- The market was within the decrease certain of an equilibrium section.

- Buying and selling volumes have softened, emphasizing traders’ choice to build up and HODL cash.

Since reaching yearly highs final month, Bitcoin [BTC] has traded in a slender buying and selling vary of $30,000-$31,000. The stagnation has lowered traders’ enthusiasm and raised questions on the sustainability of final month’s market rise, constructed on rising institutional curiosity in crypto property.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

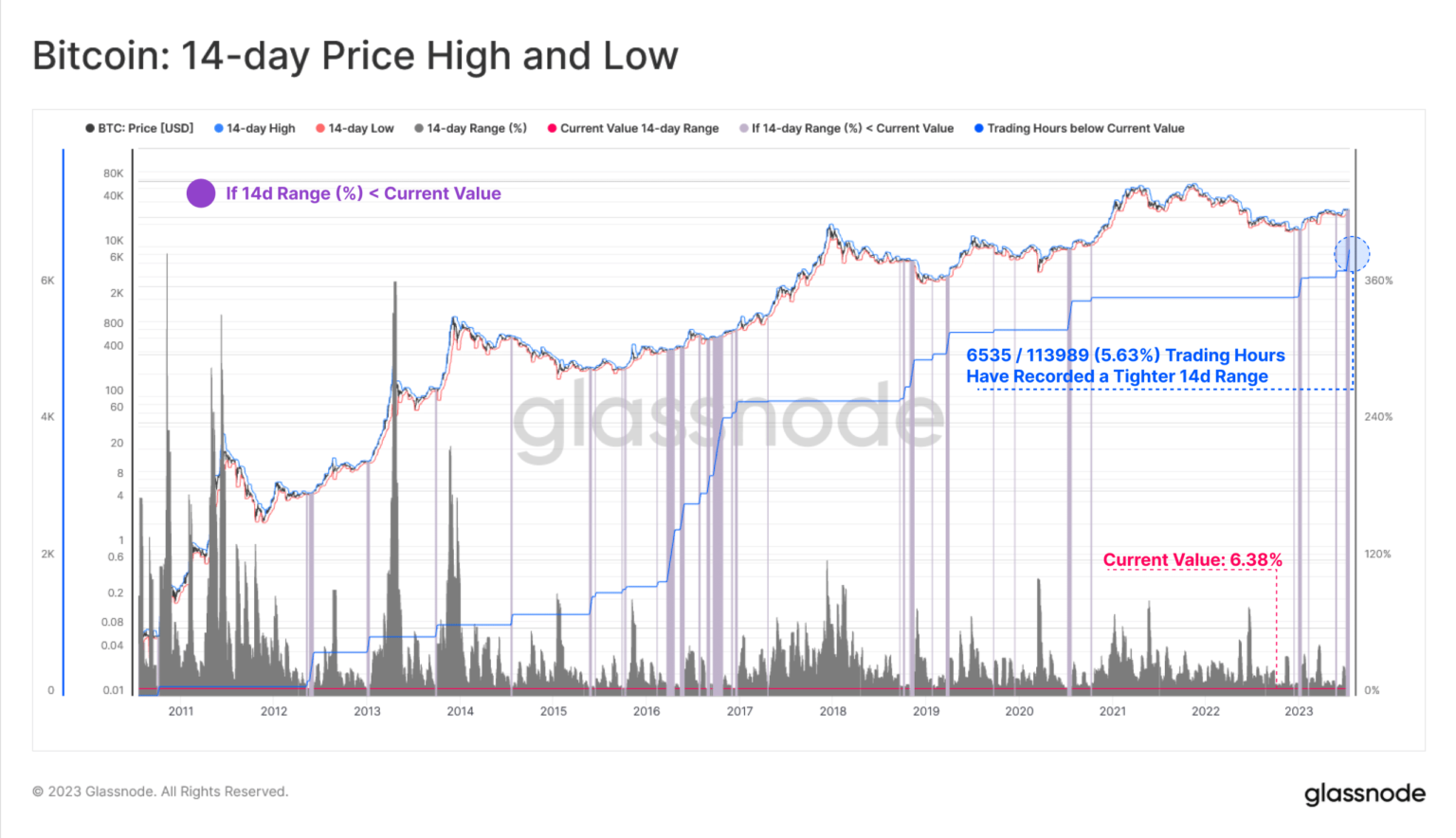

Nonetheless, this prolonged lull in buying and selling exercise might quickly give technique to a interval of volatility. As per on-chain analytics agency Glassnode, BTC’s 14-day worth vary elevated to six.38% over the previous week.

Glassnode underlined that with nearly 5.6% of the full buying and selling hours recording a narrower vary than this worth, there was a chance for a giant transfer for BTC in both path within the days to return.

Supply: Glassnode

Buying and selling exercise plummets

On-chain switch quantity is the full variety of cash transferred in profitable transactions. This quantity decreased considerably because the euphoria seen through the begin of final month’s market rally.

Combining this with the falling change inflows, it was evident that buying and selling volumes have softened. This emphasised traders’ choice to build up and HODL cash.

Supply: Glassnode

Market in a state of equilibrium

In one of many earlier articles printed by AMBCrypto, it was highlighted how the market had entered a stage of equilibrium. This section, often known as the ‘re-accumulation interval’, has traditionally adopted restoration from the lows of a bear market. Moreover, the market has conformed to a sideways development for prolonged durations of time.

The Web Unrealized Revenue/Loss (NUPL) metric backed up these deductions. This indicator gauges if the community as an entire is presently in a state of revenue or loss.

On the time of publication, the studying of the metric was 0.33, which as per Glassnode, was the decrease certain of the equilibrium section.

Supply: Glassnode

Nonetheless, the section might witness a disturbance given the low volatility and slender buying and selling ranges.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Tesla HODLing Bitcoins

Excessive-profile traders like Elon Musk’s Tesla have additionally not given up on its BTC holdings. In its Q2 earnings report, the EV big revealed that it continued to carry about $184 million value of BTC on its steadiness sheet. Tesla’s digital asset holdings remained unchanged for the fourth consecutive quarter.

Thus, merchants solely have to attend and watch if the arrogance in BTC converts to a robust bull rally.