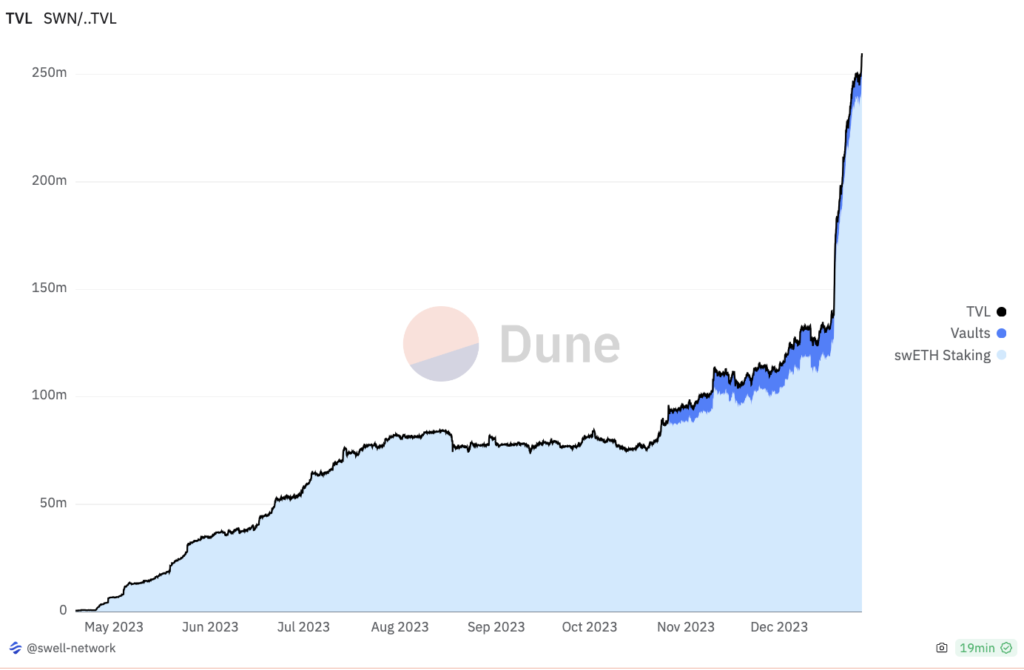

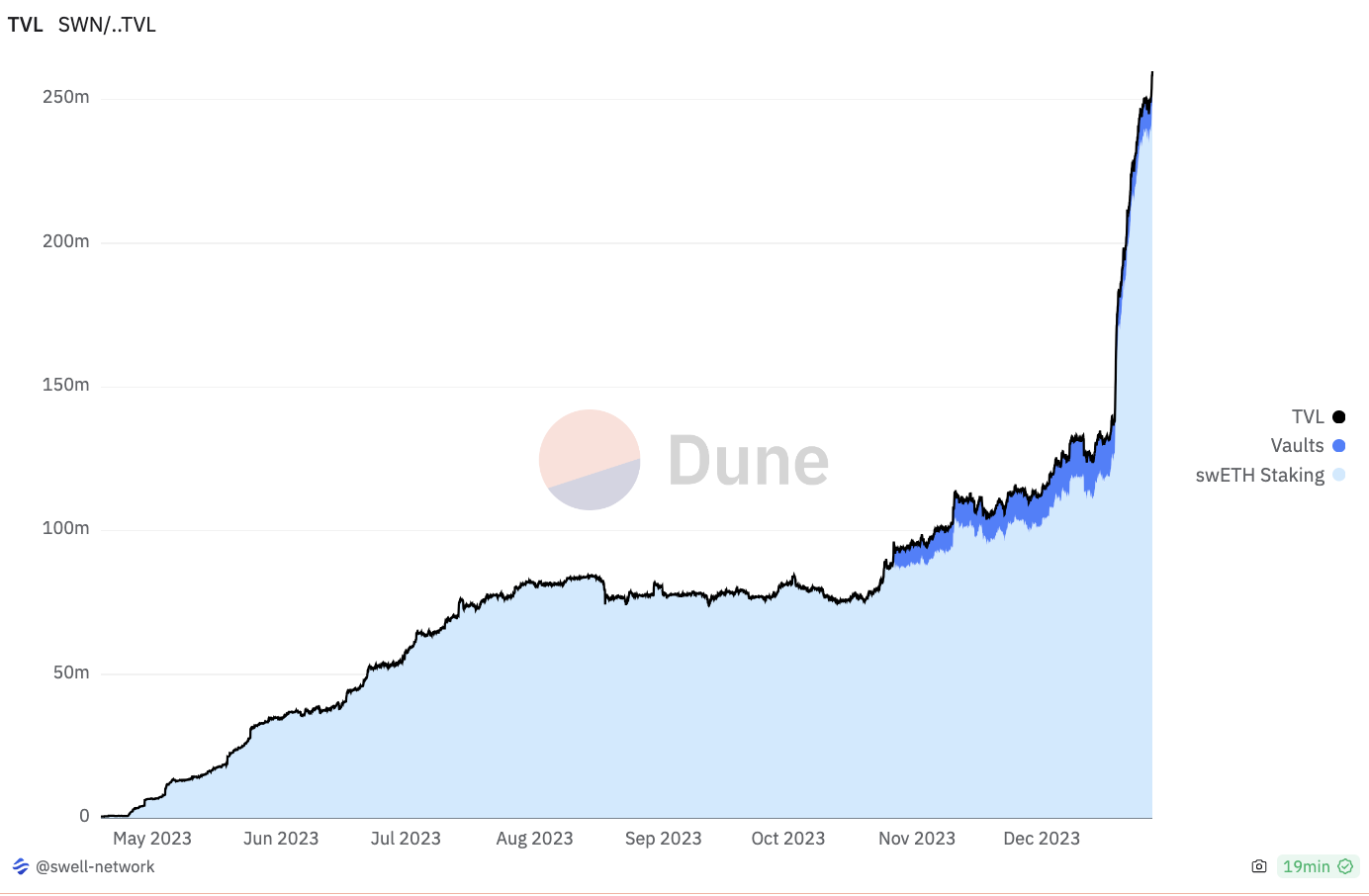

Liquid staking protocol Swell has seen its complete worth locked double this month to 108,000 ether value about $245 million.

Because the begin of December, Swell has recorded almost $125 million in ETH deposits, elevating it to the fourth-largest liquid staking protocol. It presently ranks behind main protocols resembling Lido with 9 million ETH, Rocket Pool with 846,000 ETH, and Frax with 236,000 ETH, based on Dune information aggregated by Dragonfly analyst Hildobby.

The surge in Swell inflows coincides with its crew saying “Pearl” rewards within the type of factors for customers who mint its liquid staking token, swETH, and likewise “restake” it on the EigenLayer platform.

Since mid-December, when the reward program started, there was notable exercise, with customers minting over 53,000 swETH value greater than $120 million. Most of this was subsequently deposited on EigenLayer.

EigenLayer permits customers to deposit and re-stake ether from a wide range of liquid staking tokens to safe third-party networks. It expanded its supported belongings to incorporate six extra liquid staking tokens together with Swell’s swETH, Stakewise’s sETH, Stader’s xETH, Origin’s oETH, Ankr’s ankrETH, and Wrapped Beacon Ether (wBETH). Amongst these new additions, Swell has emerged as one of many largest beneficiaries when it comes to asset inflows.

Swell’s complete worth locked | Supply: Swell (by way of Dune)

Centralization considerations

Regardless of ongoing considerations about centralization, Swell’s TVL surge exhibits that liquid staking continues to be a rising area of interest inside the Ethereum ecosystem. Its reputation is essentially attributed to simplifying the complexity related to staking, significantly when it comes to working validator nodes and permitting customers to take care of management over their capital.

Swell customers who stake their ETH obtain a yield-bearing liquid staking token in return. The token not solely holds worth but additionally supplies flexibility, as it may be retained or utilized inside the broader DeFi ecosystem to generate extra yields.