📈 #Bitcoin $BTC Imply Transaction Dimension (7d MA) simply reached a 4-year excessive of 894.524

Earlier 4-year excessive of 892.529 was noticed on 04 June 2021

View metric:https://t.co/PJ0bkLTuVs pic.twitter.com/rqgW5TOuZe

— glassnode alerts (@glassnodealerts) February 9, 2023

The state of the Bitcoin derivatives market

Bitcoin’s derivatives market has been a wholesome indicator of the state of the market prior to now. It would supply insights into BTC’s present place.

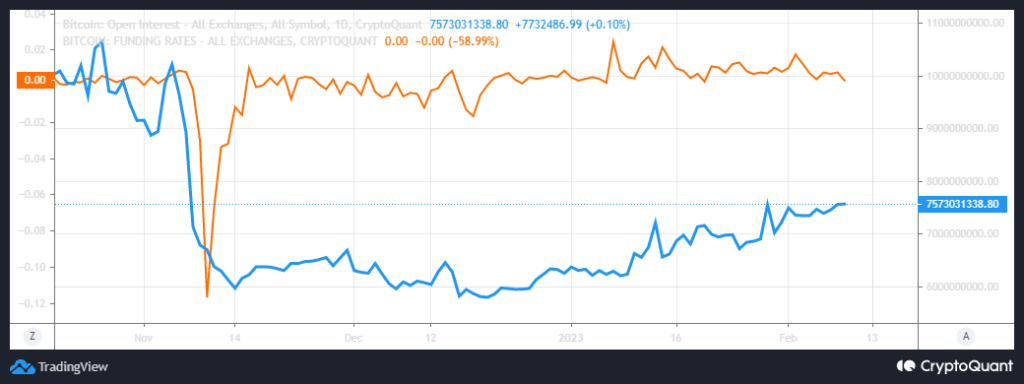

BTC’s open curiosity managed to take care of an upward trajectory, confirming that there’s nonetheless some stage of demand for BTC within the derivatives market.

Supply: CryptoQuant

Bitcoin’s funding charges have dropped regardless of the upper open curiosity. It is a reflection of the market’s indecisiveness, particularly with the declining volatility.

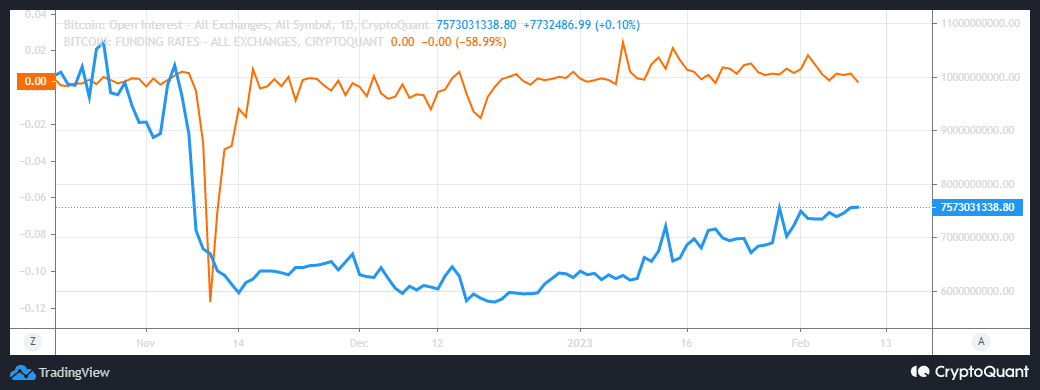

In the meantime, market indicators reveal that the extent of demand for leverage is regularly rising. That is possible as a result of decrease volatility has compelled traders to search for different technique of boosting their potential features.

Supply: CryptoQuant

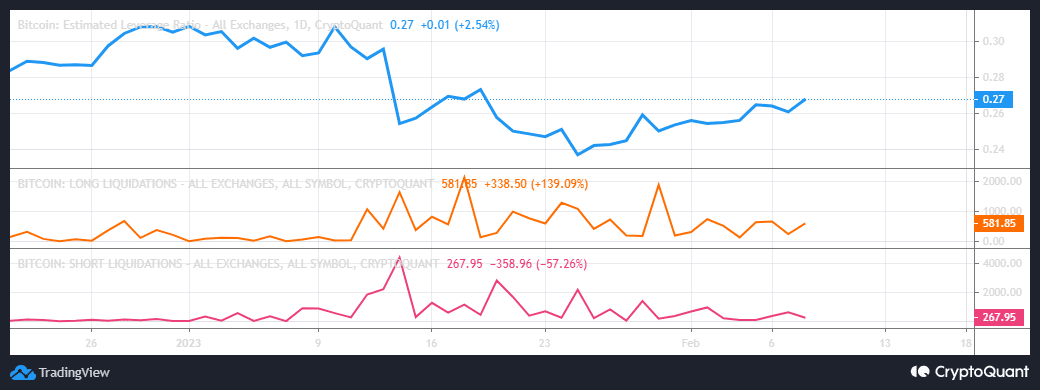

Liquidations have been nonetheless comparatively low at press time, however there was a notable enhance in lengthy liquidations within the final 24 hours. Quick liquidations decreased throughout the identical time because the bears gained extra dominance.

What number of are 1,10,100 BTCs price at this time?

The cryptocurrency has been caught inside a slim vary ($22,400 and $22,200). The market has skilled some draw back in the previous couple of days regardless of bullish indicators similar to a golden cross and decrease relative power.

Supply: TradingView

The present projection is that an extra bearish final result could ship BTC as little as $22,500 which is throughout the closest help vary. However, one other rally could yield a retest of the $24,000 resistance vary.