Analyzing the efficiency of Bitcoin towards varied fiat currencies on the Binance platform provides pivotal insights into the interaction between digital belongings and conventional monetary programs. CryptoSlate examined the efficiency information of Bitcoin buying and selling pairs with a number of key fiat currencies over various durations – 6 months, 3 months, 1 month, and 5 days- to uncover the underlying financial and market components at play.

CryptoSlate used information from Binance, as its stature as the most important and most liquid trade of the market supplies a complete and dependable dataset, making the efficiency of every fiat buying and selling pair extra indicative of the general state of the respective fiat forex.

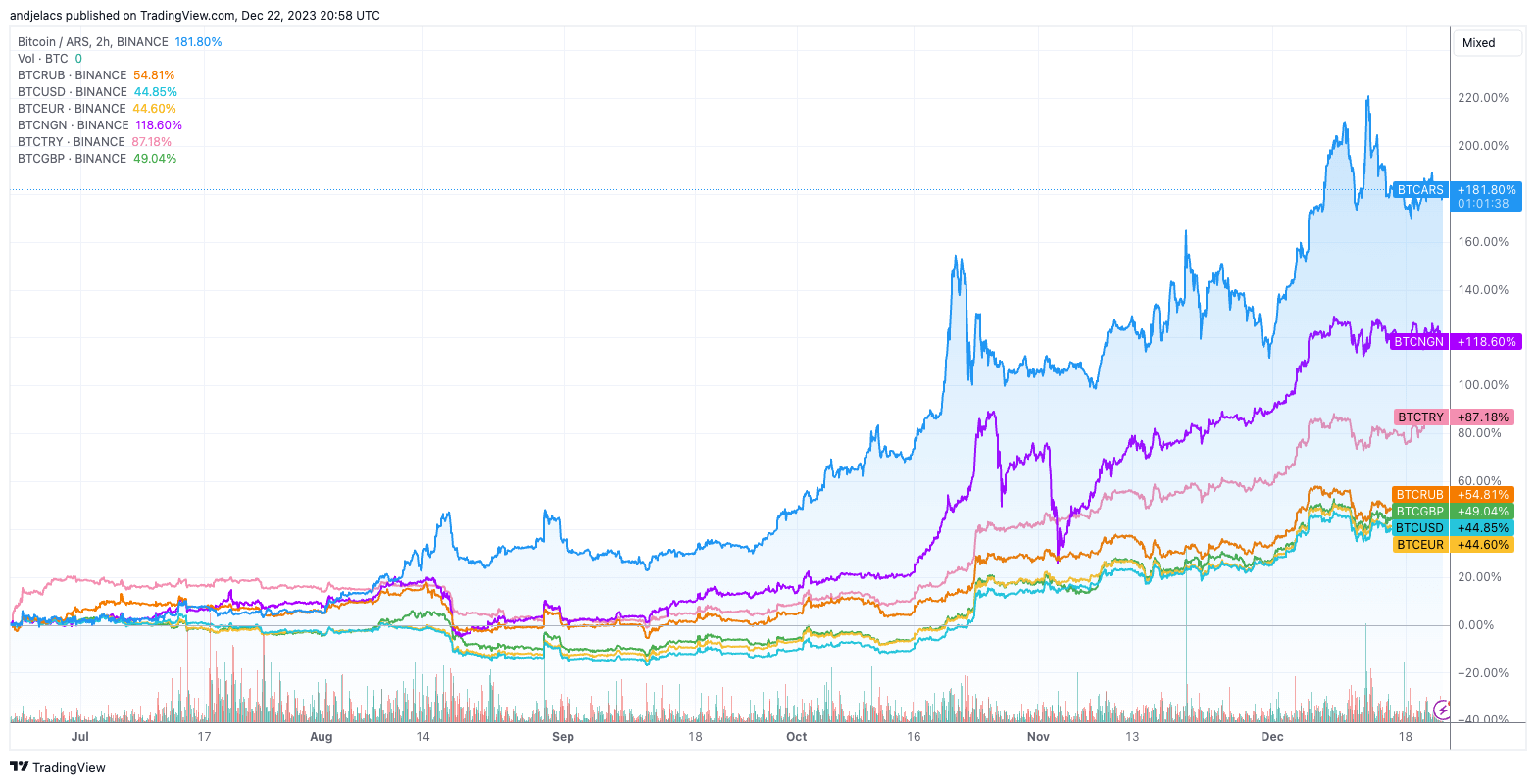

Over six months, the Bitcoin to Argentine Peso (BTC/ARS) buying and selling pair exhibited a putting improve of 181.41%. This vital surge signifies Argentina’s financial challenges and political adjustments, marked by rampant inflation and forex instability, propelling Bitcoin as a refuge and a steady retailer of worth. Equally, the Bitcoin to Nigerian Naira (BTC/NGN) pair recorded a considerable progress of 118.6%, reflecting Nigeria’s growing inflation and a rising younger, technology-oriented demographic that sees digital currencies as viable funding and remittance avenues.

The Turkish Lira, going through its personal set of financial hurdles, noticed the BTC/TRY pair develop by 87.08% in the identical six-month span. This development is a testomony to the financial difficulties in Turkey, together with vital forex devaluation and inflation, driving the populace in direction of Bitcoin. In additional steady economies similar to the USA, the UK, and the Eurozone, the will increase had been extra reasonable, with BTC/GBP rising by 48.94%, BTC/USD by 44.71%, and BTC/EUR by 44.43%, highlighting a extra mature and steady market setting for cryptocurrencies.

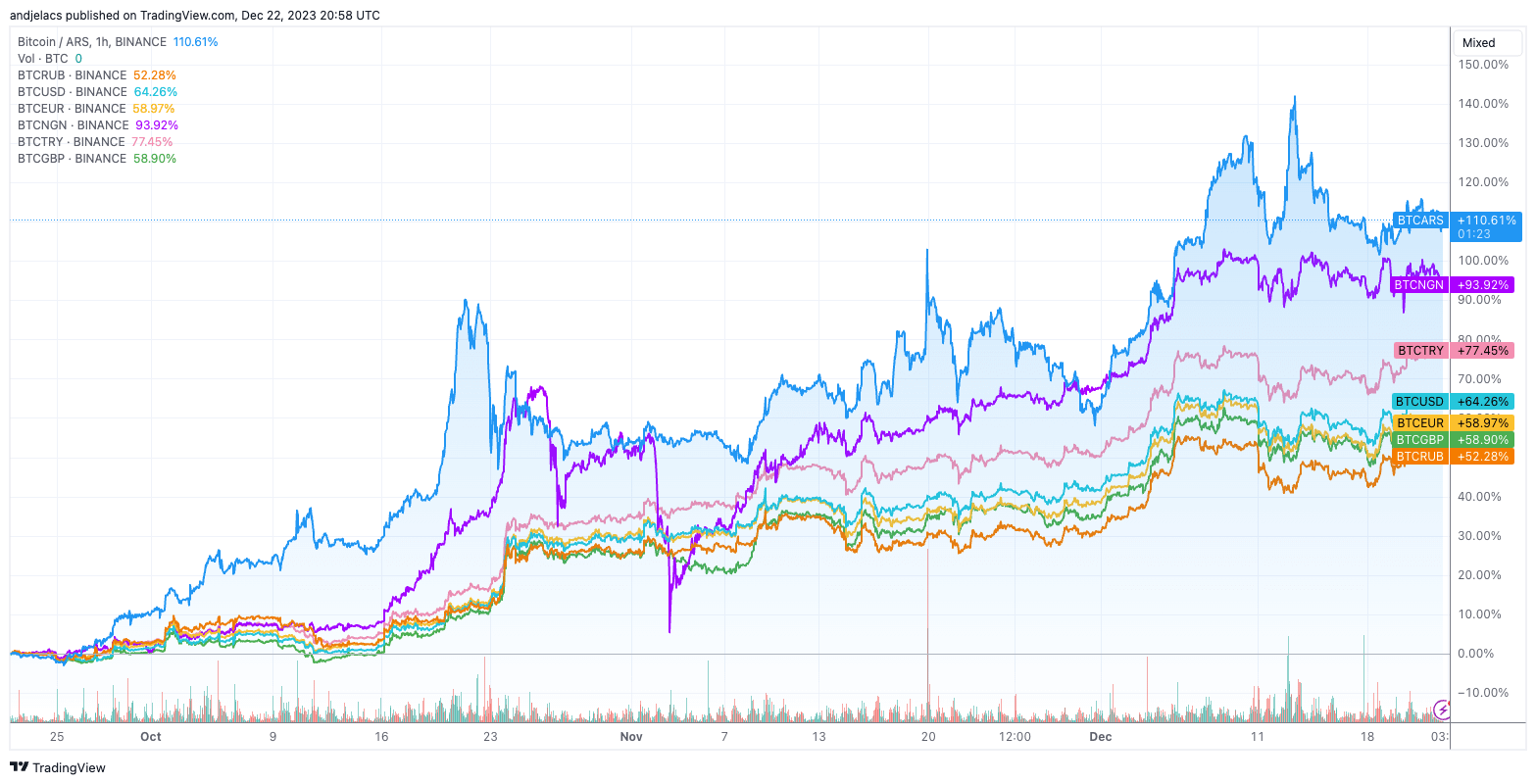

Observing the 3-month efficiency of those Bitcoin pairs, the rising market currencies outperformed their developed counterparts. The BTC/TRY pair elevated 77.45%, whereas BTC/USD and BTC/GBP grew by 64.26% and 58.90%, respectively.

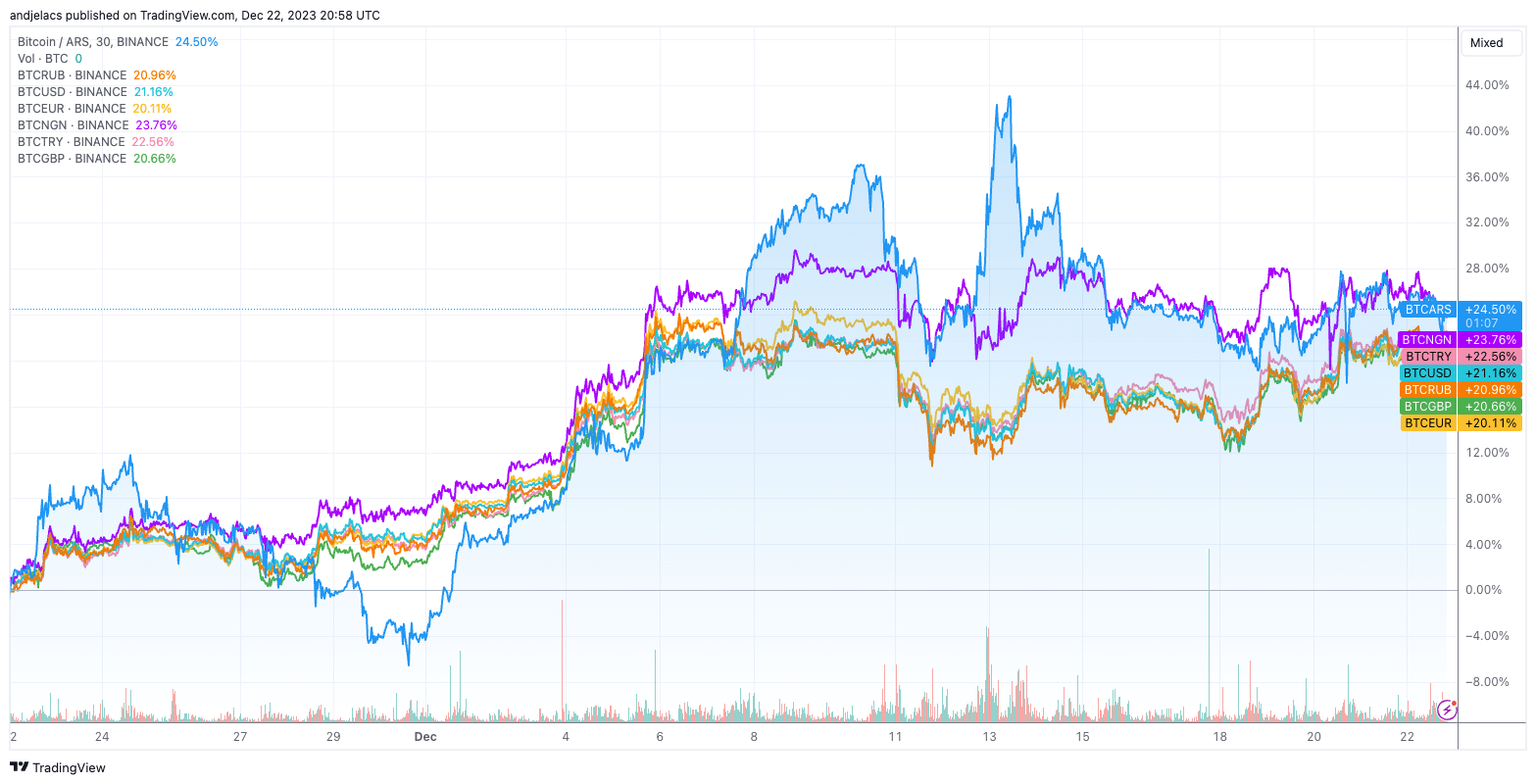

This sample endured in shorter timeframes, with the 1-month information exhibiting BTC/ARS and BTC/NGN main at a 24.50% and 23.76% improve, adopted carefully by BTC/TRY at 22.56%.

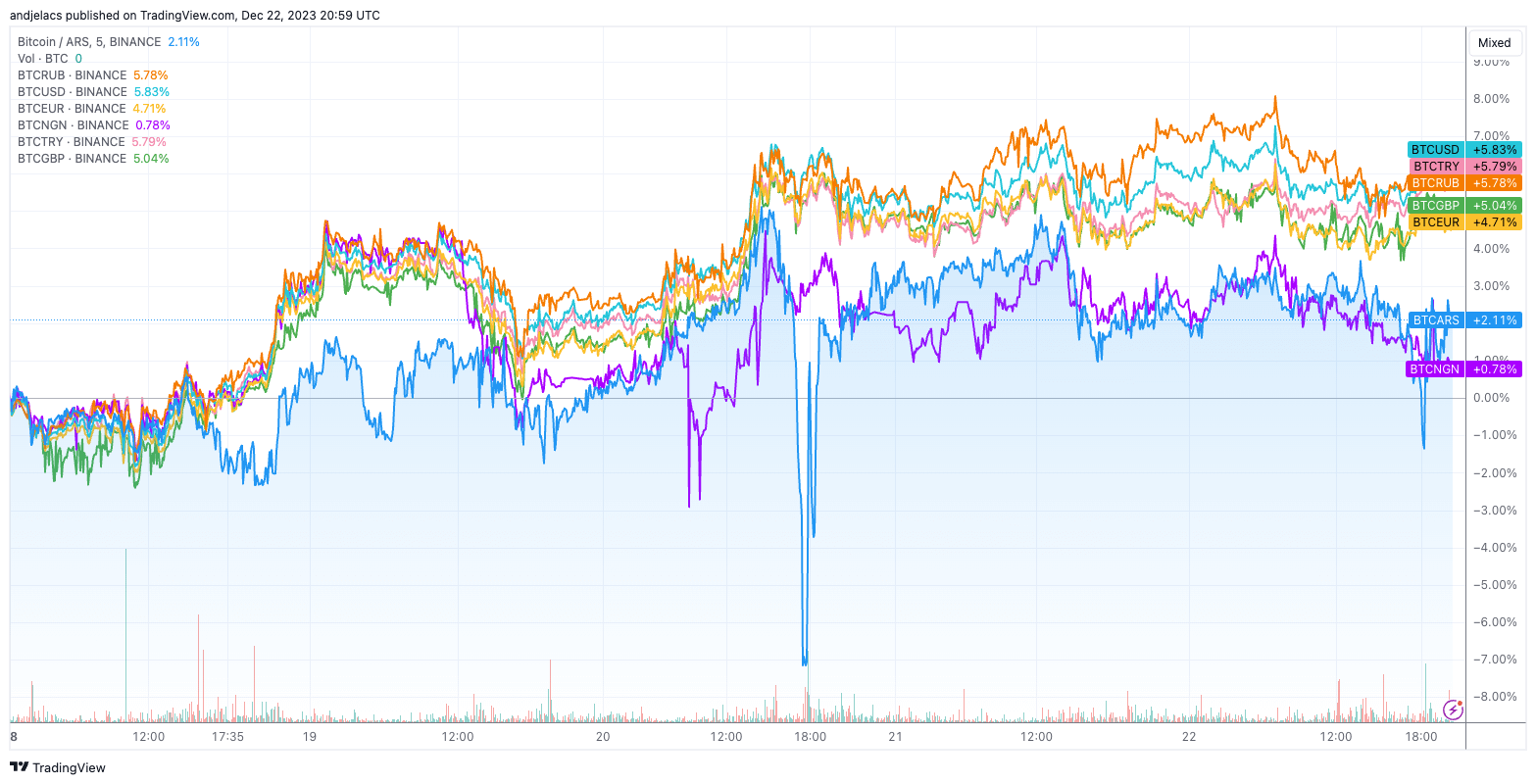

The 5-day snapshot additional substantiates this development, with BTC/USD at a 5.83% improve, BTC/TRY at 5.79%, and BTC/RUB at 5.78%.

The explanations behind these discrepancies are multifaceted. Economies grappling with inflation and devaluation typically see their populations flip to Bitcoin as a monetary protected haven. The regulatory panorama in these nations additionally considerably influences buying and selling volumes because it alters the perceived dangers and authorized standing of cryptocurrency buying and selling.

Moreover, liquidity ranges for sure buying and selling pairs can play a vital position. A scarcity of liquidity can result in larger volatility and bigger value swings, which could entice extra speculative buying and selling, thus driving the efficiency of those pairs. Moreover, geopolitical circumstances like sanctions or home unrest can speed up the adoption of decentralized monetary belongings like Bitcoin.

The varied efficiency of Bitcoin towards varied fiat currencies is a mirrored image of the financial circumstances, market maturity, and geopolitical local weather of the respective nations.

The put up Troubled economies flip to Bitcoin, sparking rally in native buying and selling pairs appeared first on CryptoSlate.