Uniswap, among the many high decentralized exchanges (DEX) launched the draft code for its newest model, Uniswap V4. The code has been launched because the builders want V4 to be in-built public. Launched in 2018, Uniswap is without doubt one of the most identified DEX for buying and selling Ethereum and eth-based tokens.

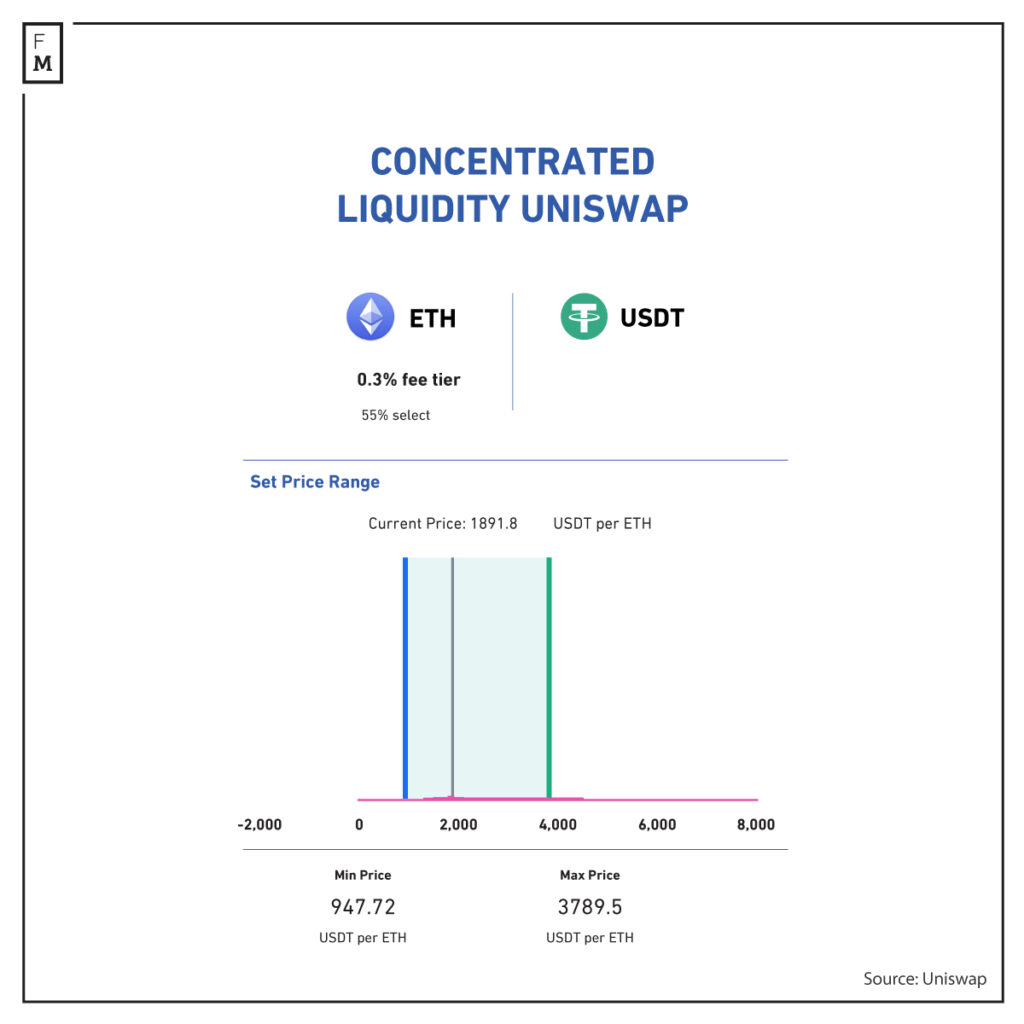

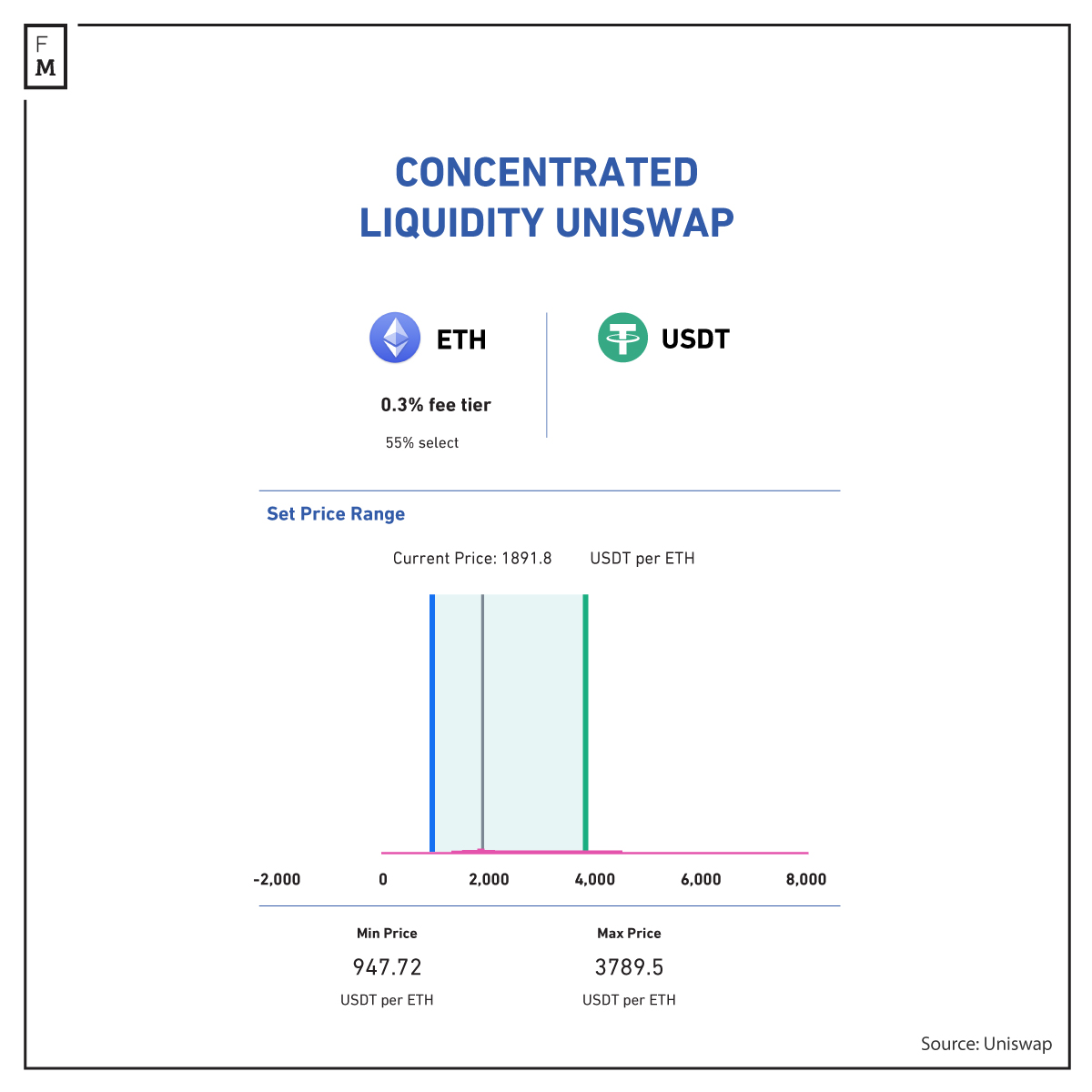

In V2 which was launched in 2020, Uniswap launched ERC-20 buying and selling pairs and Flash Swaps. In V3, concentrated liquidity was added to the protocol. Concentrated liquidity permits allocating liquidity to a value interval. This mannequin improved the usual AMM mannequin.

Liquidity suppliers (LPs) can execute as many positions as they want within the pool. LPs have higher management over what value ranges their funds will probably be used. The Uniswap V3 Enterprise Supply License (BSL) expired in April 2023.

Different DEX, reminiscent of SushiSwap, introduced it’s including Concentrated Liquidity to 13 completely different chains. Arbitrum, Fuse, Polygon, and Gnosis are a number of the blockchains that Concentrated Liquidity will probably be enabled for. The newest model has a brand new BSL license, which limits its use in business or manufacturing settings for as much as 4 years.

What Is New in Uniswap V4?

The spotlight of the brand new code is ‘Hooks.’ To simplify, Hooks are sensible contracts which are executed at sure occasions in a pool. For instance, hooks can be utilized when liquidity is added or faraway from the pool. This permits pool creators to have higher management over how their pool behaves in sure circumstances.

Hooks can be utilized for on-chain restrict orders and a time-weighted common market maker (TWAMM) pool. TWAMM allows merchants to execute giant trades (over $30M for instance) with minimal fuel charges and impression on the value.

The big order is damaged down into a number of orders (an infinite variety of small orders) utilizing AMM for a predetermined interval (days, weeks, and many others.). The identical applies to purchasing giant quantities. The TWAMM algorithm will cut up the quantity into a number of orders that will probably be unfold throughout predefined parameters (hours, days, and many others.).

TWAMM eliminates the necessity to use CEX or a buying and selling desk for such transactions. Different options embody personalized on-chain oracles and internalized MEV revenue, that are distributed throughout LP. Uniswap launched a number of samples on github.

The Singleton Contract

One other main improve from V3 is the usage of a ‘singleton’ contract. Versus V3 the place every pool has its personal sensible contract, in V4 all swimming pools reside inside a single contract. Merchants will profit from decrease charges on token swaps as routing is dramatically enhanced. Flash accounting may also be enabled. Modifications within the pool will probably be calculated primarily based on web balances somewhat than on the finish of the swap, which is able to scale back some fuel.

Did Uniswap Copy Shell Protocol’s Code?

There have been allegations that Uniswap copied a number of the code from the Shell Protocol.

Uniswap even copied the variable title for this transient ledger, “BalanceDelta.sol”. The file names in github are verbatim the identical. pic.twitter.com/7f2NNOg5Ne

— Kenny White 🐚 (@white_kenny_) June 14, 2023

The Shell Protocol has an MIT license, and a permissive free software program license. The allegations are that Uniswap used elements of the Shell Protocol for V4, which have been then licensed (BSL). Whereas permissive software program licenses are prone to stay well-liked, extra initiatives could select to guard their code higher. V4 will seemingly be deployed in a number of months and solely as soon as an settlement is made on the ultimate model.