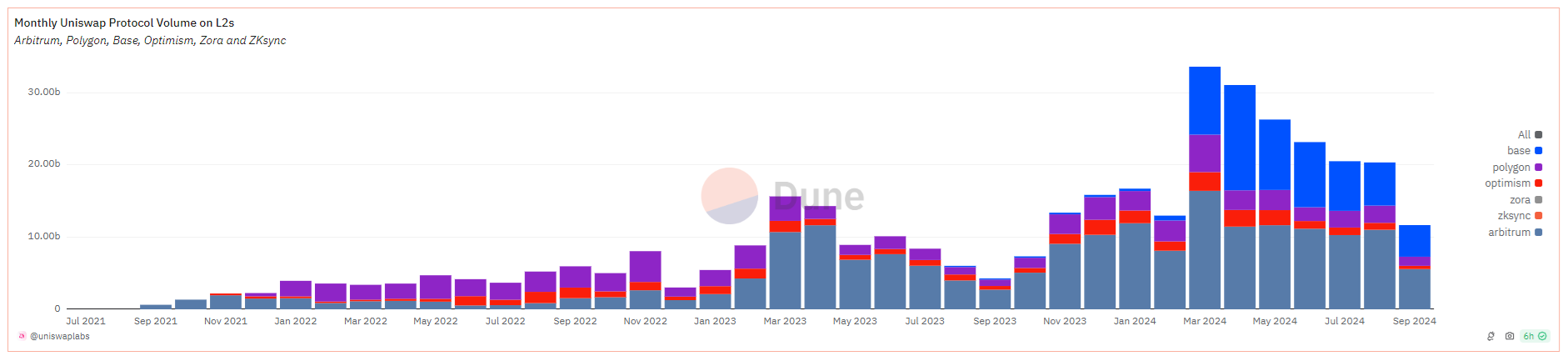

Uniswap is rising its presence on L2 chains, regardless of fears of a slowdown in September. The previous 12 months marked a change to L2 because of the demand for extra favorable charges.

Uniswap V3 elevated its presence on L2 chains prior to now 12 months. For September, the main DEX marked triple the volumes in comparison with the identical month final 12 months. Uniswap carried $11.68B in swaps, in comparison with $4.29B for September 2023.

Throughout that point, Uniswap expanded its presence to a complete of 23 chains. The dominant ones proceed to be Base and Arbitrum, because of low charges and energetic advertising. Quickly after its launch, Base began displacing liquidity swimming pools for Ethereum, principally because of the creation of meme tokens.

Uniswap had a profitable 12 months on L2 chains. | Supply: Dune Analytics

On account of the DEX liveliness, Uniswap reached $43.28M in month-to-month charges. Whereas Uniswap noticed a slowdown in September, the previous few months had been essentially the most profitable within the historical past of the DEX. The speedy influx of customers on Base turned Uniswap into the chief for meme token swaps.

The previous 12 months additionally noticed Uniswap broaden on the Celo protocol. Celo remains to be an L1 however could remodel into an L2 to raised align with the tradition of Ethereum (ETH).

Uniswap’s development on L2 reached greater than 20X since 2021. For 2024, Uniswap should break its personal document of $192B in annual trades. On the similar time, Ethereum stays the layer that also carries $3.72B in worth locked, because of legacy swimming pools and pairs. Ethereum remains to be the largest supply of stablecoins, regardless of the inflows of USDT into Arbitrum and different L2.

Arbitrum leads in volumes, however Base has essentially the most swimming pools

Uniswap’s success hinges on carrying each large-scale volumes and a number of small swimming pools. Arbitrum is the chief by way of volumes, with greater than $211M in day by day exercise.

On Arbitrum, Uniswap V3 carries 251 cash in 485 pairs. The identical model on Base displays way more energetic token minting, with 338 cash and tokens in 694 complete pairs. One of many greatest issues for Base is the presence of low-liquidity pairs. Just a few dozen addresses on Base have certainly boosted site visitors, however principally by low-quality rug pulls.

The previous few months noticed the creation of a number of swimming pools, most now inactive. Whereas enlargement on Base is seen as a constructive for Uniswap, the presence of unverified tokens and just-launched swimming pools is skewing the actual buying and selling image.

Uniswap competes with Aerodrome by way of worth locked. Aerodrome goals for top liquidity pairs, whereas Uniswap provides a wider number of tokens. As of September 25, Uniswap locks $215M in worth in its Base model and is the second most energetic app.

On Arbitrum, the Uniswap V3 swimming pools comprise $291.99M in all liquidity pairs. Uniswap is the largest DEX on the L2 chain, outcompeted solely by GMX perpetuals and Aave’s lending swimming pools.

Uniswap remains to be the highest Ethereum fuel burner

Regardless of the shift to L2, Uniswap nonetheless depends on Ethereum. The Uniswap routing service is essentially the most used L1 sensible contract. Charges on Uniswap reached about $45K per hour, or $896K prior to now 24 hours.

Ethereum itself carries 37.7% of all DEX volumes, for each main and area of interest markets. WETH remains to be essentially the most influential asset for pairings, together with USDT and USDC. The presence of bridged or native stablecoins on L2 additional boosted decentralized volumes in 2024.

Uniswap now has to face the competitors of different DEX which have additionally grown prior to now 12 months. The main market nonetheless has a 45% share of the whole DEX market. Different hubs like Aerodrome are shortly catching up with a share of 20.6%.

CurveDEX can also be increase its volumes, already carrying $1.78B in liquidity. DEXs are already including options for focused liquidity, a software that permits minimal slippage in a predetermined value vary.

As Uniswap prepares to launch V4 swimming pools, the UNI token remains to be in consolidation. UNI traded close to its one-month excessive at $6.84, although nonetheless removed from the 12 months’s peak at $15.20. UNI nonetheless awaits a breakout, with $20 a risk throughout a bull market. UNI additionally accomplished all token unlocks as of September 18, abandoning one supply of potential value stress.

Cryptopolitan reporting by Hristina Vasileva