- Spinoff and spot buying and selling quantity and alternate outflow have declined prior to now month.

- Bitcoin long-term holders have, nevertheless, continued to extend.

Bitcoin’s [BTC] upward trajectory has hit a roadblock in current months, dampening its progress and elevating considerations. Particular metrics indicated a decline, which may very well be a major contributing issue.

How a lot are 1,10,100 BTCs value in the present day?

Nevertheless, amidst this obvious stagnation, the variety of steadfast long-term holders remained remarkably regular, displaying resilience.

Bitcoin sees a decline in key metrics

A current article by CryptoQuant make clear why Bitcoin’s worth progress has been sluggish currently. The decline in two important BTC metrics and one stablecoin metric considerably affected this gradual progress.

The important thing metrics had been BTC buying and selling quantity, alternate outflow, and stablecoin influx.

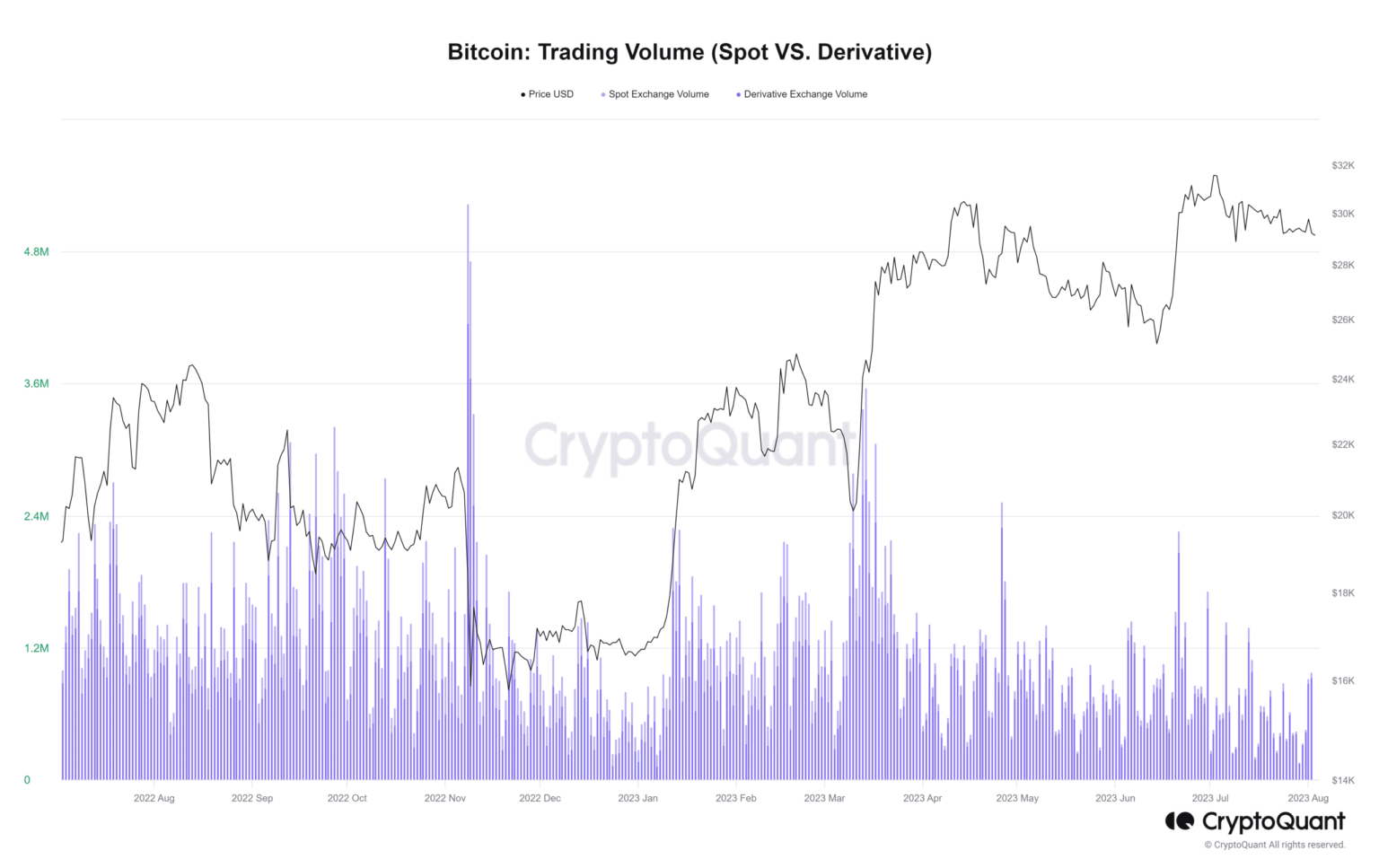

An evaluation of those metrics for July confirmed that they’d skilled a decline. Each BTC spot and by-product buying and selling volumes, in line with CryptoQuant, confirmed no important every day spikes in comparison with earlier months.

The best volumes recorded in July had been on the sixth and 14th of the month. On 6 July, the spot buying and selling quantity reached roughly 114,000, whereas derivatives surpassed 1.3 million. On 14 July, spot buying and selling was 104,000, and derivatives exceeded 988,000.

Supply: CryptoQuant

Nevertheless, these highs had been decrease than these achieved in earlier months, indicating a decline in general buying and selling exercise.

Moreover, the speed of BTC outflow from exchanges declined in July, as depicted by the BTC alternate outflow chart. Though some days confirmed spectacular outflow numbers, the general pattern indicated that extra holders had been depositing their BTC into exchanges slightly than withdrawing them.

Supply: CryptoQuant

As well as, the stablecoins alternate influx metric was analyzed, revealing a noticeable lower. The chart displayed a pointy drop in stablecoin influx throughout exchanges, signaling a decline in shopping for stress.

Supply: CryptoQuant

These declines in key metrics prompt that the sentiment surrounding Bitcoin was bearish at press time. The implication was that the worth of BTC was more likely to encounter difficulties in making important features.

Bitcoin’s long-term holders rise

Regardless of Bitcoin’s stagnant progress, the group of long-term holders remained undeterred and continued to broaden. An enchanting perception from Glassnode’s provide final energetic chart revealed an upward pattern within the two-year band.

This band represented round 47% of the whole provide initially of the 12 months. Nevertheless, as of this writing, it has surged to over 56%.

Supply: Glassnode

This important enhance within the band indicated that extra holders had taken their property off exchanges. Moreover, these property have remained untouched by buying and selling actions for the previous two years. Primarily, this prompt a rising variety of buyers dedicated to holding onto their Bitcoin for the long run.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

BTC decline continues

The Bitcoin every day timeframe chart confirmed that its worth decline had persevered. As of this writing, the worth was buying and selling at a lower, though it was lower than 1%. Particularly, it was buying and selling at round $29,100, which indicated a continuation of the downtrend.

The decline was additional confirmed by a drop within the Relative Power Index (RSI), suggesting robust promote stress.