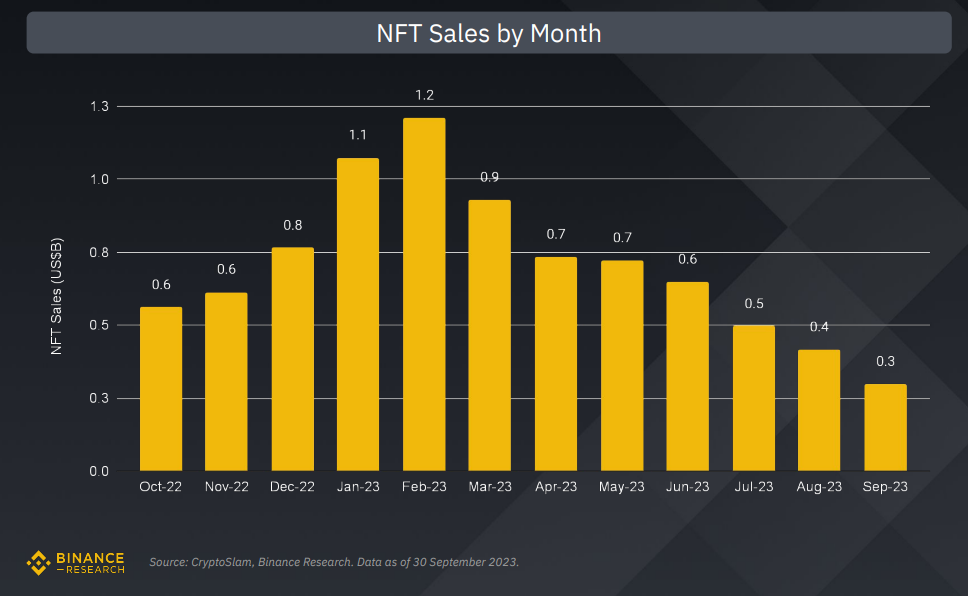

The third quarter of 2023 has been difficult for the non-fungible tokens (NFTs) market, with gross sales hitting their lowest level because the final quarter of 2020. September alone recorded a dismal gross sales determine of round $300 million. This downturn is primarily attributed to a major drop in common gross sales costs and ground costs of fashionable collections.

The NFT market has been on a downward trajectory, notably in September, which noticed the worst gross sales figures since January 2021. The common gross sales value in September plummeted to $38.17, a stark distinction to its peak of $791.84 in August 2021. Collections like Azuki, BAYC, and MAYC have seen their ground costs decline by greater than 25% quarter-over-quarter.

The most recent Binance Analysis quarterly report reveals whereas the NFT market is struggling, Ethereum and Immutable X have managed to realize market share. Ethereum’s share elevated by 6% in Q3, partly because of decrease fuel charges and a lower in ETH costs. Immutable X, a Layer 2 resolution constructed on high of Ethereum, additionally noticed its market share rise from 4% to eight%. The platform hosts fashionable blockchain video games like Gods Unchained, which led in gross sales rely for the quarter.

Our newest State of Crypto Report summarises all the important thing insights, occasions, and learnings from Q3.

Discover all the pieces you have to find out about developments within the house, together with evaluation of:

🔸 Layer 1s & 2s

🔸 DeFi

🔸 NFTs

🔸 GamingBegin studying right here ⤵️https://t.co/ES5z6g8FMU

— Binance Analysis (@BinanceResearch) October 19, 2023

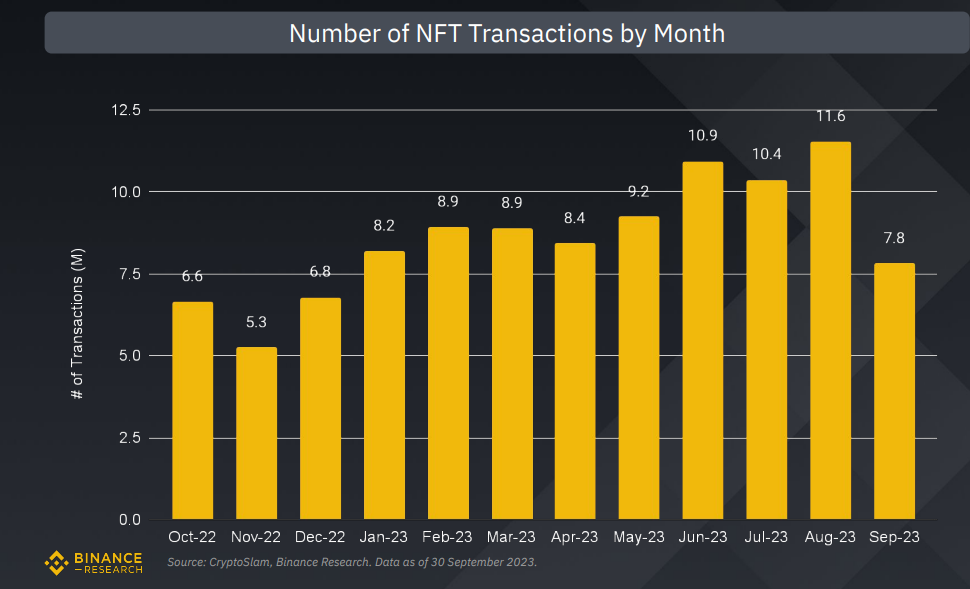

Regardless of the gloomy gross sales figures, the variety of NFT transactions in Q3 elevated by 4.6% in comparison with the earlier quarter. Gaming NFTs like Gods Unchained, Axie Infinity, NBA Prime Shot, NFL All Day, and Legendary Beings dominated when it comes to transaction rely.

Much less Patrons, Decrease Costs

The common variety of every day distinctive consumers dropped by 14.1% to round 53,000, signaling a decline in total market curiosity. What’s extra, the NFT-500 value index, a measure of NFT efficiency, additionally took successful, declining by 31% in Q3. Numerous NFT collections throughout sectors skilled a fall in costs, contributing to the index’s poor efficiency.

Whereas Blur stays the biggest market by gross sales quantity, it has misplaced floor to rivals like Opensea, which led when it comes to lively wallets. New entrants like Component have additionally risen within the ranks, because of their integration with a number of networks like Base, Linea, opBNB, Bitcoin, and zkSync. This implies that merchants on Blur are dealing in increased volumes, aligning with its positioning as a platform for skilled merchants.

NFT Artwork Market Takes a Hit

The NFT market has been in a hunch, notably within the artwork section, which has seen a steady decline in each the variety of gross sales and complete gross sales worth. This downturn just isn’t current; it has been ongoing because the 2022 crypto crash. Whereas the market did present some indicators of restoration, the general development stays destructive.

Separate information from Statista and NonFungible confirms Binance Analysis numbers and reveals that NFT artwork gross sales aggregated worth throughout Ethereum, Ronin, and Circulate blockchains was a mere $22.3 million in September 2022. This was a staggering 40 instances lower than the gross sales recorded in the identical month the earlier yr. By the tip of 2022, the month-to-month gross sales worth had additional dwindled to $17.1 million.

The information clearly signifies that the NFT artwork market is going through a protracted downturn, with little signal of quick restoration. This decline isn’t just a blip however seems to be a extra enduring development, elevating questions concerning the future sustainability of the NFT artwork market.

Furthermore, crypto and NFT thefts have surged, leading to investor losses exceeding an astonishing $26 billion. Each hour, criminals are raking in $289,000.