- USDC’s market cap dropped to 18-month lows as depeg affect prolonged.

- The demand for the stablecoin noticed some restoration fueled by demand in good contracts.

Circle [USDC] skilled strong outflows within the final two weeks of March, which initially triggered a depeg. It will definitely regained its greenback peg and has since then remained steady till press time. Nonetheless, it continued to expertise outflows, which have shrunk its market cap by a large margin thus far. USDC’s market cap fell as little as $32.50 on the finish of March.

Life like or not, right here’s USDC’s market cap in BTC’s phrases

The final time USDC’s market cap was this low was in April 2022, therefore it has fallen to an 18-month low. It’s also not the one facet of the stablecoin that has been negatively affected. In response to Glassnode, USDC’s transaction quantity has additionally been severely affected, falling to a nine-month low.

📉 $USDC Transaction Quantity (7d MA) simply reached a 9-month low of $300,956,391.56

Earlier 9-month low of $301,341,768.00 was noticed on 21 October 2022

View metric:https://t.co/UR3yK7fM1y pic.twitter.com/frKp3PsnVj

— glassnode alerts (@glassnodealerts) April 2, 2023

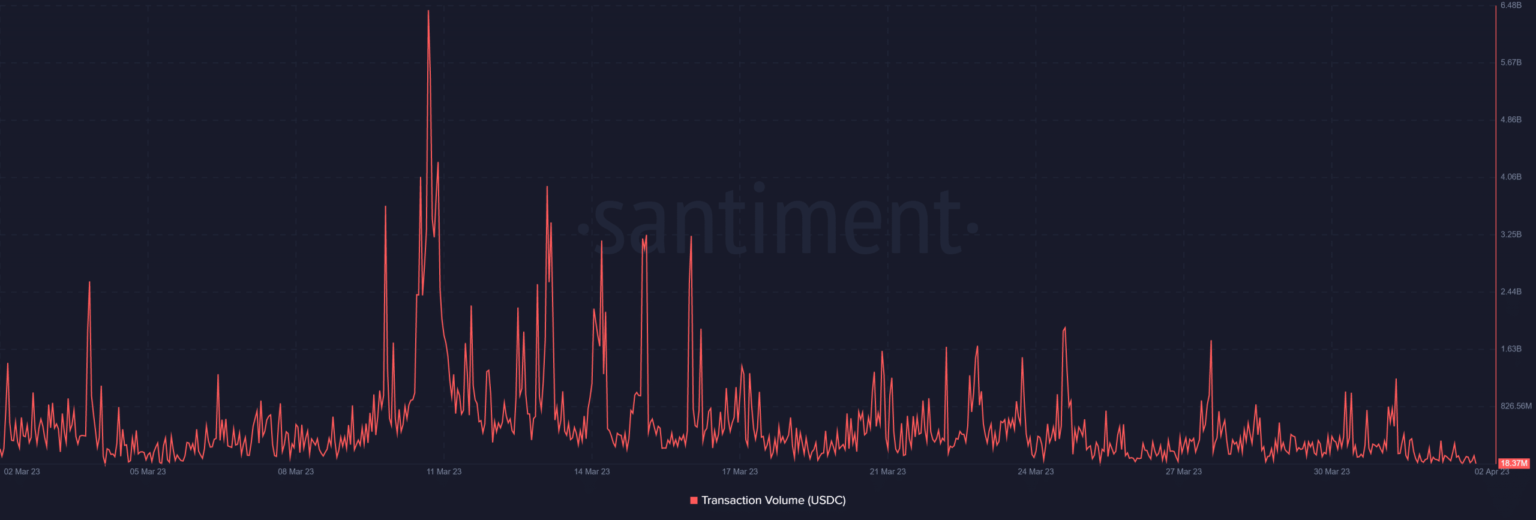

A take a look at USDC’s transaction quantity metric on Ethereum [ETH] confirmed a slowdown, because the stablecoin’s each day transaction quantity fell beneath $2 billion within the final 5 days.

Supply: Santiment

Demand for USDC sees uptick on this key space

Though USDC’s demand continued to take a success, as highlighted by the market cap and weighted sentiment, there may be one space that confirmed promise. The share of USDC locked in good contracts has bounced again and was at an 11-month excessive at press time.

📈 $USDC P.c Provide in Sensible Contracts simply reached a 11-month excessive of 42.806%

Earlier 11-month excessive of 42.690% was noticed on 04 Could 2022

View metric:https://t.co/eCjboyzLH7 pic.twitter.com/h4CAPks3Vr

— glassnode alerts (@glassnodealerts) April 2, 2023

This remark confirmed that USDC was recovering, particularly in DeFi. This will likely assist soften its fall and maybe even assist flip issues round within the mid to long run. May the current woes change into a blessing in disguise?

Some could view USDC’s depegging as signal as a result of it uncovered some extent of weak spot as a consequence of SVB’s publicity. Nonetheless, that time of weak spot has not been handled and the stablecoin has regained its peg. Change stream information revealed that there have been vital trade flows within the final seven days. This included wholesome outflows, which can recommend demand restoration.

Supply: Santiment

The trade flows had been backed by noteworthy tackle exercise. The variety of each day lively addresses buying and selling with USDC dropped because the SVB incident. Maybe USDC’s restoration impressed confidence amongst customers. A extra favorable end result than UST’s state of affairs months prior.