DeFi

A central restrict order guide (CLOB) is a digital platform or system that facilitates buying and selling monetary devices comparable to shares, bonds, commodities or cryptocurrencies. It’s a vital part of contemporary digital buying and selling and is utilized by monetary exchanges, marketplaces, and buying and selling venues to match purchase and promote orders from varied market contributors.

A CLOB is a database that organizes and manages incoming purchase and promote orders, aggregating orders from totally different market contributors. These orders are time-sequenced, creating an order guide reflecting the market’s present provide and demand dynamics.

The CLOB operates based mostly on a steady buying and selling mannequin, the place orders may be submitted and matched in real-time as new orders are obtained. The CLOB sometimes helps a number of order sorts, together with restrict orders, market orders, cease orders and extra, permitting merchants to specify their desired value, amount and time of execution.

When an order is submitted to the CLOB, it’s saved within the order guide in line with its value degree and time of submission. A commerce happens if the order matches one other present one, and the transaction particulars are recorded. The CLOB ensures that the perfect obtainable costs are exhibited to market contributors, because it aggregates and kinds orders based mostly on value and time of submission.

One key characteristic of a CLOB is that it gives transparency to the market. It permits merchants to see the market’s present provide and demand ranges, together with the amount and costs of purchase and promote orders at totally different value ranges. This transparency permits market contributors to make knowledgeable buying and selling selections and assess the liquidity of a selected instrument.

One other essential side of a CLOB is its means to deal with giant buying and selling volumes effectively. Fashionable digital markets typically expertise excessive ranges of buying and selling exercise, with quite a few orders being submitted, modified or canceled in real-time. The CLOB is designed to deal with excessive order volumes and execute trades rapidly and precisely.

Centralized CLOB vs. Decentralized CLOB

Centralized CLOBs (cCLOB) and decentralized CLOBs (dCLOBs) are two totally different approaches to facilitating buying and selling within the monetary markets. Centralized CLOBs are broadly utilized in conventional monetary markets.

In a cCLOB, an alternate acts as a central occasion that receives and matches orders from market contributors. The alternate maintains an order guide, which information all of the purchase and promote orders, and executes trades in line with predefined guidelines. The alternate additionally sometimes holds custody of the property being traded and settles trades on behalf of the contributors.

Alternatively, in a dCLOB, the order guide is decentralized and maintained on a blockchain. In consequence, no central occasion matches orders or settles trades. As an alternative, contributors work together immediately with the blockchain and submit their orders to the decentralized order guide. Trades are executed by sensible contracts based mostly on predefined guidelines. Members retain custody of their property, with settlements accomplished routinely on the blockchain.

Current: Neglect Cambridge Analytica — Right here’s how AI might threaten elections

DCLOBs are a comparatively new idea that emerged with the arrival of decentralized finance (DeFi) platforms, the place blockchain know-how permits peer-to-peer buying and selling with out intermediaries.

Dexalot, for instance, is a decentralized alternate (DEX) based mostly on Avalanche that employs a dCLOB. The platform features a discovery software that makes use of the dCLOB to generate an public sale for a sure period of time — normally 24 hours — wherein matching is disabled, and all contributors submit bids and gives.

This lets contributors observe provide and demand, and accurately place themselves to manage danger deterministically utilizing restrict orders.

Dexalot, like cCLOBs, works by protecting a listing of purchase and promote orders for a selected asset and routinely matching orders to execute transactions. Nonetheless, it runs on a decentralized community, the place transactions are dealt with and ruled by community members as an alternative of centralized exchanges.

What this implies for customers

Some within the trade imagine that decentralization is helpful to merchants. Pei Chen, vp of development for sensible contract platform Rootstock, instructed Cointelegraph:

“CLOB DEXs have the potential of shaping the way forward for crypto exchanges. They contribute to the decentralization and scalability of DeFi by permitting customers to commerce property in a peer-to-peer surroundings with out counting on a government and by offering extra transparency and autonomy over consumer funds.”

Chen continued, “Given the extreme rules that centralized exchanges are confronted in the present day, CLOB DEXs or decentralized CLOBs have a novel alternative to get forward by offering a trustless and permissionless surroundings. That stated, an absence of regulatory necessities may additionally introduce obstacles to adoption. It’s nonetheless too early for us to attract significant conclusions.”

Regardless of his enterprise’ decentralized mannequin, Tim Shan, chief working officer of Dexalot, instructed Cointelegraph that centralized CLOBs “have a big benefit over decentralized CLOBs” as a result of they aren’t “certain to the constraints of blockchains.”

Nonetheless, he added that “customers should custody their property with the CEXs [centralized exchanges], enable the CEXs to make use of their property for the alternate’s personal profit, face the danger of front-running, and concentrate on the potential for fraud.”

One other key issue between centralized and decentralized CLOBs is the extent of management and transparency. In a cCLOB, the alternate controls the order guide and might set guidelines for order matching, pricing and execution.

The alternate may additionally manipulate the order guide or prioritize sure orders over others. Nonetheless, this additionally introduces opacity and reliance on belief within the alternate to behave pretty and transparently.

Alternatively, in a dCLOB, the order guide is clear and open for anybody to entry and confirm. Moreover, the principles for order matching, pricing and execution are encoded in sensible contracts, executed autonomously with out human intervention. This eliminates the necessity to belief a central occasion, offering extra transparency and management to contributors.

One of many foremost benefits of cCLOBs is their means to assist giant commerce sizes with tight pricing. As well as, centralized exchanges typically have deep liquidity swimming pools, which might present higher pricing and sooner execution for big trades.

CCLOBs additionally supply extra subtle order sorts, comparable to restrict orders, which permit contributors to specify a selected value for his or her trades with out slippage. These options make cCLOBs engaging to institutional merchants and market makers.

Know-how may additionally be a bonus for CLOB DEXs specifically, in line with Shan, who stated, “Blockchain know-how has superior lately with improvements comparable to Avalanche subnets and customized digital machines, which permit for much higher velocity and throughput and decrease gasoline charges. We’re seeing absolutely decentralized CLOB DEXs emerge that can considerably enhance the DeFi house.”

Alternatively, dCLOBs could face challenges in supporting giant commerce sizes with tight pricing attributable to their decentralized nature. The liquidity in dCLOBs is often supplied by particular person contributors, who could have restricted sources and can’t assist giant commerce volumes.

In consequence, slippage and value influence could also be increased in dCLOBs than cCLOBs, particularly for big trades. DCLOBs may additionally have restricted order sorts and functionalities in contrast with cCLOBs, which might restrict the buying and selling methods that contributors can implement.

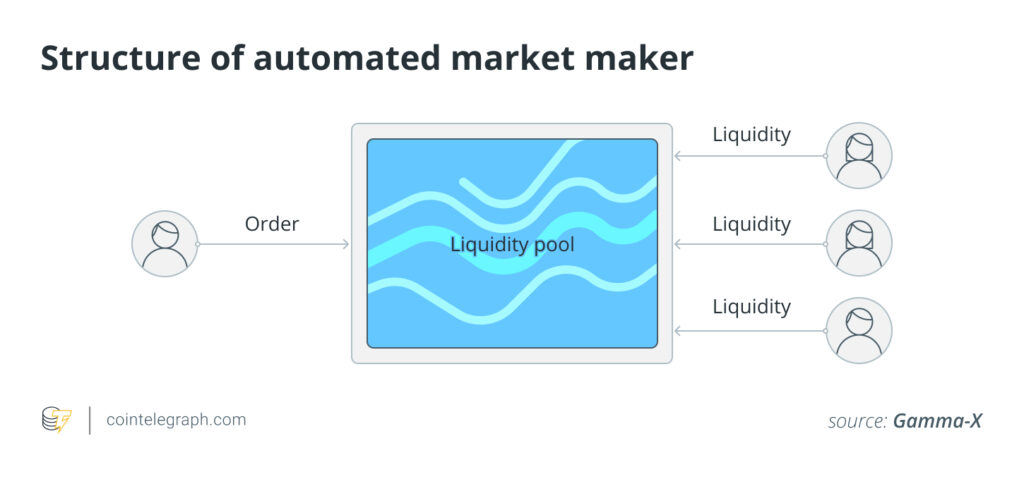

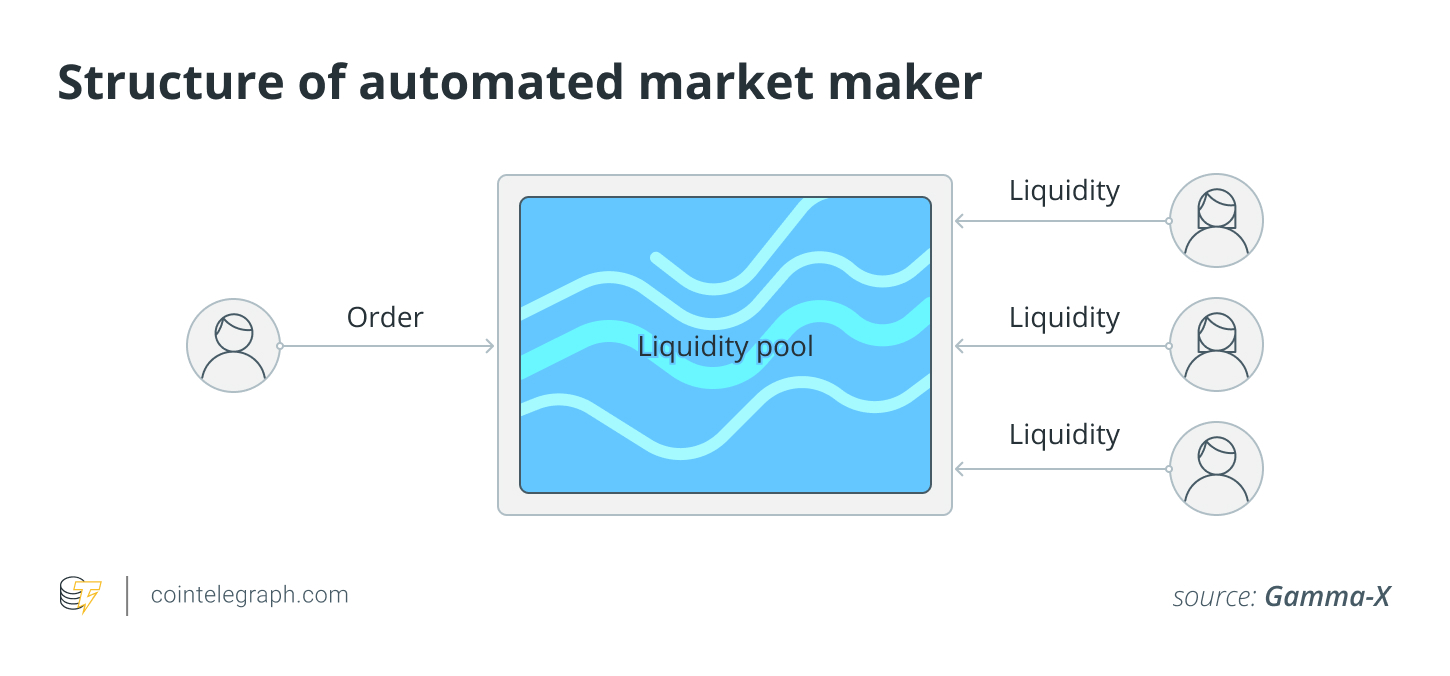

AMM vs. CLOB

Automated Market Makers (AMMs) have been initially created to handle protocol-level points comparable to velocity, finality, throughput and computational burdens in blockchain transactions. They revolutionized the consumer expertise of buying and selling by introducing a easy single-click transaction course of, successfully sweeping an order guide. AMMs use a system that constantly defines the worth based mostly on the ratio of two property. The worth modifications solely when a participant executes a commerce and modifications the asset quantities within the pool.

AMMs led to vital enhancements from the sooner days of blockchains when transactions have been costly, and putting and canceling orders consumed extreme bandwidth and computational sources.

Nonetheless, there have been trade-offs related to AMMs. One problem was creating liquidity, as retail traders supplied liquidity by locking up property in AMM swimming pools for a share of the buying and selling charges. Nonetheless, this idea, referred to as liquidity farming, had a downside referred to as impermanent loss, the place the worth misplaced by the liquidity supplier occurred when the costs of the property within the pool diverged. In different phrases, the charges collected have been typically inadequate to cowl the chance misplaced attributable to arbitrage trades.

One other complication of AMMs, particularly those who use fixed product formulation, is the problem in creating liquidity that may assist giant trades with tight pricing. Supporting liquidity in AMMs sometimes requires a considerable amount of capital for medium-sized trades; because the commerce dimension will increase, the slippage incurred additionally will increase considerably.

As compared, CLOBs are extra capital environment friendly and supply extra instruments for buying and selling, comparable to restrict orders with no slippage, orders with modifiers like time-in-force, and direct visibility into obtainable depth, which helps merchants handle their exercise in a extra granular, deterministic method and higher estimate dangers.

CLOBs additionally present higher preliminary and continued value discovery options than AMMs. Alternatively, direct AMM listings and liquidity bootstrapping pool (LBP) model listings — frequent strategies for bringing new property to the market in DeFi — have vital drawbacks.

Journal: Cryptocurrency buying and selling habit: What to look out for and the way it’s handled

Direct AMM listings typically lead to vital value spikes adopted by sharp drops attributable to market manipulation by operators who understand how blockchains work. Alternatively, LBPs, which block sellers and solely enable consumers to take part within the value discovery course of for some time, create an imbalanced market the place the customer demand is depleted, leading to inflated costs and eventual value drops.

In distinction, CLOBs enable each bids and gives to be current within the order books, making them extra appropriate for preliminary and continued value discovery. They can be tailored for preliminary value discovery by public sale mode so as books, much like conventional monetary markets.