The monetary expertise (fintech) business has its roots within the late twentieth century, with the appearance of digital banking and on-line inventory buying and selling. Since then, fintech has expanded and adjusted over time on account of technological and web advances. In consequence, new monetary providers and merchandise have been created with the intention of enhancing accessibility, simplicity and effectiveness within the monetary providers business.

The 2008 international monetary disaster aided the expansion of fintech by rising buyer demand for non-traditional banking and monetary providers. By enabling prospects to entry monetary providers from any location at any time, the rise of cellular units and the widespread utilization of smartphones have additionally fueled the expansion of the fintech business. Immediately, fintech continues to form the monetary business and is driving innovation in areas equivalent to funds, lending, investing and insurance coverage.

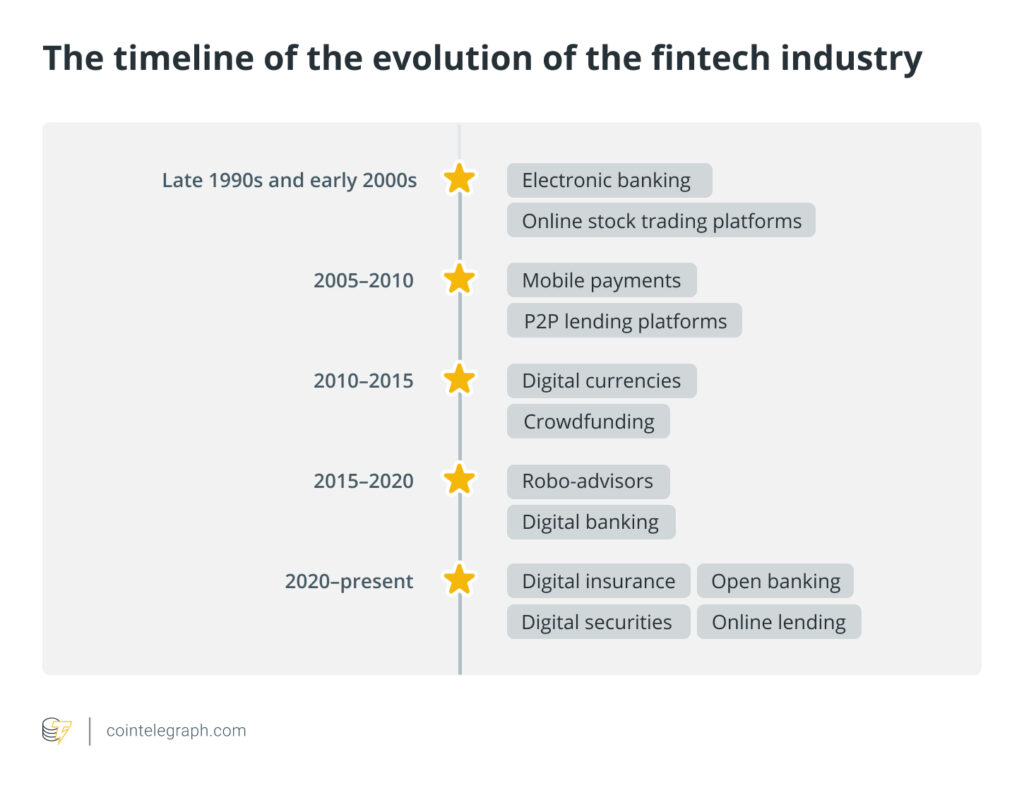

The evolution of the fintech business

The fintech business as we all know it as we speak didn’t exist earlier than the late Nineties and early 2000s. Nonetheless, fintech’s origins will be traced again to the appearance of pc programs and the expansion of digital banking within the monetary providers business within the Nineteen Seventies and Eighties. These early improvements set the stage for fintech’s enlargement and improvement within the latter half of the twentieth century and past.

The evolution of the fintech business has been speedy and dynamic, with important modifications going down 12 months after 12 months.

Late Nineties and early 2000s

Early adopters of the fintech sector supplied elementary monetary providers equivalent to on-line inventory buying and selling and digital banking when the sector was nonetheless in its infancy. The next are some cases of fintech merchandise and companies that appeared within the late Nineties and early 2000s:

- On-line inventory buying and selling platforms: Clients had been in a position to commerce shares on-line for the primary time because of companies like E-Commerce and Charles Schwab, dramatically enhancing accessibility and comfort within the inventory market.

- Digital banking: Wells Fargo and Citibank, amongst different monetary establishments, supplied on-line banking providers that allow purchasers monitor their accounts and conduct monetary transactions.

Moreover, fee processors, equivalent to PayPal, emerged as early gamers within the funds area, offering customers with a handy and safe strategy to ship and obtain cash on-line.

2005–2010

New services had been created in industries, together with funds, loans and insurance coverage on account of the expansion of latest fintech companies. The enlargement of fintech was additionally fueled by the rising use of smartphones throughout this era. Two examples of fintech merchandise or companies that appeared between 2005 and 2010 are:

- P2P lending platforms: Lending Membership, one of many earliest peer-to-peer (P2P) lending platforms, was established in 2006 and connects traders and debtors with out the necessity for conventional establishments.

- Cellular funds: In 2009, Sq., an organization specializing in funds on the go, created a system that permits small firms to simply accept bank cards by way of a cellular machine. This was a major development within the funds business that aided within the improvement of cellular funds.

2010–2015

Following the monetary disaster of 2008, the emergence of different finance gave fintech companies new prospects in sectors equivalent to crowdfunding and peer-to-peer lending. Blockchain expertise’s emergence has additionally began to point out promise as a possible disruptor within the monetary providers business.

The fintech merchandise or firms that emerged throughout 2010–2015 are:

- Crowdfunding: Kickstarter, based in 2009, turned one of many first crowdfunding platforms, permitting entrepreneurs and creators to boost funds for his or her initiatives from numerous supporters.

- Digital currencies: Bitcoin (BTC), created in 2008, was the primary decentralized digital foreign money and marked the start of the rise of cryptocurrencies. Bitcoin and different digital currencies supplied a brand new approach for customers to retailer and switch worth, disrupting conventional finance.

2015–2020

Fintech services have been extensively adopted, resulting in additional consolidation within the sector because it continues to develop and flourish. To introduce new monetary providers to the market, conventional monetary establishments began to enter the market and collaborate with fintech companies. The emergence of digital property like cryptocurrency gave the market a recent perspective.

Two examples of fintech merchandise or firms that emerged throughout 2015–2020 are:

- Robo-advisers: Betterment and Wealthfront, based in 2008 and 2011, respectively, turned two of the main robo-advisers, utilizing algorithms and automation to offer customized funding recommendation and handle portfolios for particular person traders.

- Digital banking: Challenger banks equivalent to Monzo, N26 and Revolut, based in 2015, 2015 and 2013, respectively, supplied digital-only banking providers, offering customers with various banking choices and a extra fashionable and handy banking expertise.

2020–current

Because of the COVID-19 epidemic, many shoppers at the moment are utilizing digital monetary providers for the primary time, which has accelerated the enlargement of fintech. New applied sciences like synthetic intelligence (AI) and machine studying are getting used to boost monetary providers because the sector continues to develop and innovate. The regulatory panorama is likewise evolving to replicate the event and maturity of the fintech sector.

Some examples of fintech merchandise or firms which have emerged after 2020 embrace:

- Digital insurance coverage: Lemonade, based in 2015, turned one of many main “insurtech” firms providing a digital platform for buying house and renters insurance coverage.

- Digital securities: Firms equivalent to Coinbase, Bakkt and Paxos, based in 2012, 2018 and 2012, respectively, have emerged as leaders within the digital securities area, offering platforms for purchasing, promoting and holding digital property, equivalent to cryptocurrencies and safety tokens.

Associated: Binance vs. Coinbase: How do they examine?

- Open banking: Firms like Plaid, based in 2013, and Yapily, based in 2016, have emerged as leaders within the open banking area, offering APIs and infrastructure for safe entry to monetary knowledge and enabling innovation within the fintech business.

- On-line lending: Affirm, based in 2012, and Afterpay, based in 2014, present customers with a variety of credit score choices for on-line purchases.

The way forward for the fintech business

The way forward for fintech is predicted to proceed its speedy progress as expertise continues to form and revolutionize the monetary business. Monetary providers will turn out to be extra accessible, safe and modern because of improvements like blockchain, AI and open banking.

As well as, there will likely be a pattern towards digitization as increasingly more prospects select cellular and on-line banking choices. It may be anticipated that conventional monetary establishments and fintech companies will more and more combine, which can end result within the improvement of latest monetary providers and merchandise.