- ETH promote stress drops to a month-to-month low because the market loses volatility.

- An absence of bullish momentum confirms that the bears are nonetheless ready on the sidelines.

Ethereum’s native foreign money ETH has been comparatively dormant for nearly two weeks throughout which it delivered some sideways exercise. This efficiency might not final for lengthy as ETH could be about to regain volatility in keeping with this new information.

Learn Ethereum’s [ETH] worth prediction 2023-24

The most recent information from Glassnode revealed that ETH bears had been shedding grip over the market. This may increasingly create a possibility for the bulls to dominate. However are the bulls able to take over?

First, let’s check out a few of the newest market observations that will provide insights into the market’s subsequent route. The most recent Glassnode information revealed that the quantity of ETH flowing into exchanges was at its lowest degree within the final 4 weeks. This may be translated as a drop in promote stress.

📉 #Ethereum $ETH Alternate Influx Quantity (7d MA) simply reached a 1-month low of $11,224,406.65

Earlier 1-month low of $11,740,219.01 was noticed on 19 Might 2023

View metric:https://t.co/1UqsIRQu7N pic.twitter.com/ISV7jbC5ih

— glassnode alerts (@glassnodealerts) May 22, 2023

As well as, Glassnode information additionally confirmed that extra ETH holders had been staking their cash. Consequently, the entire worth locked in ETH 2.0 deposit contracts has been on the rise and it just lately soared to a brand new ATH. In different phrases, extra ETH holders had been considerably assured in locking up their ETH, which signified a long-term focus.

📈 #Ethereum $ETH Complete Worth within the ETH 2.0 Deposit Contract simply reached an ATH of 21,750,259 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/72Ce5baIBz

— glassnode alerts (@glassnodealerts) May 22, 2023

ETH bulls fail to capitalize on the present alternative

These findings might provide a positive outlook however provided that there was corresponding demand. Our first go-to might be ETH whales which have been offloading some ETH within the final seven days.

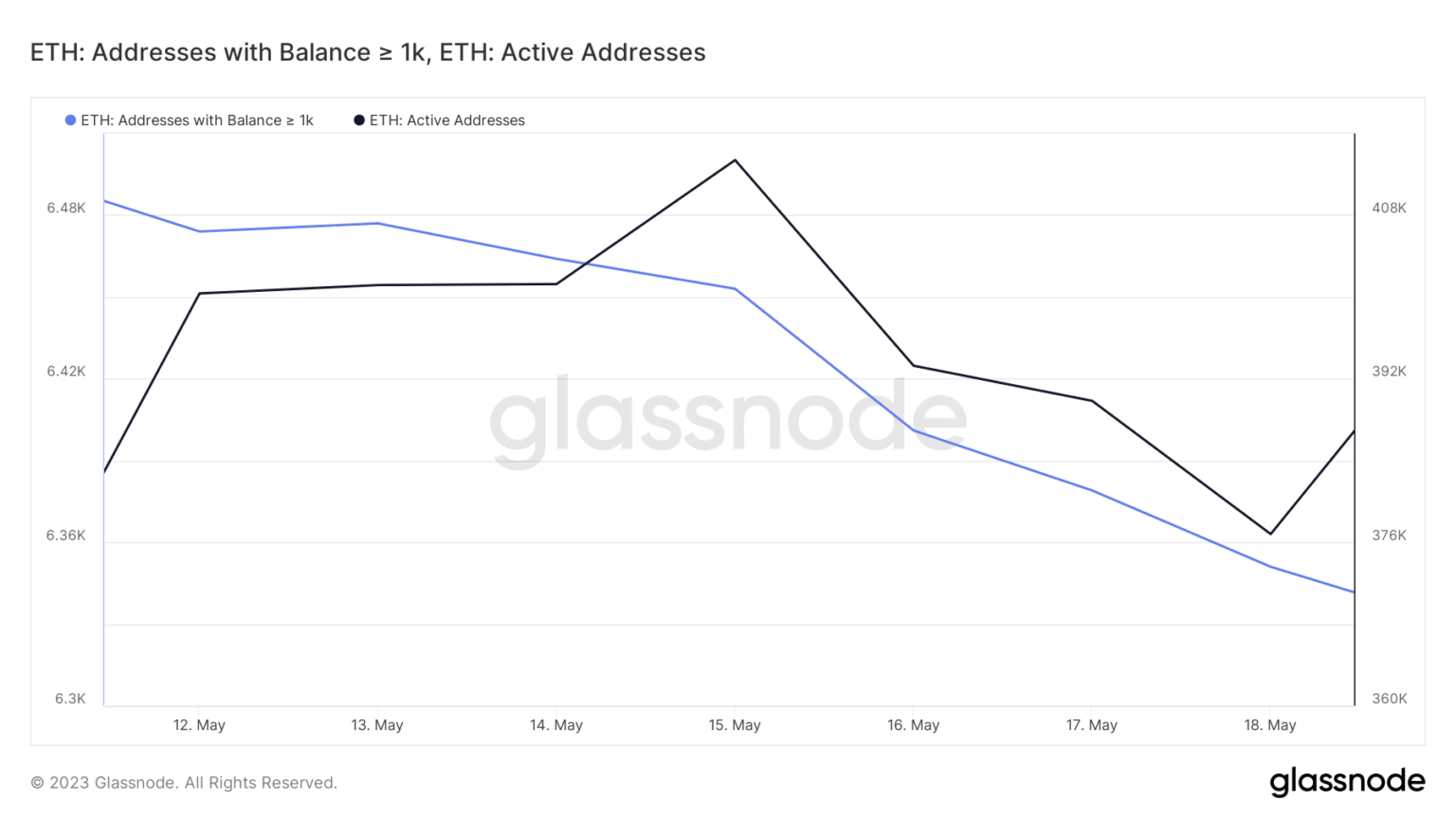

Addresses holding at the least 1000 ETH have been on the decline throughout this era. The variety of lively addresses additionally dropped particularly since mid-Might. Nevertheless, information confirmed that addresses had been now regaining exercise which would be the first signal of upcoming volatility.

Supply: Glassnode

The deal with circulation painted a glim picture for the bulls. Receiving addresses had been decrease between 19 and 21 Might, reflecting decrease bullish demand. In the meantime, there was a surge within the variety of sending addresses between 18 and 21 Might, indicating that the ratio of shopping for vs. promoting stress was nonetheless in favor of the bears.

Supply: Glassnode

Primarily based on the above findings, it was clear that there was nonetheless lots of uncertainty available in the market on either side of the divide (bulls and bears). ETH’s derivatives metrics demonstrated an analogous consequence.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

ETH’s open curiosity within the derivatives market has been sideways for many of Might. Up to now it doesn’t point out any noteworthy change. Equally, ETH’s funding price confirmed the shortage of pleasure available in the market.

Supply: CryptoQuant

Primarily based on the above findings, ETH metrics didn’t precisely provide any concrete indicators of a directional pivot. Nevertheless, a return of directional volatility might nonetheless happen this week given the fast-paced nature of the crypto market.